In a surprise move, the Swiss National Bank (SNB) in January removed the floor it had placed on the Swiss currency vis-à-vis the euro. The removal of the currency peg created extreme volatility in the currency market, the kind not seen in more than four decades in developed world currencies. The aftermath of the chaos in the currency market was near bankruptcy for FXCM Inc. (FXCM), one of the largest currency brokers serving retail and institutional clients.

The Swiss Effect-FXCM shares tumble, Source; stockcharts.com

FXCM's clients' loses resulted in the broker incurring $225 million in negative equity balance. The losses have now risen to $276 million. A day after the chaos, FXCM got a lifeline from Leucadia National Corporation (LUK) in the form of a $300 million ($279 million in net proceeds) rescue package. Leucadia has in the past rescued Knight Capital, which suffered substantial losses after a software trading glitch. The rescue package from Leucadia does come at a price.

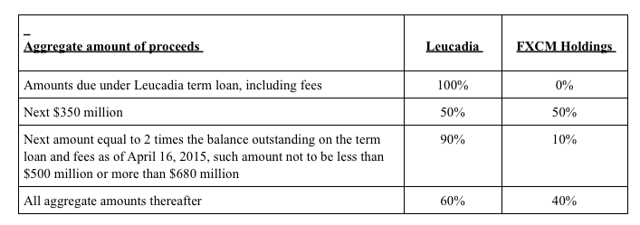

FXCM will pay in cash to Leucadia and its assignees a percentage of the proceeds from certain transactions. The transactions could include sale of assets, dividends or distributions, the sale or indirect sale of FXCM Newco LLC, which was formed after the agreement with Leucadia was signed. The table below gives the details of Leucadia's share.

Source; 8K Filing, FXCM

Following is the summary of the amended agreement, according to 8K filing from FXCM.

The Amended and Restated Letter Agreement added that beginning in three years and thereafter, upon the request of Leucadia or its assignees, the Company, Holdings and Newco will cause the sale of Holdings, Newco and/or any their respective subsidiaries' assets or equity interests for cash at the highest reasonably available price. Under the Letter Agreement, this provision only applied to the sale of Newco.

The Amended and Restated Letter Agreement provides for the termination of the agreement in certain circumstances as described above under the heading "Summary of Amended and Restated Letter Agreement."

The events upon which Newco and Holdings would be required to pay in cash to Leucadia and its assignees a percentage of the proceeds were clarified to include: the issuance of any debt or equity securities; and specified non-ordinary course events, such as certain tax refunds and litigation proceeds

The Amended and Restated Letter Agreement incorporates restrictive covenants set forth in the Credit Agreement.

The Amended and Restated Letter Agreement includes restrictions on the ability of the Company to issue equity securities as described above under the heading "Summary of Amended and Restated Letter Agreement."

The Amended and Restated Letter Agreement provides that Leucadia and its assignees are entitled to tax distributions in certain circumstances as summarized above under the heading "Summary of Amended and Restated Letter Agreement."

The Amended and Restated Letter Agreement provides for the reimbursement by Holdings and Newco of Leucadia's expenses incurred in connection with the negotiation, execution and administration of such agreement.

There are other harsh conditions that FXCM had to agree to or face imminent bankruptcy. The loan, which matures on January 16, 2017, carries an initial interest rate of 10%. The interest rate will increase by 1.5% per annum each quarter as long as the loan is unpaid. There is a ceiling on the interest rate of 20.5% per annum.

Under the agreement, FXCM had to pay $60 million by April 16, 2015. In case, the amount of the loan outstanding exceeded $250 million at this date, FXCM would have to pay an additional financing fee of $30 million. Fortunately, the company has managed to pay this amount and clear the first hurdle.

Substantial Part of the Loan Paid

On April 2, FXCM said in a press release that it repaid an additional $54 million outstanding under the credit agreement with Leucadia. The company had already paid $12 million. The two payments brought the amount of outstanding loan to $244 million, below the limit set by the credit agreement. The news had a positive impact on FXCM shares, as the company avoided a punishing $30 million contingent financing fee.

The $54 million payment was funded from the sale of FXCM Japan. The company sold the Japanese unit to Rakuten Securities Inc. for approximately $62 million.

FXCM will continue to sell its non-core assets as it looks to close the loan as early as possible.

What After the Loan is Repaid

Even after the loan is repaid in full, FXCM will have to pay down the other tranches as part of the agreement. This is the major concern for existing shareholders. The terms are such that current shareholders could potentially end up with nothing and at best 50% of the current trading price.

Once the loan is repaid, FXCM will have to pay 50% of the next $350 million in proceeds from a sale to Leucadia. FXCM will end up with $175 million; however, this will be paid towards the convertible notes due in 2018. The next tranche will see Leucadia keep 90% of the amount equal to twice the balance outstanding on the term loan and fees as of April 16, 2015, with minimum amount at $500 million and maximum amount at $680 million. FXCM's outstanding is $244 million so the amount will be $500 million, 10% of this or $50 million will go to FXCM shareholders. This translates to roughly $1 per share at 50.70 million shares outstanding.

Before the SNB's surprise move, FXCM had a market cap of $850 million. At this stage, it is difficult to value FXCM as the company is selling non-core assets. Also, it is difficult to predict how FXCM's business will evolve in the wake of potential new regulations. New regulations could entirely change the retail FX landscape. This was even noted by FXCM CEO Drew Niv in the conference call post Q4 earnings release last month.

"I think the regulators obviously don't dictate business policy but obviously are -- you know it is not just U.S. regulators but regulators around the world are making everybody not just us, look carefully at risk management issues, liquidity issues. Things that obviously this event has brought up as being important. This is something that's happening across the board in the FX industry."

With tightening regulations, it is difficult to foresee FXCM creating significant value in its business. To return $1 to shareholders after the Leucadia tranches and convertible bondholders are paid, FXCM will have to be valued at $1.15 billion, at least. This is 35% more than the market cap before "Black Thursday." Considering that FXCM still trades at $2.15, there is still a huge opportunity to short the stock. The upside here is still more than 50% even if FXCM repays entire loan in the next year or so. The downside is minimal. At this stage, it is highly unlikely that FXCM shares will appreciate significantly.