When I recently assembled my top posts of 2013 (through the first half of the year), several themes jumped off the page. The top four posts of the year summarize what many investors have been worrying about this year:

- "The Low Volatility Story In Pictures"

- "Four Years Of SPX Pullbacks In One Plot"

- "VIX ETP Performance In 2012"

- "All-Time VIX Spike No. 11 (And A Treasure Trove Of VIX Spike Data)"

These issues are related to pullbacks in stocks, the VIX spikes associated with them, how to minimize portfolio volatility when these types of events happen, and what the implications are for various VIX exchange-traded products.

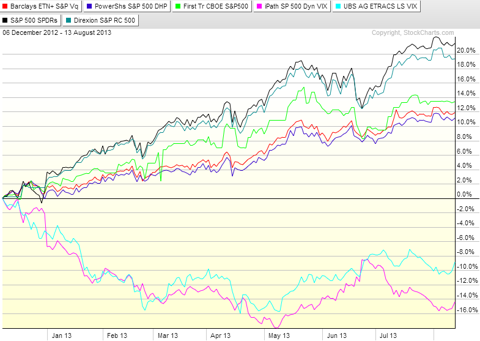

With that backdrop and a stock market that has been looking fatigued while it has meandered sideways for the past month, quite a few investors are thinking about how to hedge a portfolio that has a long-equity bias. In the graph below, I capture the recent performance of a number of ETPs that may be suitable for hedging that type of portfolio.

Interestingly, the performance of these securities appears to fall into three distinct groups. The top group has two ETPs:

- SPY (black line), included largely for reference purposes.

- Direxion S&P 500 RC Volatility Response Shares (VSPY), which employs a market timing mechanism that dynamically allocates between stocks and bonds according to measures of market volatility (blue-green line).

The second group contains the core of the VIX-based dynamic hedging products:

- First Trust CBOE S&P 500 Tail Hedge Fund ETF (VIXH), which is essentially a portfolio consisting of 99%-100% of SPY, augmented by a dynamic allocation of 0%-1% of VIX options (light green line).

- Barclays ETN+ S&P VEQTOR ETN (VQT), which has a dynamic allocation of VIX futures that fluctuates based on realized volatility and the trend in implied volatility (red line).

- PowerShares S&P 500 Downside Hedged Portfolio (PHDG), like VQT, has a dynamic allocation of VIX futures and is based on the S&P 500 Dynamic VEQTOR Index (dark purple line).

The bottom group includes two performers:

- UBS ETRACS Daily Long-Short VIX ETN (XVIX), which is equivalent to a fixed allocation of a 100% long position in VXZ, offset by a 50% short position in VXX. I have included XVIX (aqua blue line) here largely to show how closely the performance corresponds to that of XVZ.

- iPath S&P 500 Dynamic VIX ETN (XVZ), utilizes the slope of the VIX:VXV ratio (SPX 30-day implied volatility to SPX 93-day implied volatility) to determine the dynamic allocation to short-term and medium-term VIX futures. In this case, the allocation to short-term VIX futures (think VXX) can be either long or short, while the allocation to medium-term VIX futures will always be long, though it is variable (fuchsia line).

Keep in mind that the most aggressive hedges are almost always the ones that underperform the most in bullish periods. If you want a very different look at how some of these products perform when stocks decline sharply, check out "Performance Of VIX ETP Hedges In Current Sell-Off."

Disclosure: Long VQT and short VXX at time of writing.