Introduction

"I think the market is overvalued now," is a common refrain that I'm hearing from most of the individual investors I have recently been coming in contact with. Consequently, many of these same investors are also currently eschewing investing in common stocks because of that fear. Although I do not agree that the market is currently overvalued, I believe I understand why so many people think it is. Individual investors currently believe the market is overvalued because of two common fallacies that at first blush appear to be logical.

This is the first of what will be a sequence of 10 subsequent articles designed to show how retirees, or pre-retirees, can construct dividend growth portfolios comprised of high quality blue-chip stocks all purchased at fair value, in spite of what many believe to be an overvalued market. I do not believe that investors should be denied the opportunity to create sound and prudent portfolios capable of producing long-term capital appreciation and a growing dividend income stream at reasonable levels of risk because of unsubstantiated fears based on the fallacy that all stocks are overvalued.

Simply stated, I will clearly illustrate that they are not. Some are, but many are not. Moreover, I further intend to demonstrate that there are a more than adequate number of undervalued stocks with which investors can build conservative high quality and properly diversified dividend growth portfolios in today's environment.

The First Fallacy: Stocks Are At All-Time Highs And Therefore Overvalued

The first fallacy is based on what appears to be the logical conclusion that since many stocks are trading at all-time highs that they must simultaneously be overvalued. In truth, a stock can be trading at an all-time high, and still be reasonably priced or even undervalued. Below I offer two clear examples, one that is undervalued and one that is fairly valued, to illustrate my point. For the sake of balance, I will also add a third example of a stock that actually is overvalued. As I will elaborate on later, is a market of stocks not a stock market.

International Business Machines (IBM) Is Undervalued But Price Is At An All-Time High

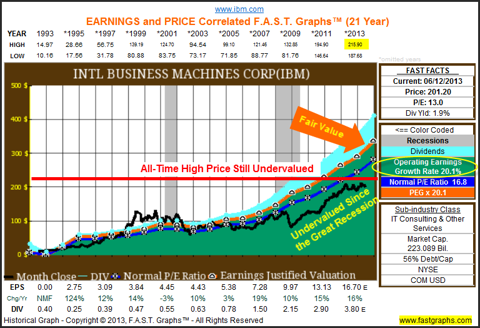

I offer the following 21-year earnings and price correlated F.A.S.T. Graphs™ on IBM as a case in point of an undervalued stock trading at an all-time high. Clearly, IBM's stock price is the highest that it's ever been, even though its current P/E ratio of 13 is below its historical normal P/E ratio of 16.8. Therefore, even though IBM is trading at an all-time high price, its current valuation is historically low because earnings (the orange line) have actually grown faster than the stock price.

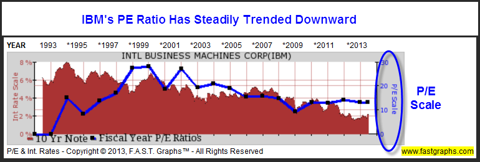

The following graph plotting IBM's historical year-end P/E ratio is another way to see this clearly. A quick glance shows that the historical fiscal year-end P/E ratios on IBM (the black squares on the dark blue line) show that IBM's P/E ratio has actually been falling since 1999, and is currently on the low end of normal. To repeat, IBM reflects a situation where earnings growth has been much stronger than price appreciation, and therefore, the shares remain undervalued even though share price is at an all-time high.

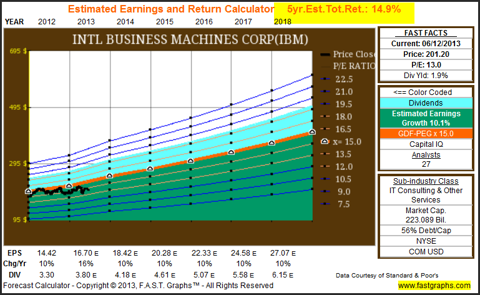

The above graphs illustrate that IBM is undervalued based on historical earnings growth rates. The following estimated earnings and return calculator graph shows that it is also moderately undervalued based on current consensus forecasts.

