Every research firm and data analysis over the last couple of months suggested that Facebook (FB) is losing users especially amongst the younger generation. Reading the Q113 earnings call transcript, one gets the impression that the company has unlimited user growth ahead and no issue with the teen crowd. Why does such a dramatic dichotomy exist in the market?

While Facebook remains the dominant leader in social media, sources from Piper Jaffray analyst Gene Munster to SocialBakers suggests that the younger generation and especially teens are quickly moving on from the site to Twitter or other social outlets. The company is desperately attempting to address the issue via numerous new products that aren't attracting enough revenue to exceed the cost of the products.

The big question is why the data doesn't match up. Everybody knows people that are no longer as active on the site. Even the company itself spends much more time on developing products for advertisers and not users. Just about all the new products involve better methods to monetize users that outside of Home provide limited reasons to use Facebook more. In fact, Instagram is the product that Facebook should spend a considerable larger amount of time figuring out how to monetize, yet the company continues to push it off into the future.

Q113 Highlights

The company reported the following highlights for Q113:

- Daily active users (DAUs) were 665 million on average for March 2013, an increase of 26% year-over-year.

- Monthly active users (MAUs) were 1.11 billion as of March 31, 2013, an increase of 23% year-over-year.

- Mobile MAUs were 751 million as of March 31, 2013, an increase of 54% year-over-year.

- Revenue for the first quarter totaled $1.46 billion, an increase of 38%, compared with $1.06 billion in the first quarter of 2012.

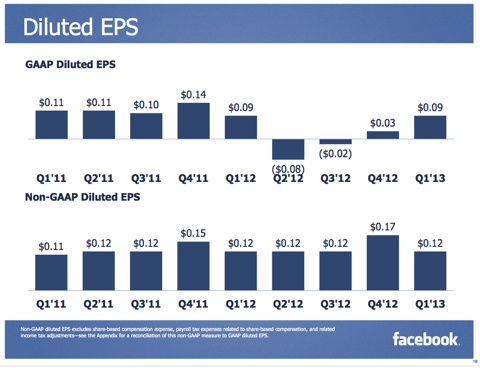

- Non-GAAP diluted EPS for the first quarter of 2013 was $0.12, essentially flat compared to the first quarter of 2012.

- Non-GAAP operating margin was 39% for the first quarter of 2013, compared to 46% for the first quarter of 2012.

It is never a good sign when revenue grows by 38% and DAUs surge 26%, yet the earnings per share were flat with last year. For the company to deserve a $67B market cap, it shouldn't need to invest so much for the future.

Stalled Earnings

Though investors cheer the surging revenue, the company has failed to increase the earnings per share over the last 3 years. In fact, outside of the fourth quarter of the last couple of years, Facebook has yet to report an EPS greater than $0.12. All of the additional revenue has come at a cost that matches the revenue generation. By attracting customers to a free service, Facebook continues to struggle with monetizing those users in an increasing profitable manner.

The data highlights the difference between attracting users and attracting users to a profit-generating product.

Is Facebook In Denial?

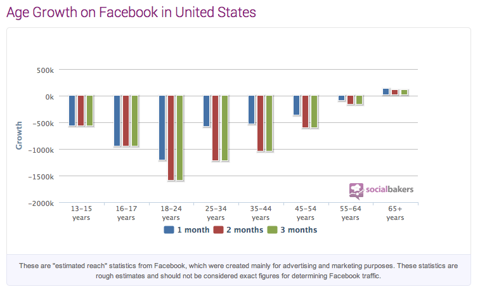

As with most of the analyst and media reports, little discussion takes place regarding the apparently eroding user base in North America and the developed part of the world. While emerging markets such as Brazil and India continue to grow, the revenue-generating portion of the user base has clearly stalled regardless of the data provided directly from Facebook.

The company lists the North American monthly user base at 195M, while SocialBakers shows the number plunging to 175M - a drop that would crater the stock if backed up by the company. Unfortunately, analysts are unwilling to question how Facebook calculates monthly average users and why the difference is so dramatic between other data providers.

Even surveys such as the one from Piper Jaffray clearly points out that the teen crowd is turning away from the social network in favor of Twitter and even Instagram. Sure Facebook owns that service, but it will cost a ton of money to figure out how to monetize it.

Even more incredible was the statement from the CFO on the earnings call after a question from Mark Mahaney from RBC Capital Markets:

I guess I'd start by saying we remain really pleased with the high level of engagement on Facebook by people of all ages around the world. You asked about people under 25, we continue to have really high penetration rates among that age group, both in the U.S. and globally. And the younger users remain among the most active and engaged users that we have on Facebook. And then in addition, younger users are extremely active users of Instagram as well. So that's great and makes our position even stronger.

Based on this statement, the company appears in complete denial that the younger generations are leaving the network for better and newer services. Or maybe investors should read more into the fact that the CFO didn't say the under 25 crowd was still growing by instead alluding to high levels of engagement and activity. The statement while subtle actually could be the key to the earnings call. Considering nobody disputes that the younger generation continues to be active, the lack of a comment regarding that group still growing is very telling.

In fact, that generation is leaving for Instagram, which Facebook has yet to monetize even though it has a user base of over 100M. That user base matches with the 102 MAUs that Yelp (YELP) reported and it already has a revenue base heading towards $200M.

The below graph from SocialBakers highlights the reported declines in each age group with the under 25 group leading the way:

Stock Valuation

With investors focused solely on mobile and revenue growth, the stock appears set for a rally to higher levels as the below chart shows a potential breakout:

Conclusion

Investors remain convinced that Facebook will continue growing unabated. Even though, all data sources and personal experiences suggest that Facebook is not only losing the teen crowd, but also every crowd other than the older generations. It continues to report revenue growth as it monetizes the existing user base. With the market favoring the monetization of mobile, the stock remains difficult to short.

The analyst group has been unwilling to identify why Facebook has numbers that differ with all other reporting metrics. At some point, the reality will hit the market and Facebook will run into problems. Everybody knows that the younger generation is leaving for cooler social network services, yet the stock market ignores these facts. Investors have to be cognizant of this fact and either be long the stock only for a trade or on the sidelines waiting for the ultimate peak in the stock where it will become a short of historical proportions.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.