This article is about Northern Dynasty Minerals (NYSE:NAK). Northern Dynasty Minerals has a market capitalization of $190 million. It is a 50% owner of the Pebble Mine in Alaska.

Pebble is one of the largest mineral deposits in the world. It contains mostly copper with some gold, molybdenum, and other metals. Assuming that it goes into production it will be an incredibly large and profitable producer that will enrich Northern Dynasty Minerals' shareholders.

Why, then, does the company have a valuation of just $190 million? The answer is that environmental groups worldwide vehemently oppose the project. They are concerned that the mine will disrupt the salmon fishing industry to a point of devastation, and that it will pollute Iliamna Lake and Bristol Bay. As a result investors have become fairly convinced that the Pebble Beach mine will not be built, and the stock is down 90% from its 2011 peak.

But a longer-term chart of Northern Dynasty Minerals suggests that a contrarian position might be warranted: the stock failed to make a new low recently, having bounced without breaching the 2008 trough.

Also, the shares have also made a series of higher lows (2002, 2008, 2013), and higher highs (2007, and 2011).

While this certainly does not imply anything about the future of the Pebble Project, it does suggest that behind all of the negativity there are investors who believe that the project is worth betting on at the current valuation. An analysis of the Pebble Project that pushes all environmental and political concerns aside for a moment will reveal why this is the case.

The Pebble Project

The Pebble Project is an enormous potential mine in Alaska containing mostly copper, and some gold and molybdenum. The project is owned by the Pebble Partnership, of which Northern Dynasty Minerals owns half, while Anglo American (AAUKY.PK) owns the other half.

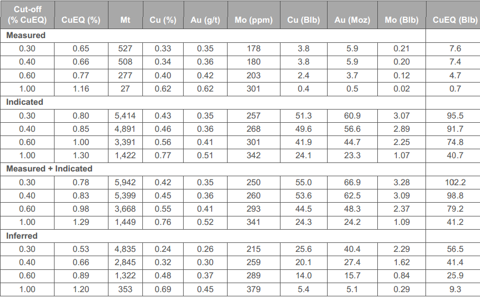

A: Resources

The resource base at the Pebble Project is enormous: it is one of the largest projects (developed or undeveloped) in the world. If we assume a 0.3% copper equivalent cutoff grade then the company has the following resources (note that the cutoff grade uses $1.85/lb. for copper, but $902/ounce for gold, which means that the company's copper equivalents are lower than the data it provides, but the economics of the project are ultimately more favorable):

- 55 billion pounds of measured and indicated copper resources at 0.42%

- 25.6 billion pounds of inferred copper resources at 0.24%

- 66.9 million ounces of measured and indicated gold resources at 0.35 grams per tonne

- 40.4 million ounces of inferred gold resources at 0.26 grams per tonne

- 3.28 billion pounds of measured and indicated molybdenum resources at 250 parts per million

- 2.29 billion pounds of inferred molybdenum resources at 215 ppm

This information, along with data for higher cutoff grades, is provided on the following chart.

B: Production

From this resource data it is evident that the Pebble Project will be able to produce an enormous amount of metal for several decades. In fact the most conservative scenario that the company has released estimates that it will produce for more than 20 years. Assuming rosier scenarios, this figure can increase to over 70 years. I will look at the company's third, "middle ground" scenario (aka "the reference case"), in which it can produce for 45 years.

Annual production figures are as follows:

- 678 million pounds of copper (339 million attributable to Northern Dynasty Minerals)

- 673,000 ounces of gold (336,500 attributable)

- 32 million pounds of molybdenum (16 million attributable)

- 3 million ounces of silver (1.5 million attributable)

Gross annual sales from these figures at current metal prices (roughly $3.20/lb. for copper, $1,400/ounce for gold, $10/lb. for molybdenum, and $24/ounce for silver), would exceed $1.7 billion.

Of course building a mine of this size takes time and capital. Current estimates are for $4.7 billion. But Anglo American is financing $1 billion of this, and it is paying for half of the remaining as a 50% partner, and so Northern Dynasty Minerals is on the hook for $1.85 billion. Once the proper permits are received it should take about four years to bring the project into production.

Production costs are relatively low, so that the mine would be comfortably profitable at today's metal prices. On a co-product basis the company estimates that cash costs will be $1.04 per equivalent pound of copper. Conservatively, if we incorporate taxes, administrative expenses, mine repairs, and interest payments, this figure should reach around $2.00/lb, although it will likely be a little lower than this.

At current metal prices the company's 50% stake in the mine should give it about 525 million pounds of annual copper equivalent production. With a conservative $2/lb. all in production costs, the following chart estimates its cash flow at various copper prices.

| Copper Price | Northern Dynasty Minerals' Cash Flow |

| $2.50/lb. | $262.5 million |

| $3/lb. | $525 million ($630 million at the current copper price of $3.20/lb.) |

| $3.50/lb. | $787.5 million |

| $4/lb. | $1,050 million |

| $5/lb. | $1,575 million |

| $6/lb. | $2,100 million |

Even if we assume that the company will simply dilute shareholders to raise the capital it needs ($1.85 billion), it still trades at slightly more than 3 times its projected cash flow at current metal prices. However, once it gets permitting, given the size and profit margin of the Pebble Project, Northern Dynasty Minerals will almost certainly be able to get funding. While this will increase its production costs slightly as we have to add in additional interest payments, it is conceivable that dilution will be minimal, and that the company's market capitalization is the same as, or potentially lower than, its future cash flow.