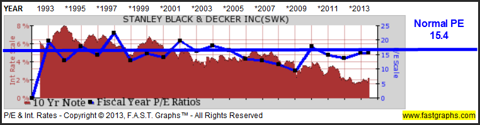

Stanley Black & Decker Inc. Is Fairly Valued But Price Is At An All-Time High

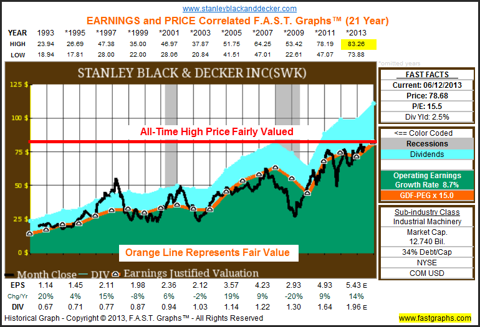

The following 21-year earnings and price correlated F.A.S.T. Graphs™ on Stanley Black & Decker (SWK) clearly illustrate that the company is currently fairly valued. The black monthly closing stock price (the black line) is sitting right on the orange earnings justified valuation line indicating fair value. Consequently, in this example, we not only see that price clearly tracks earnings over the long run, we also see several examples when the stock was overvalued (the price is above the orange line) and when the stock was undervalued (the price was below the orange line). But more importantly, we see that price always returns to fair value, whether it is over or under. Nevertheless, Stanley Black & Decker is trading within its all-time highs, but yet the company remains fairly priced with a P/E ratio of 15.5.

A review of the historical fiscal year-end P/E ratios of Stanley Black & Decker show that its current P/E ratio is clearly within its normal range of valuation. In other words, although the stock price is near an all-time high, current valuation is well within its earnings justified levels, and even arguably slightly on the low side of normal value.

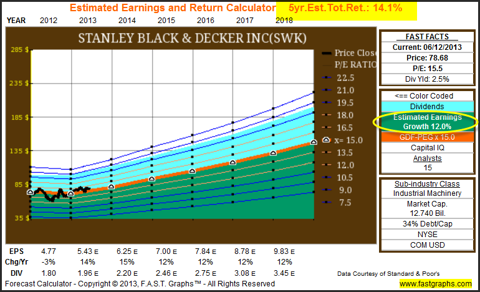

The consensus 5-year earnings forecast for Stanley Black & Decker expect earnings growth to accelerate to 12% per annum. This rate of growth justifies a 15 to 16 P/E ratio, which is precisely where the company is currently valued at today by the market place.

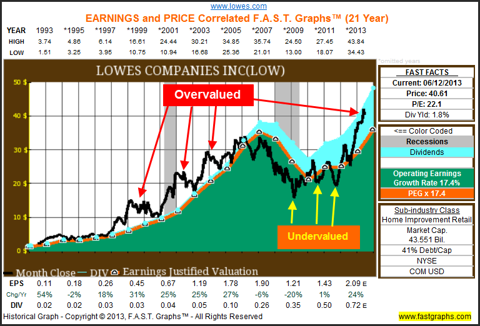

Lowe's (LOW) Is Both Overvalued And At An All-Time High

There are several lessons that the Lowe's graph teaches us. However, the most important one is that the company is clearly currently overvalued as its price is significantly above the orange earnings justified valuation line. A second important lesson is that in the long run price (the black line) tracks earnings. In other words, where earnings go stock price soon follows. The third important lesson is that we see a legacy of the company's price rising above the orange earnings justified valuation line, only to see it soon return to fair value. A similar pattern occurs when the price falls below the orange earnings justified valuation line.

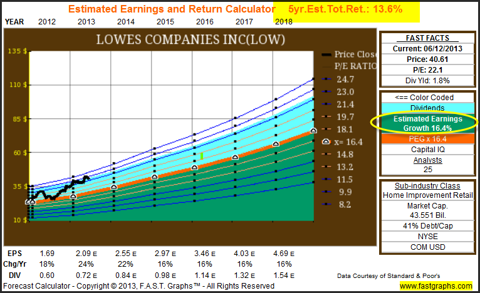

Interestingly, Lowe's is expected to continue growing future earnings at a rate that is very consistent with its historical growth. However, even considering that the consensus of analysts expects earnings growth of 16.4%, Lowe's is clearly overvalued at today's 22.1 P/E ratio. Perhaps even more interesting, because of this high-growth expectation, Lowe's could still actually be a very good long-term investment even at these high valuation levels. The 5-year estimated total annual return, including dividends, is expected to be 13.6%.

