I am bullish on Rite Aid Pharmacy (RAD); the company's strong results for 4QFY15 were backed by improving store traffic, caused by the gradually growing aging U.S. population. In fact, RAD has accelerated its growth activities, focused on growing its store traffic and getting a leaner cost base, which will portend well for the company's top-line and bottom-line base growths in the years ahead. RAD's ramped-up efforts to improve its health and wellness image by remodeling existing stores and by adding additional RediClinics to its store base will strongly position it among leading health and wellness service providers in the industry. Also, the company's efforts to attract customers with a wide range of private label brand offers will continue to grow its store traffic. In addition, the EnvisionRx acquisition, which is about to be complete by September 2015, will act as an important growth driver in the years ahead.

Financial Performance and Growth Drivers

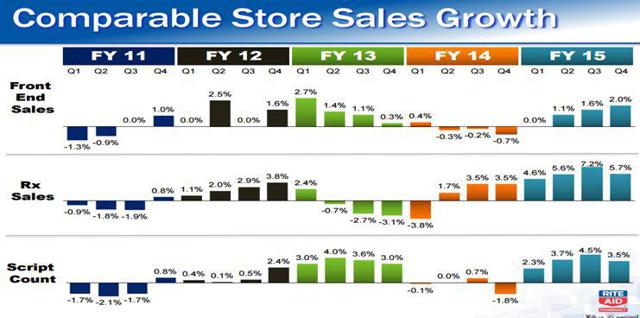

In the past few quarters, owing to the increasing U.S. aging population, the company's Rx script count has been growing at a healthy rate, which has been helping its comparable store sales grow at a decent pace; in 4QFY15, RAD's comparable store sales were up 4.5% year-over-year. And it is due to the healthy comparable store sales growth that the company's quarterly sales increased by 3.8% year-over-year. The following charts shows the detailed growth rates of RAD's front-end and Rx sales, and incorporates the growth rates of the company's script count reported in all four quarters of FY11 to FY15.

Source: Company's 4QFY15 Earnings Presentation

It is due to RAD's healthy sales growth and effective cost savings efforts that the company reported net income of $1.835 billion for 4QFY15, higher than the net income of $55.4 million reported in 4QFY14. Driven by the impressive income gains, RAD's 4QFY15 EPS of 12 cents outpaced analyst estimates by 71.43%.

Moving ahead, due to the aging U.S. population, pharmacy companies continue to benefit from higher healthcare spending by old citizens. According to estimates, healthcare spending by the aging U.S. population will sum up to more than $5 trillion by the end of 2022, which means more upside for pharmacy retail companies. As far as RAD is concerned, owing to its increased focus on growing health and wellness services, I believe the increasing medication usage trend in the aging U.S. population will act as an important tailwind for the company. And in this regard, RAD's store remodel program will continue to enhance its pharmacy image. Under the program, the company is aggressively remodeling its traditional stores to wellness format stores that provide both pharmacy and clinical services to its customers. By the end of 4QFY15, RAD had completed wellness remodels at 1,634 stores; considering its present momentum of remodeling stores to wellness format, I believe that by the end of 2015, almost half the store base will be converted to the wellness store format. In its 4QFY15 earnings conference call, the company affirmed that it will remodel an additional 400 stores in FY16. Keeping in-line with its wellness strategy, the company has recently announced to open a new store outlet in Harrisburg, which will have special pharmacy departments inside to provide shoppers with easy access to trained pharmacists.

Moreover, RAD is actively working to integrate its previously acquired RediClinic to the company's owned stores. Thus far, three RAD-RediClinic have been opened in the Seattle market, while 24 are operating in Philadelphia and Baltimore, Washington DC. Moving ahead, 8 new RAD-RediClinic will be operating in the Seattle market, which will increase the total number of RAD-RediClinic to 35. Given the fact that RediClinic provides top-class convenient care clinic services, I believe the rapid integration of RediClinic to RAD's store base will portend well for the company's objective of developing as a leading pharmacy and clinical service provider, which will help its script count improve and sales grow at a decent pace.

