Skittishness has increased in September over a potential hike in U.S. interest rates, especially ahead of next week's (9/20-9/21) FOMC meeting. In August (the month covered in this post), these concerns were mostly in the background. The ongoing search for yield continues to bring investors into emerging markets debt. Our view is that a rate hike by the Federal Reserve (the "Fed") is not likely to dampen this trend, and that the environment for emerging markets debt will remain supportive.

All Eyes on the Fed

Investors focused on the Fed's annual event in Jackson Hole, Wyoming (held in late August) for clues about the likely path of interest rates. A surprisingly strong July jobs report led to increasing expectations of a rate hike before the end of the year, and comments from Yellen and Fed Vice Chairman Stanley Fischer seemed to support that case. However, following the meeting, weaker-than-expected U.S. manufacturing and August employment figures seem to have convinced the market that an imminent rate hike is now less likely.

Despite this rate uncertainty, flows into emerging markets debt remained strong in August, slightly moderating from the previous month. Globally, $8.0 billion flowed into emerging markets debt funds according to J.P. Morgan, bringing year-to-date flows to $31.3 billion, with $29.0 billion going into hard currency debt.

Developments in August

With approximately $11.7 trillion in negative yielding global debt, investors continued to allocate to emerging markets debt despite negative developments in some countries. In South Africa, an investigation of the finance minister increased uncertainty over leadership and caused the South African rand to tumble. Turkey maintained its investment grade status for now, but reviews are ongoing and Fitch Ratings lowered its outlook to negative. Standard & Poor's lowered Mexico's rating outlook to negative, citing sluggish growth and increasing debt. The agency noted that structural reforms undertaken continue to show positive results, but have not yet stimulated sufficient investment. In Brazil, President Dilma Rousseff was ousted by the Senate, providing hope that the country can move on with fiscal reforms under President Michel Temer. However, Temer's ability to impose fiscal discipline is unclear, as the country remains divided with relatively little appetite for austerity measures.

There were also positive developments in August. Colombia's government announced a peace deal with FARC (The Revolutionary Armed Forces of Colombia), ending a 52-year-old war with the leftist rebel group. If successful, the Colombian government may now be able to focus on much needed tax reforms. In addition, the strength of emerging markets local currencies this year, assisted by commodity price gains, has helped central banks build up foreign currency reserves for the first time in two years.

Besides bullish political developments in Brazil, there are signs that monetary policy has turned more supportive as Brazil's central bank indicated potential room for easing. Low or slowing inflation in other countries (e.g., Russia and Indonesia) may provide central banks room to ease rates or end tightening cycles to help boost growth. Elsewhere, including Chile and Mexico, central banks appear to maintain a more hawkish tone.

Spread Tightening Boosts Hard Currency Bonds

In August, hard currency sovereign bonds returned 1.79%, outperforming local currency sovereign bonds, which returned 0.04% (all returns are stated in U.S. dollar terms), and corporates which returned 1.18%. Returns of hard currency bonds were driven by a tightening of spreads over U.S. Treasuries. Local currencies detracted from positive local bond returns as the U.S. dollar showed strength amid expectations of a rate increase.

Latin America was the highest returning region among hard currency sovereign bonds. Both Peru and Colombia released positive economic data, with the latter also benefiting from the peace process. Bonds issued by Mexico were also top performers, despite a cut to the country's credit rating outlook. Laggards included Mongolia, South Africa, and Chile.

Also of note within the hard currency bond universe is the relative performance of emerging markets high yield corporate debt. At 14.75% total return through the end of August, the sector is performing in line with U.S. high yield, which has returned 14.58%, and is 600 basis points ahead of emerging markets investment grade corporates which have returned 9.35% year-to-date. Emerging markets high yield corporates were still yielding above 7% at the end of August and provided 107 basis points pick-up versus U.S. high yield in option adjusted spread terms. Emerging markets high yield corporates currently have a one notch higher average credit rating than U.S. high yield and a shorter duration as well (3.74 vs. 4.20). That said, the spread pickup over U.S. high yield is near its lowest level since early 2013.