On the other hand, based on the historical patterns discussed above, prudence might suggest that over the shorter term you might be given an opportunity to buy this company at a better valuation, which could actually reduce long-term risk while simultaneously enhancing your long-term rate of return. My point being that overvaluation does not necessarily indicate a bad investment or future losses. Instead, as in the case of Lowe's, it might simply be indicating that you are taking higher risk than you might need to in order to achieve an acceptable future return.

The Second Fallacy: After a 3½ Year Run Stocks Must Be Overpriced

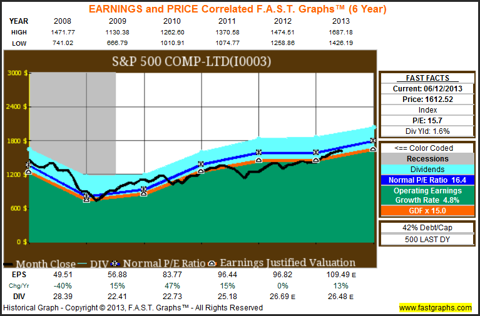

The second fallacy is based on the misconception that since the market had a very strong run, not only this year, but over the past 3½ years, many people automatically assume that it must be overpriced. However, the truth is that the market, just like the IBM and Stanley Black & Decker examples above, has had a rise that closely correlated to its earnings growth coming out of the great recession of 2008. In other words, the market may be at an all-time high, but not necessarily overvalued.

The overall stock market as represented by the S&P 500 is well within its 200-year historical normal P/E ratio average of between 14 to 16 times earnings. The following earnings and price correlated F.A.S.T. Graphs™ on the S&P 500 illustrate that its price is well within its historical earnings justified valuation. If the overall market is high, it's only by a smidgen, and certainly not beyond reason or fair value norms.

The Greatest Investor Fallacy Of All

What has been written thus far leads me to a discussion on what I believe to be the greatest investor fallacy of all. This is the fallacy of making investment decisions based on predictions about the general state of the stock market. In other words, I do not believe in predicting markets, instead, I believe in analyzing individual companies based on their own merit and then building my portfolios one company at a time.

Moreover, my years of experience and research have led me to conclude that whether the market is a bear or bull, there will always be fairly priced, overpriced and underpriced individual companies to be found. Therefore, I believe that investors are better served by looking for good businesses at sound valuations, regardless of what they believe the market may currently look like. In the long run, the evidence clearly supports the idea that it is time in the market, not market timing that matters most.

To be clear, I'm talking about owning great individual businesses bought at sound valuations and held for the long run. With this philosophy, I am rarely concerned about what the general state of the market might be. Instead, I am greatly concerned about the fiscal health and valuation of each of the individual companies I own. Moreover, this is where I spend all of my time, energy and effort. Once I buy a great business I like, at a good price, I continuously monitor and research that business with little concern about the general state of the markets, or the economy for that matter.

A Methodical Approach To Finding Value In This Market

I believe in diversification as a risk minimization tool. However, in the context of this article, I'm going to discuss sensible or prudent diversification within the dividend growth stock asset class. In other words, I'm going to present a logical and methodical approach to creating a diversified portfolio of dividend growth stocks purchased at fair value in our current market environment.

For starters, I believe a dividend growth portfolio can be properly diversified with only 20 to 25 stocks. However, I would add that with this amount of concentration, it's critical to continuously monitor the fundamentals behind each of the businesses in the portfolio. This is the old adage that if you only put a few things in your basket, then you must watch that basket very closely. But I believe that continuous monitoring is a good practice regardless of how many names in your portfolio. My point being that it is much easier to watch and closely monitor 20 to 25 stocks, than it would be 100 or more.

