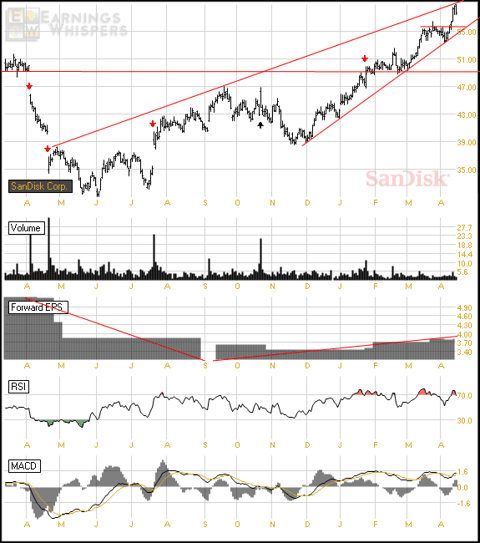

SanDisk (SNDK) was originally scheduled to be play on Friday, April 12, 2013 for a long trade ahead of earnings this week. Monika Garg at Pacific Crest Securities and Sidney Ho at Nomura Securities both said they recommend owning shares of the stock ahead of an expected earnings beat and raised guidance from the company. However, with the stock having already broken to new highs, much of our statistical edge for a trade ahead of the news is gone and we removed the stock from our play list.

Yet, as Dean Grumlose at Stifel Nicholaus said, the company still has tailwinds. One tailwind is the Japanese yen, which has dropped approximately 10% since the last time SanDisk reported results. Dan Niles at AlphaOne Capital said this alone should add 4% to SanDisk's gross margins. The company's guidance for the first quarter was for revenue of $1.225 billion to $1.30 billion with gross margins of 36% to 40%. Throw in operating expenses of $225 million and a tax rate of 28% for the quarter, we calculate a range of $0.64 to $0.87 per share. The consensus earnings estimate is right in the middle of this range at $0.75 per share. Bump the gross margin range up by 2% to 4% with the move in the Yen, and we get a range of $0.71 to $1.02. This puts upside room to the Earnings Whisper ® number of $0.89 per share.

This is without factoring in the upside potential for the top line. Demand for NAND memory has been growing at the same time wafer supply has been limited, thus pushing NAND prices higher. Mehdi Hosseini at Susquehanna Financial said this has led to positive checks throughout the quarter. Thus, there is upside risk to estimates even without factoring in the decline in the Yen... and the same upside exists to the company's 2013 guidance and fiscal year estimates.

The company's guidance was for revenue of $5.3 billion to $5.6 billion, gross margins of 39% to 43%, and operating expenses of $1.05 billion, and a tax rate of 30.5%. By our math, this puts earnings at $2.89 to $3.87 per share. The consensus earnings estimate has ticked higher throughout the quarter from $3.51 to $3.84 per share. Adding the margin upside due to the decline in the Yen, we get a range of $3.20 to $4.50 per share. So the consensus estimate is already at the mid-point of this range, but analysts get there using revenue above the company's guidance with $5.63 billion. As we've pointed out several times in the past, it is statistically positive for stock prices ahead and through a company's earnings release when analysts have estimates above the company's guidance. Using the consensus revenue estimates and the revised gross margins due to the move in the Yen, we get a mid-point of $4.06 per share.

These expectations are important because, while an earnings miss has a significant negative impact on the stock, there has been little net movement from a simple beat of the consensus estimates for SanDisk in the past. Since 2005, when the company has beat the consensus earnings estimate it has meant almost nothing. On average, when the company beats the consensus estimate, the stock has gapped higher by only 0.05%, then traded down 1.20% and remained in the red for a week before starting to see some recovery. Not coincidently, there has only been one time in the past 15 years that the company beat consensus estimates but missed the Earnings Whisper ® number and the stock still gapped higher on the news. So, the ideal trade for a short after the news on a whisper miss hasn't been available too often for a stock that has averaged a 12.1% move on earnings. On the other hand, there have been 18 times when the company beat the Earnings Whisper ® number and the stock has averaged a gap higher of 3.89% on the news. On a gap higher this quarter though, we need the stock to hold above $59 to confirm additional upside.

SanDisk is scheduled to report earnings after the market closes on Wednesday, April 17, 2013 with a conference call at 5:00 PM ET

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in SNDK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. Also willing to short the stock after earnings based on the results and price action