If you were to look only at the flurry of upgrades and price target increases which happened right after Amazon.com (NASDAQ:AMZN) reported its Q4 2012 earnings, you might be led to believe that Amazon.com's prospects, no matter its sky-high valuation, had materially improved. That the beautiful future everyone expects had just drawn closer.

So, if Amazon.com's prospects had just become so much clearer and brighter, surely enough that the earnings and revenue estimates, already optimistic, had just taken on another shot of vigor. Knowing this, one just had to wait for those revamped estimates to hit the consensus and be grateful for such a favorable outcome and evolution.

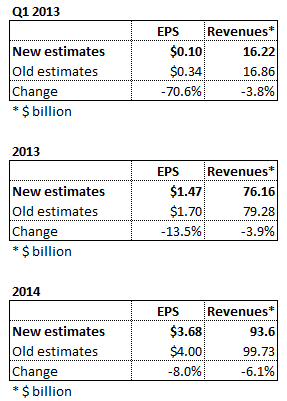

Well, today is the day when we can start seeing some results from the renewed optimism. Let us then go over what changed regarding Amazon.com's consensus earnings and revenue estimates for the next quarter, as well as for 2013 and 2014.

Holy Moly! Yet another quarter where Amazon.com's estimates suffer a huge implosion! Maybe "better than estimated margins" regarding Amazon.com has taken on a new meaning. Usually Amazon.com's estimates for the nearest quarter fall by 80%-90%, and this time they fell by just 70%. Maybe that's it.

This isn't new

One could think this is a one-off for the leading, highest valued (in terms of multiples) mega capitalization stock in the market. But it isn't. It has been the same story ever since Q4 2010. Every quarter since then saw not only near-term estimates be lowered, but also estimates as much as two years down the road, much like today. This has thus been going on for more than two years, and the end result has been that whereas in 2012 Amazon.com was already supposed to be earning more than $5.00 per share, it ended up posting a loss for the entire year.

Now, the thesis on Amazon.com rests on it producing huge earnings down the road. That thesis has been used to promote Amazon.com to such an extent that its enterprise value (roughly, market capitalization less net cash) is now worth about half of Apple's (AAPL), the most profitable company in the land, even though Amazon.com posted a loss in its last year of operations. Just let that sink in - to justify the level at which Amazon.com trades, it will have to get as much as half Apple's profits, which amounted to nearly $42 billion in the last year, some 40 times larger than the best Amazon.com ever put in the table. It's obvious that the likelihood of Amazon.com ever earning what it needs to earn is up there with being hit by lightning.

Conclusion

Once again, Amazon.com went through its traditional lowering of estimates, where analysts confess their sins, are absolved and price targets rejoice. Although such festivities are to be celebrated, it would seem that investing based on this cultural phenomenon is somewhat ill-advised, on a par with running ahead of mad bulls in Pamplona.

One day Amazon.com might yet produce the profits the analysts keep predicting but never happen. Betting on Amazon.com at a $125 billion market capitalization, however, is the same as betting on the Lottery by paying $5 million for a ticket, which might award $10 million once in a million times. You might actually win, but the odds are stacked heavily against you.

Disclosure: I am short AMZN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.