For those that would be uncomfortable with such high concentration, I would acquiesce that 30 to 50 stocks would also work. With 50 stocks, you would only have a 2% exposure to your overall portfolio in the event that any one of those stocks actually went completely bankrupt. On the other hand, if you're careful with your selection in the first place, the odds of that occurring are very rare. To repeat, the problem with holding this many companies is the time, complexity and amount of effort required to monitor your portfolio efficiently and effectively.

Regardless of whether you like a concentrated, or are more comfortable with a more broadly diversified portfolio of stocks, what follows is my logical and methodical approach to putting one together today. First of all, I will utilize the screening function of the F.A.S.T. Graphs™, fundamentals analyzer software tool and search each of the 10 major sectors for potential candidates. My initial search is very simple and straightforward. The Global Industry Classification Standard (GICS) was developed by Morgan Stanley Capital International (MSCI) a leading provider of global indices, and Standard & Poor's (S&P).

There are 10 sectors designated by 2 digit codes as follows:

10 - Energy

15 - Materials

20 - Industrials

25 - Consumer Discretionary

30 - Consumer Staples

35 - Health Care

40 - Financials

45 - Information Tech

50 - Telecommunications

55 - Utilities

Additionally, under each of these major sectors there are several subsectors, anyone interested in seeing all the information on all sectors and subsectors can follow this link.

Consequently, in searching for dividend growth stocks at fair value within each sector, I utilized the following simple screen. I searched by sector, and then for companies within each broad sector that have a minimum of a 2% dividend yield. Then I reviewed each company that the screen produced and handpicked only those companies that had reasonably consistent historical earnings growth, and that were plus or minus at fair value. The reason I included stocks that might be slightly overvalued, was because they could quickly become attractive candidates with only a moderate correction.

Summary and Conclusions

Within this article, I provided a sneak peek at the sectors: 45 - Information Tech with my IBM example, 20 - Industrials with Stanley Black & Decker, and finally 25 - Consumer Discretionary with Lowe's. In the subsequent articles in this series, I will provide samples of prescreened companies that I believe are currently at fair value or close to it, in each of the 10 broad sectors in the order that they are listed above.

Therefore, the first of my 10 future articles will cover the energy sector. Incidentally, there are numerous companies in the energy sector that are undervalued in comparison to equivalent quality companies within the other sectors. I will provide a portfolio review, covering a hand-selected list of companies in each sector that I feel are currently fairly valued, and worthy of consideration and a more comprehensive due diligence effort. I will also include specific examples that I feel represent two general types of dividend growth opportunities. The first I will categorize as Conservative Growth and Income, and the second I will categorize as Aggressive Growth and Income.

When I started my career in the financial services industry in 1970, it was prior to Modern Portfolio Theory's coming into vogue and ubiquity. It was a time that I now refer to when investors practiced "Ancient Portfolio Reality." In these, what I consider to be more sane and rational times, portfolios were constructed and designed based on the unique and specific goals, objectives, risk tolerances and needs of the individual investor. Instead of asset allocation, and its highly profitable (to the professional providers) policy of continuous rebalancing that generated lots of new commissions each year, portfolios were built to get a specific job done.

Instead of spreading as much mud up on the wall, regardless of whether an asset class made prudent sense or not, the approach was more intelligent, at least in my humble opinion. Investors were given the choice of having their portfolios constructed on investing principles and strategies such as conservative, moderate or aggressive growth. Other choices included conservative, moderate or aggressive growth and income. Accordingly, portfolios were constructed in such a manner that the investor could understand, embrace and sleep well at night.

Consequently, since this series of articles is focused on dividend income, and the growth thereof, I will provide aggressive and conservative examples covering each of the 10 sectors. What I've already learned from this exercise, is that a portfolio of quality blue-chip dividend growth stocks, all trading at fair value, can be properly constructed today, in spite of the market's recent run-up. There is a lot of value left in quality common stocks, if you're willing to look, and smart enough to think specifically rather than generally. Regardless of the market, there are always fairly valued, undervalued and overvalued stocks available. As a result, no investor needing income and safety, need ever feel left out.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.