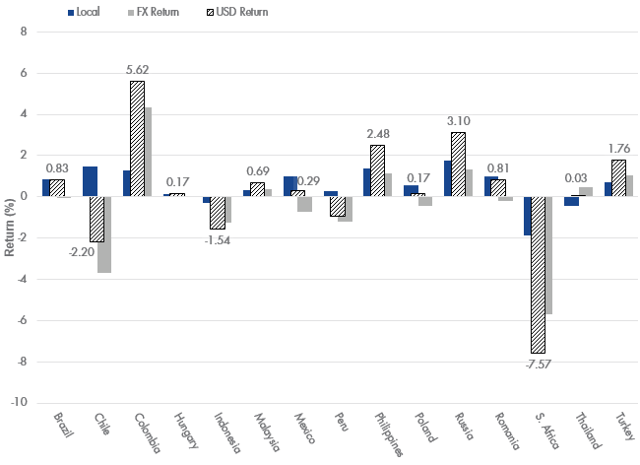

Among local currency sovereign bonds, Colombia, Russia, and the Philippines all experienced currency appreciation, adding to positive local bond returns. South Africa, Chile, and Indonesia were laggards. Chile's government is dealing with an economic slowdown and rising pension costs. The ability to address these issues is in question given the unpopularity of the current government.

The Supportive Market Environment

In the short run, investors are likely to continue to focus on Fed action and the potential impact of a rate increase on the U.S. dollar. Despite these concerns, we feel the overall conditions remain supportive for emerging markets debt. Emerging markets yields continue to be attractive to investors looking beyond the low and negative rates available from most developed markets core fixed income asset classes.

1-Month Total Returns by Country

Source: FactSet as of 8/31/2016.

Download Emerging Markets Debt Observer PDF with Fund specific information and performance

Related Funds:

| VanEck Vectors ETFs | |

| (NYSEARCA:CBON) | ChinaAMC China Bond ETF |

| (EMAG) | Emerging Markets Aggregate Bond ETF |

| (NYSEARCA:EMLC) | J.P. Morgan EM Local Currency Bond ETF |

| (NYSEARCA:HYEM) | Emerging Markets High Yield Bond ETF |

| (IGEM) | EM Investment Grade + BB Rated USD Sovereign Bond ETF |

| (NYSEARCA:IHY) | International High Yield Bond ETF |

| VanEck Funds | |

| (MUTF:EMBAX) | Unconstrained Emerging Markets Bond Fund: Class A |

Important Definitions and Disclosures

Sources of all data: FactSet, J.P. Morgan, and BofA Merrill Lynch. All data is as of 8/31/2016.

Option adjusted spread: yield spread which has to be added to a benchmark yield curve to discount a security's payments to match its market price, using a dynamic pricing model that accounts for embedded options.

Duration is a measure of the sensitivity of the price of a fixed-income investment to a change in interest rates.

Any indices listed are unmanaged indices and include the reinvestment of all dividends, but do not reflect the payment of transaction costs, advisory fees or expenses that are associated with an investment in a fund. An index's performance is not illustrative of a fund's performance. Indices are not securities in which investments can be made.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Non-VanEck proprietary information contained herein has been obtained from sources believed to be reliable, but not guaranteed. Not intended to be a forecast of future events, a guarantee of future results or investment advice. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission of VanEck.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed on this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

Please note that Van Eck Securities Corporation offers investment products that invest in the asset class(es) included in this commentary.

Debt securities carry interest rate and credit risk. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. Credit risk is the risk of loss on an investment due to the deterioration of an issuer's financial health. Securities may be subject to call risk, which may result in having to reinvest the proceeds at lower interest rates, resulting in a decline in income. International investing involves additional risks which include greater market volatility, the availability of less reliable financial information, higher transactional and custody costs, taxation by foreign governments, decreased market liquidity and political instability. Changes in currency exchange rates may negatively impact the Fund's return. Investments in emerging markets securities are subject to elevated risks which include, among others, expropriation, confiscatory taxation, issues with repatriation of investment income, limitations of foreign ownership, political instability, armed conflict and social instability.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will generally decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of a Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com/etfs. Please read the prospectus and summary prospectus carefully before investing.