Furthermore, the company is making active efforts to increase private label brand penetration in its stores. In fact, RAD is focused on improving its product ranges and quality in order to build a top-notch private label brand. During 4QFY15, the company introduced a new skin repair line under the brand name of "Receutics" to increase the range of its private label brand dermatological products. Moreover, its management affirmed that they would revamp private brand offerings in stores in order to boost RAD'S portfolio of private brand products. I believe that having extended, world-class private label brands will improve the company's store attractiveness for customers, which will add well towards its sales base. Also, the private label brand products being high margin products will help improve RAD's profitability margin base.

In an attempt to improve margins, the company has entered in to a definitive agreement worth $2 billion to acquire a PBM EnvisionRx in order to increase its pharmacy reach. Having its own PBM will generate significant cost benefits for RAD. I believe the company could benefit from these cost savings by benefiting its customers with lower drug prices. Having lower price drugs will increase customer traffic at RAD and will better the company's competitiveness among its peers. Moreover, EnvisionRx offers prescription drug plans by causing the plan enrollees to fill their drug prescriptions at RAD; EnvisionRx will increase foot traffic at the company's stores and will strongly position it within the Pharmacy Industry. I believe that an increasing PBM traffic visiting RAD's stores to fill their prescriptions will portend well for the company's future sales and profitability margin base.

Bottom-Line

RAD's consistent cost savings, earned from its previous partnership contract with MCK, have helped its bottom-line grow at a decent pace. In its attempt to continue driving growth from the MCK partnership, the company has extended its contract with MCK. The renewed contract, which is set to expire on 31st March 2016, will help RAD save more costs and generate efficiency right through its long-established drug dispensing business in the years ahead. In the 4QFY15 earnings conference call, while affirming his commitment to pulling distribution expense out of its cost structure, the company's CEO and Chairman said:

"There's a number of different activities that we go through with McKesson that we think will continue to drive cost out of this thing and we do believe that as they continue to build scale, it will benefit us overtime, that is our belief."

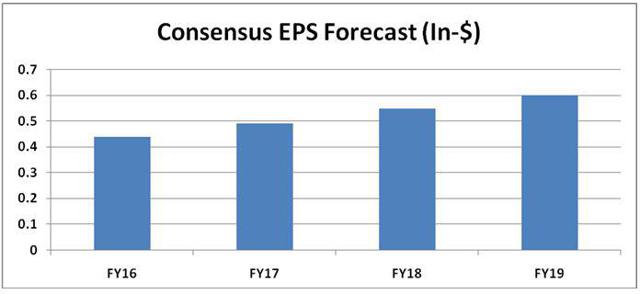

I believe that by ramping up its cost saving efforts under the MCK partnership, RAD will be able to support its earnings trajectory and will witness healthy EPS growth in the years ahead. Analysts are also anticipating gaining a steadily growing EPS base from this company, as shown in the chart below.

Source: Nasdaq.com

Outlook-FY16

Owing to the potential of RAD's strong strategic growth plan, its management has given an impressive outlook for FY16. The company is expected to have a comparable store sales growth of around 2.5% to 4.5%, which in turn will help its net revenue remain in a range of $26.9 to $27.4 billion. Moreover, the management expects the FY16 earnings to remain in a range of $0.16-$0.27 share.

Conclusion

I believe that RAD has strong growth potential and intelligent strategies lined-up to fuel its future growth, which will positively affect the stock price. The company's efforts to improve its image as a health and wellness service provider will continue to direct more customer traffic at its stores, generating better sales in the years ahead. Moreover, RAD's initiative to get a leaner cost base through an extended partnership contract with MCK makes me believe that the company's bottom-line numbers will remain impressive. Also, analysts have estimated an impressive next 5-year earnings growth rate of 13% for RAD. Due to the aforementioned factors, I am bullish on RAD.