It's been a tale of two markets for many high-flying tech stocks over the past few months. While the S&P 500 is down only 6% since peaking in September, investor favorites like Amazon.com (AMZN), Apple Inc. (AAPL), and Google Inc. (GOOG) are all down over twice that amount over the same period (see table below).

What Will 2013 Hold For These Stocks?

We feel that these tech stocks are close to bottoming out, but where should investors expect share prices to go from here?

Well, according to S&P Capital IQ, Wall Street analysts still feel very favorable about the future prospects of these stocks. The charts below compare the mean consensus target price and the actual price for each stock. As you can see from the charts, the spreads have widened significantly over the past few months.

The mean target price for Amazon among Wall Street analysts is currently $272.00 (for 2013). Among the 33 analysts that S&P Capital IQ tracks, price target estimates range from $133.00 on the low-end to $350.00 on the high-end, with a median target price of $275.00 (which is in line with the mean).

As shown in the graph above, the mean target price is off its high of around $274.00 in late October, but the spread between the current price and the mean target price has clearly widened as the stock price has plummeted recently.

The current spread between the actual price and the mean target price for Amazon is around $45.00. The last time the spread was this wide was back in mid-May when the stock pulled back to around $208.00. However, investors will recall that Amazon made a new high of $264.00 a few short months after that (a 26% increase).

The mean target price for Apple among Wall Street analysts is currently $768.00 (for 2013). Among the 45 analysts that S&P Capital IQ tracks, price target estimates range from $277.00 on the low-end to $1,111.00 on the high-end, with a median target price of $770.00 (which is in line with the mean).

As shown in the graph above, the mean target price is off its high of around $790 in early October, but the spread between the current price and the mean target price has clearly widened as the stock price has plummeted recently.

The current spread between the actual price and the mean target price is around $220.00. The last time the spread was this wide was back in mid-May when the stock fell to around the same level as today (~$530.00). However, investors will recall that Apple made a new high of $705.00 a few short months after that (a 33% increase).

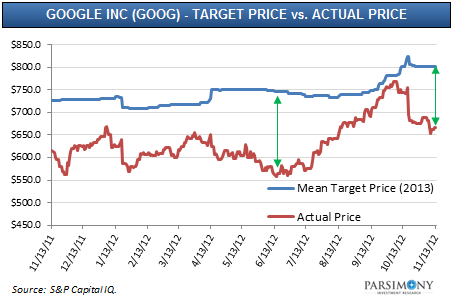

The mean target price for Google among Wall Street analysts is currently $802.00 (for 2013). Among the 37 analysts that S&P Capital IQ tracks, price target estimates range from $675.00 on the low-end to $910.00 on the high-end, with a median target price of $800.00 (which is in line with the mean).

As shown in the graph above, the mean target price is off its high of around $825.00 in late October, but the spread between the current price and the mean target price has clearly widened as the stock price has plummeted recently.

The current spread between the actual price and the mean target price for Google is around $136.00. The last time the spread was this wide was back in mid-May when the stock pulled back to around $560.00. However, investors will recall that Google made a new high of $775.00 a few short months after that (a 38% increase).

The Downside: Are Target Prices Too High?

As discussed above, the last time spreads between actual prices and target prices were this wide ... it was just before all of these stocks rallied significantly! Obviously, this isn't a complete investment thesis for purchasing these stocks, but following where actual prices are in relation to consensus target prices is a great metric to track.

The flip side is that Wall Street recommendations tend to LAG the market (i.e., analysts tend to react to prices). It's not rocket science how these analysts come up with their target prices. It really comes down to two variables: future earnings and future valuation multiple. If an analyst decides to lower either of these variables, the target prices will definitely come down. And if target prices come down meaningfully, the stock prices will probably react accordingly.

While we believe that the target prices for the stocks discussed above are appropriate, investors should definitely follow earnings guidance closely when deciding whether or not a target price is too high.

Conclusion

When market prices and analyst opinions differ this much ... something has to give. If history is any guide, we think that these spreads will start to narrow soon and 2013 might be a pretty good year after all for these stocks.

Disclosure: I am long AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.