By New Deal Democrat

Today began a 3-day blizzard of manufacturing and sales data spanning April to June. This morning we got total business sales for April and retail sales for May. Tomorrow, we get May industrial production and the June Empire State Index. On Thursday, the June Philly Fed Index will be reported.

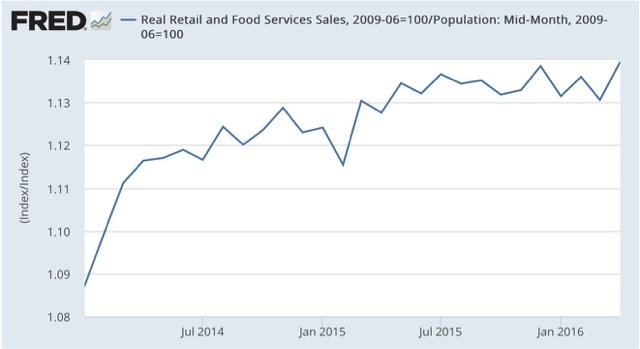

I'll just briefly note that we need to wait for tomorrow's inflation report before we know what May real retail sales were. *If* the CPI is in line with +0.3% expectations, then real retail sales for May will set another record - another indication that the consumer economy is OK and we are not on the cusp of any recession. Here are real retail sales per capita through April:

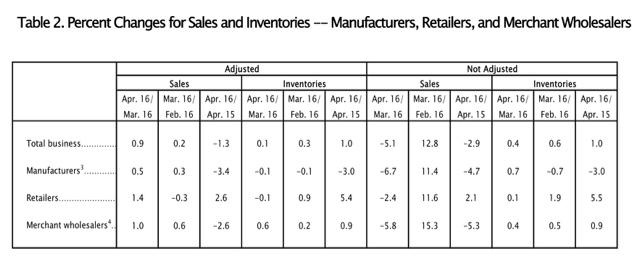

This morning's April business sales report showed that total Business inventories rose +0.1%, but sales grew a strong 0.9%. Sales at all levels - Retail, wholesale, and manufacturing - grew, and only wholesale inventories increased, while retail and manufacturing inventories shrank, as shown in the table below:

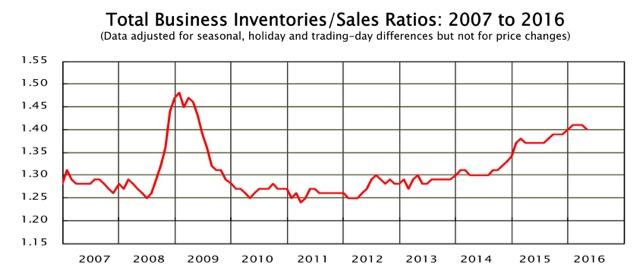

As a result, the total business inventory to sales ratio declined:

This pattern of increased sales and decreasing inventories is what happens just after a recovery from a recession starts. It adds to the evidence that March was the bottom of the shallow industrial recession. But the acid test will be the industrial production report tomorrow.