Excerpt from Raymond James Economist Dr. Scott Brown's latest economic commentary:

The Federal Open Market Committee began the current easing cycle in September 2007, when the Fed funds target rate was 5.25% – not especially high by historical standards. The Fed cut rates by 100 basis points by the end of last year and another 225 basis points by the spring. According to Fed Chairman Bernanke, “by way of historical comparison, this policy response stands out as exceptionally rapid and proactive.” However, financial instability increased in September and the FOMC cut by another 100 basis points in October (the October 8 move was an unprecedented coordinated cut with five other central banks). With inflation looking like a credible threat, some criticized the Fed’s rate cuts. However, in hindsight, the Fed’s action seems well-timed. Inflation did advance into the summer months, but has begun retreating, due largely to falling energy prices.

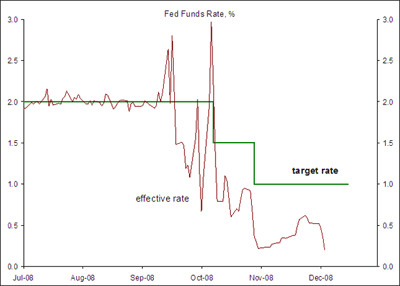

Since October, the effective Fed funds rate has averaged 0.39% – well below the 1% target rate. This begs the question, would another 50 basis points taken off the Fed funds target rate qualify as an ease?

There may be some good reasons not to cut the target rate to zero. The Fed began paying interest on reserves in October (currently equal to the Fed funds target rate). Theoretically, the change was supposed to help set a floor on the actual funds rate. However, that hasn’t been the case. One factor, according to Fed Chairman Bernanke, is that some large suppliers of funds, such as Fannie Mae and Freddie Mac, are not eligible to receive interest on reserves and are willing to lend overnight federal funds at rates below the target.

...

Still, the Fed is running out of room to cut. Nominal interest rates cannot fall below zero. However, as Fed Chairman Bernanke has indicated, “there are several means by which the Fed could influence financial conditions through the use of its balance sheet, beyond expanding our lending to financial institutions.” One of these is quantitative easing.