Here are a few good charts to help conceptualize last week's record breaking rally in Gold. In my view, each chart supports further upside this week with a probable short-term high developing later in the week.

Of course it's hard to mention Gold without mentioning Goldman Sachs (GS), the new market bell-weather, which has earnings Thursday before the bell. It will be interesting to see if Gold can continue its rally amid a larger financial rally or vice-a-versa (last week GLD gained 4.5% and XLF gained 6.65% an uncharacteristic correlation).

My favorite pics below are the CBOE Gold Volatility Index and the GLD Weekly with Acceleration Bands Signals. The 'Gold Vix' as it's called gives unique insight on Gold prices and similar the the traditional VIX can provide guidance on short-term reversal areas. In the chart below I'm looking for relative extremes in Gold Volatility on Bollinger Bands.

Finally, the GLD weekly chart is nothing short of awesome. With all time highs being made each day it would seem a reversal is near, however, if we close outside the upper Acceleration Bands this week, look out for an even larger weekly rally. Note the past signals and average length of holding.

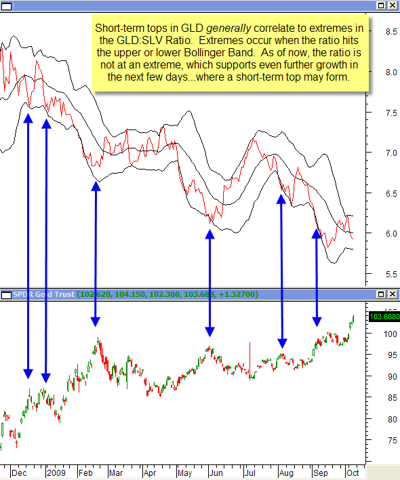

Gold:Sliver Rally (GLD:SLV) with Bollingers

Top 20 Option Trade from Breakout Day (10/6) - LiveVolPro.com

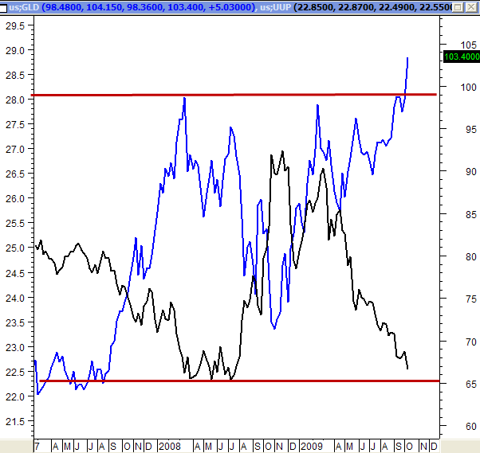

Gold (GLD) versus US Dollar (UUP)

GLD Weekly with Acceleration Band System

Gold Volatility Index (Gold Vix)with Bollingers

5 Gold Charts for Short-Term Timing

Andrew Hart is a Research Analyst and Portfolio Manager at BigTrends.com. BigTrends specializes in investment research, recommendations and education - specifically in the field of Options Trading. As a Portfolio Manager Andrew leads the ETF Options Trader and the ETF Stock Trader Portfolio recommendation service, and acts as a supportive manager with Price Headley's Options Shark service. His articles are published weekly under the Daily TrendWatch and Sector Spotlight outlets, and his writing has appeared on websites such as Seeking Alpha and stockweblog.com (http://stockweblog.com/).

BigTrends was founded in 1999 by Price Headley; Andrew joined the research division in 2007 and quickly developed his own trading systems based on consistent growth and risk containment. After graduating from Wittenberg University, Andrew worked on Capitol Hill before transitioning to the World Bank as a contractor. During his time at the World Bank, Andrew worked with the World Bank Credit Union in lending -- his experience in global finance helped forge his trading mindset, which focuses on strategic risk reduction.

Andrew Hart employs different trading techniques for different asset types; his disciplined systems are based on growth, risk reduction, and consistency. He believes technical analysis is paramount in short term trading scenarios while fundamental data advantageous in longer term situations. Andrew believes one of the most important and effective trading philosophies is sector rotation, which seeks to exploit the best trending sectors and industries through the use of Exchange Traded Funds (ETFs).