I'm a bit concerned which of Santa's lists I'm going to fall on this year. I feel like I've been nice, but Mr. Market is treating me as though I've been naughty.

Over the past couple of years I've been buying what I think are good Canadian unconventional oil producers at what I think have been excellent prices. Why did I buy Canadian? I bought Canadian because the stocks are considerably cheaper than similar companies trading in the States. I've focused mainly on smaller off the radar producers and look what Mr. Market has done to me:

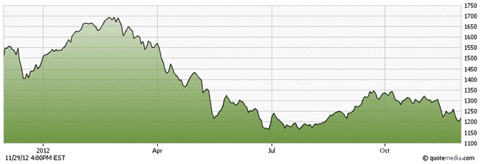

That chart is the Toronto Venture Stock Exchange Index and is comprised of the smaller companies that I have been focused on. It has been a painful drop to experience while I watch the US markets slowly climb higher.

At some point though the tide is going to start rising, and fundamental valuation will win out. It always does, the only question is when.

I'm still very interested in unconventional oil producers. I'd encourage other investors who also are to compare the relative valuations of such producers both in the United States and in Canada.

I will demonstrate by comparing the valuation of American unconventional producer Kodiak Oil and Gas (KOG) with Canadian unconventional producer Novus Energy (NOVUF.PK). Kodiak is considerably larger than Novus, but both companies are growing at similar rates and have similar long-term growth prospects.

By comparing the two, I believe I can show that the valuation of the Canadian producers like Novus is much more compelling.

Kodiak Oil & Gas Valuation

1. Step One: Calculate Enterprise Value

· Shares outstanding -- 263 million

· Most recent closing stock price -- $8.56

· Market Capitalization -- $2.251 billion

· Total debt outstanding -- $915 million

· Enterprise Value -- $3.166 billion

2. Step Two: Determine Valuation of Production

· Expected Exit Production Level - 27,000 barrels per day

· Enterprise Value / Production = $117,270 per flowing barrel

Novus Valuation

1. Step One: Calculate Enterprise Value

· Shares outstanding -- 212 million

· Most recent closing stock price -- $1.04

· Market Capitalization -- $220 million

· Total debt outstanding -- $65 million

· Enterprise Value -- $285 million

2. Step Two: Determine Valuation of Production

· Expected Exit Rate Production Level - 4,200 barrels per day

· Enterprise Value / Production = $67,971 per flowing barrel

Compare the Valuations

No two companies are exactly the same, so differences have to be factored in when thinking about valuation. These two companies are quite similar, though, so their valuations should be at least in the same ballpark.

Both companies are pure plays on high netback unconventional or tight oil production. Both companies are growing very quickly. Kodiak is growing a little more quickly, but has almost twice the debt to cash flow that Novus does.

These are two very similar companies, yet Kodiak at $117,000 per flowing barrel (based on targeted exit rates) is valued 74% higher than Novus which trades at $68,000 per flowing barrel. And the only reason the valuation disconnect isn't larger is because Novus announced two weeks ago that it is looking to realize value (aka sell the company) which has caused a 25% increase in its share price.

My point isn't that Kodiak is overvalued, in fact far from it. Kodiak is a fast-growing unconventional oil producer with a future that is going to see that growth continue. I like those. My point is that Novus is also a pretty fast-growing unconventional oil producer, also with a future of continued growth, but valuation multiples that are a fraction of Kodiak's.

I think the future growth prospects of Novus (and other Canadian producers) are being greatly unappreciated by Mr. Market. If you like the fast-growing unconventional American oil producers, I encourage you to have a closer look at Novus and other unconventional Canadian producers. I believe the Canadian producers have all of the attributes investors like in the American producers, but much more attractive valuations.

Disclosure: I am long NOVUF.PK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.