Aruba Networks (ARUN) has long been an interesting stock. The provider of next-generation network access solutions for mobile enterprises had a serial issue with diluting away the strong revenue growth. It reported Q2 2013 earnings that exceeded the market estimates, sending the stock higher in after-hours trading.

Previous research for this article (see Aruba Networks: Revenue Growth Disappears In Thin Air) had suggested ignoring this stock until revenue growth actually flowed to the bottom line. Back then; the company had 34% revenue growth in the December 2011 quarter that lead to earnings only increasing from $0.14 to $0.16. Has management finally changed the tune to suit shareholders?

Q2 2013 Earnings

The company reported the following highlights for Q2:

- Second Quarter Revenue Increased by 23 Percent Year-Over-Year and 8 Percent Quarter-Over-Quarter to a record $155.4 Million

- Non-GAAP net income for Q2'13 was $27.3 million, or $0.22 per share, compared with Q2'12 non-GAAP net income of $19.4 million, or $0.16 per share.

- Strong Gross Margin and Leverage Lead to Record Operating Margin.

- Generated $45.7 Million in Cash Flow from Operations and Increased Cash and Short-Term Investments to $402.3 Million.

The good news was that the net income soared much faster than the 23% revenue growth. More importantly, diluted shares outstanding only increased to 123M from 120M last year. In fact, the original guidance for Q3 2012 or the March 2012 quarter was for the share count to increase to 122M. In the course of 2012, the company has managed to not dilute shareholders any further.

Business Outlook

More important than the huge gain after hours is the fact that the company raised the revenue estimates for the next quarter. The updated business outlook is as follows:

- Total revenue to be in the range of $159 million to $161 million.

- Non-GAAP profits of about $0.20.

The guidance is basically in line with previous street estimates with the slight boost to the revenue expectations. At roughly 20% revenue growth, the guidance provides for solid 25% earnings growth. Investors must see this type of margin expansion going forward to become enamored with Aruba.

Increased Competition?

Over the last year, the public markets have become more competitive for investor capital with the addition of Ruckus Wireless (RKUS). While Ruckus competes more in the cellular offloading Wi-Fi segment, it still dilutes capital from investors interested in the general Wi-Fi sector. In the future, it could also transition more into the enterprise sector.

The main competitor continues to be Cisco Systems (CSCO). The CTO was clear on the earnings call that Cisco appears to no longer want to compete on technology alone. Strange comments for such a public event as it could only help fuel resurgence by the sleeping giant. Important though, the company has not seen any reduction in the win rate regardless of the expectations that Cisco would re-focus on this sector after buying Meraki Networks.

As the market continues to develop, the two distinct Wi-Fi areas will continue to overlap. Aruba is already deploying solutions for large venues such as stadiums or airports and hospitality events that overlap with the cellular offload. The market will undoubtedly become more competitive.

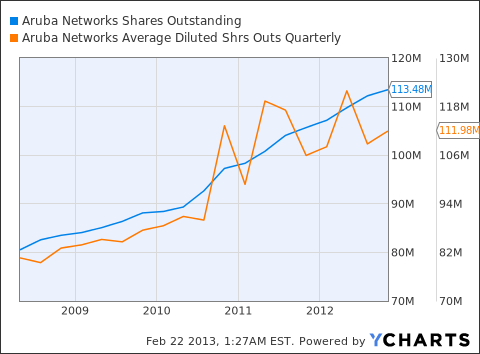

Stock Dilution

The stock has gone nowhere over the last two years as net income growth hasn't been able to outgrow the additional shares leaving EPS mostly flat. The below chart highlights the massive growth in outstanding shares over the last few years:

ARUN Shares Outstanding data by YCharts

The company did guide to 125M shares outstanding signaling some further creep higher on share counts unless the company buys more shares with the $402M of cash on the balance sheet.

Conclusion

Now that Aruba Networks has solved the constantly spiraling higher share count, the leading provider in the enterprise wireless LAN market can be considered for purchase. The BYOD environment should continue fueling the growth of the sector and the stock while stealing market share from Cisco Systems appears all but certain to lead to faster growth.

Compared to the valuation of Ruckus Wireless, Aruba appears attractively priced if the company can continue growing earnings per share and not just the net income.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.