In this article, I will be constructing a new permanent portfolio, with the goal of being able to own the funds in the portfolio through all market cycles, to capture upside, and limit downside risk. There are a couple popular permanent portfolios out in the investing world already, the first is the Harry Browne permanent portfolio, and the second is Global X Permanent ETF (PERM). In the table below, I show the breakdown of assets and allocation for the Harry Browne Portfolio and the Global X Permanent ETF.

Harry Browne Portfolio

For the Harry Browne Portfolio I found a website that has his portfolio broken down by asset and allocation. He breaks down his portfolio into four categories: Stock, Long-term Government Bonds, Cash, and Gold.

Corresponding ETF | Reason/Recommendation | ||

25% | (SPY) | 25% in U.S. stocks, to provide a strong return during times of prosperity. For this portion of the portfolio, Browne recommends a basic S&P 500 index fund. | |

25% | (TLT) | 25% in long-term U.S. Treasury bonds, which do well during prosperity and during deflation (but which do poorly during other economic cycles). | |

25% | (MINT) | 25% in cash in order to hedge against periods of "tight money" or recession. In this case, "cash" means a money-market fund. | |

25% | (GLD) | 25% in precious metals (gold, specifically) in order to provide protection during periods of inflation. |

Portfolio Yield

[Yield Data from Seekingalpha]

Yield | W*Y | ||

25% | SPY | 2.70% | 0.68% |

25% | TLT | 2.69% | 0.67% |

25% | MINT | 0.91% | 0.23% |

25% | GLD | 0.00% | 0.00% |

Portfolio Yield | 1.58% |

Global X Permanent ETF

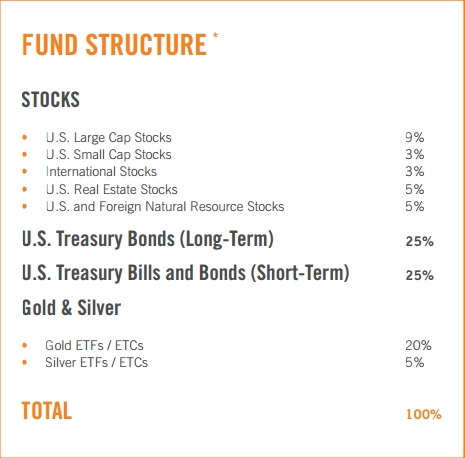

For the Global X Permanent ETF I went to its fund page to find its asset and allocation breakdown. I found that the fund was very similar to Harry Browne's portfolio, but it does have some key differences. The permanent ETF uses short-term government bonds rather than a money market fund, and also the permanent ETF allocates 5% to silver where as Harry Browne strictly allocates to gold. The image below from the Permanent ETF fund page shows the portfolio target allocations for each asset class.

Portfolio Yield

According to SeekingAlpha PERM has a yield of 0.81%

Concerns with Existing Permanent Portfolios

Harry Browne Portfolio Concerns:

- The portfolio has no allocation to international stocks.

- The portfolio has no allocation to international bonds.

- The portfolio has a low dividend yield.

Global X Permanent Portfolio Concerns:

- The portfolio only has a 3% allocation to international stocks.

- The portfolio has no allocation to international bonds.

- The portfolio has a low dividend yield.

- The portfolio has a large allocation [50%] to U.S. Government debt government debt.

My New and Improved Permanent Portfolio

Below is a list of the goals I wanted to accomplish when constructing the portfolio.

Portfolio Goals:

- Construct a portfolio that is more diversified than the Harry Browne portfolio or the Permanent ETF.

- Construct a portfolio that has a lower volatility than the Harry Browne portfolio or the Permanent ETF.

- Construct a portfolio that has a higher dividend yield to generate more income than the Harry Browne portfolio or the Permanent ETF.

- One concept that the Harry Browne portfolio and Permanent ETF both have is an equal weight across each asset in the portfolio, so I will weight my portfolio equally as well.

Asset Selection:

For my portfolio, I included the following asset classes. The reason why I chose to include each is listed below, as well as an ETF that corresponds to the asset class.

- Low volatility U.S. Stocks

I chose to include low volatility U.S. stocks to meet my goal of diversification, and because of the lower volatility than traditional indexes like the S&P 500, Dow Jones Industrial Average, or the Russell 1000.

Fund Selected: PowerShares S&P 500 Low Volatility Portfolio ETF (SPLV)

- Low Volatility Emerging Markets Stocks

I chose to include low volatility emerging markets stocks to meet my goal of diversification, and because of the lower volatility than other emerging market indices like the MSCI Emerging Markets Index.

Fund Selected: iShares MSCI Emerging Markets Minimum Volatility Index ETF (EEMV)

- Short-term investment grade corporate bonds

I chose to include a short-term corporate bond fund for two reasons, the first is to reduce duration risk of the portfolio, and the second is that corporations have much better balance sheets than the U.S. government.

Fund Selected: Vanguard Short-Term Corporate Bond Index ETF (VCSH)

- Emerging market bonds

I chose to include a emerging market bond fund for three reasons, the first is diversify the portfolio's bond holdings, the second is that emerging markets in general have much better balance sheets than the U.S. government. The third reason is to help accomplish my goal of the portfolio having a higher dividend yield.

Fund Selected: PowerShares Emerging Markets Sovereign Debt Portfolio ETF (PCY)

- Gold

I chose to include a gold fund because of the diversification aspect for the portfolio, and because gold is a hedge against weakening currencies worldwide, and inflation.

Fund Selected: SPDR Gold Trust ETF

Portfolio Yield

Weight | Symbol | Yield | W*Y |

20% | SPLV | 2.99% | 0.60% |

20% | EEMV | 1.25% | 0.25% |

20% | VCSH | 1.91% | 0.38% |

20% | PCY | 4.65% | 0.93% |

20% | GLD | 0.00% | 0.00% |

Portfolio Yield | 2.16% |

Historical Performance

Because PERM is a relatively new ETF, I will compare my portfolio to PERM and the Harry Browne portfolio back to February 8, 2012, which is the inception date for PERM. Then I will compare my portfolio to the Harry Browne portfolio going further back with the data available. I will be using ETFreply.com for the total return and volatility data in the tables below.

Total Return | Volatility | Return/Volatility | |

My Portfolio | 8.80% | 6.20% | 1.42% |

PERM | 1.50% | 6.80% | 0.22% |

Harry Browne | 3.60% | 5.10% | 0.71% |

As the table above shows, my portfolio had the greatest risk adjusted return compared with the Harry Browne portfolio or PERM since February 8, 2012. In the table below, I will compare my portfolio with the Harry Browne portfolio as far back as October 20, 2011, which is the inception date for EEMV. As the table below shows, my portfolio posted a better risk adjusted return than the Harry Browne portfolio.

Total Return | Volatility | Return/Volatility | |

My Portfolio | 16.40% | 7.70% | 2.13% |

Harry Browne | 9.60% | 5.70% | 1.68% |

Closing thoughts/Observations

Overall, I am very pleased with the portfolio because it accomplished all the goals I had set. First, my portfolio is diversified across more asset classes than the other permanent portfolios. Second, my portfolio has a lower volatility than PERM but not the Harry Browne portfolio because of the allocation to the money market fund MINT. Finally, my portfolio has a higher dividend yield than PERM or the Harry Browne portfolio. It will be interesting to see how this portfolio will perform in the future with the purposeful exclusion of U.S. government debt.

Disclosure: I am long SPLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.