This is very inexpensive when compared to other mining companies with large projects in the permitting stage. But Northern Dynasty Minerals is hardly comparable to these companies. The company estimates that it will take three to four years to get its permits, although permitting has been going on already for the better part of a decade, and so we really don't know how long permitting will take. As I've mentioned already, construction is estimated to take four years according to the company's NI 43-101. Thus the earliest that the company will see this cash flow is 2020, but it may take much longer.

Risks To Northern Dynasty Minerals' Shareholders

There is no shortage of risk in this stock, which is why it is so inexpensive relative to its potential cash flow.

A: Environmental Concerns

Environmental groups, native Alaskan tribes, politicians, and more generally concerned citizens argue that the EPA should disallow the project, claiming that it can do so under the Clean Water Act's section 404(c). The EPA's fact sheet says the following:

Section 404(c) [...] authorizes EPA to

restrict, prohibit, deny, or withdraw the use of an

area as a disposal site for dredged or fill material

if the discharge will have unacceptable adverse

effects on municipal water supplies, shellfish

beds and fishery areas, wildlife, or recreational

areas.

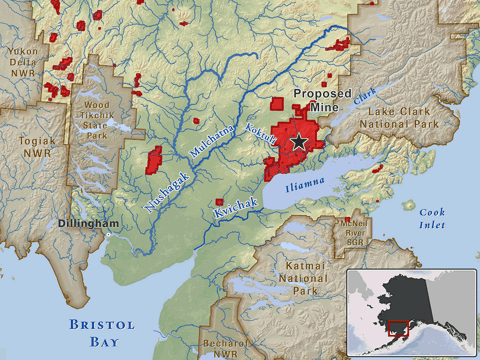

While this is an authority that the EPA rarely uses, it is under a lot of pressure to do so to prevent mining at Pebble. Opponents of the mine argue that it will contaminate Iliamna Lake and the Bristol Bay Watershed, which are pictured on the map in proximity to the proposed mine below.

In addition to this, opponents of the mine are also concerned that it will harm the salmon that live in these waters, and that it will also hurt the salmon fishing industry, which is an important part of southwestern Alaska's economy.

The EPA confirms this with its studies. While it hasn't officially denied The Pebble Partnership the right to mine at Pebble, many investors believe that its current stance implies that it will.

Naturally the Pebble Partnership and Northern Dynasty Minerals are fighting back. In a recent news release the latter claims that it believes that the scientific merit of anti-Pebble studies is questionable, and that data has been intentionally misconstrued to manipulate public opinion.

We believe the Bristol Bay Watershed Assessment process to be a cynical effort to manipulate public perception about a project before it has been proposed or undergone federal and state permitting. And we believe the draft BBWA to be a fundamentally biased report that should have no bearing on the future of America's most important undeveloped mineral resource.

Northern Dynasty Minerals believes that it can use modern mining techniques that won't cause the environmental damage that is feared by so many. Investors are encouraged to look at the company's presentation, which provides the details.

Ultimately, from an investment standpoint the scientific debate doesn't matter that much. No matter which studies and data points are released this is really a political and legal issue (for a solid overview of this struggle take a look at this article). Opponents of the mine will not look at the Pebble Partnerships data without bias, and Northern Dynasty Minerals will continue to fight opposition regardless of the scientific merit of its opposition.

Ultimately, the risk that the Pebble project will not be built is unquantifiable. But given this risk so many investors have simply looked elsewhere for opportunities, and as a result the shares have gotten incredibly inexpensive. Thus while this risk dominates investor perception of Northern Dynasty Minerals, it is almost certainly priced in.

B: The Price of Copper

As of late the price of copper has been in a downtrend given that Europe was in a recession and China's growth was slowing. The following chart of the iPath copper ETN (JJC) illustrates this downtrend.

Now that Europe appears to be growing again, and China's growth appears to be picking up the price of copper is rising in sympathy. The value of the Pebble Project will be highly leveraged to the copper price. But the price of copper may not just determine the bulk of Northern Dynasty Minerals' potential cash flow. A higher copper price will make it more likely that the company will be able to borrow the money it needs to develop the Pebble Project. Furthermore, a higher copper price makes the company's case against environmental groups more compelling, especially if the rise in price is due to a shortage, or some sort of emergency demand (e.g. war).

C: The Price of Gold

The price of gold has fallen precipitously recently, and Northern Dynasty Minerals' cash flow will be somewhat correlated to the gold price. So long as this downtrend remains intact, there is a reasonable possibility that the gold price will continue to fall in the short term.

The price seems to have found a bottom around $1,200, which suggests that the downtrend in gold may come to an end. Still, it is intact, and lower gold prices will be reflected in Northern Dynasty Minerals' share price.

However, I do not believe that the downtrend will continue, as many gold mining companies cannot make a profit in the current gold price environment. A lower gold price will force companies with unprofitable or marginally profitable projects to shut them down, and this will put significant pressure on future supply. But while gold is barely economical to mine at $1,400/ounce, there is no reason that the price cannot remain at this level for some time.

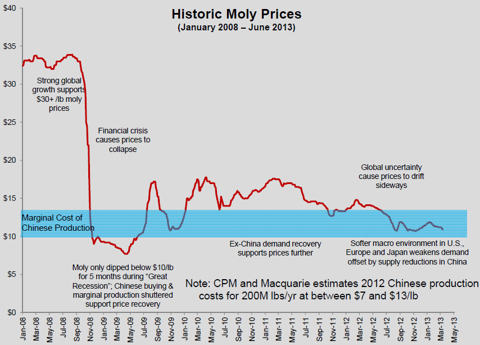

D: The Price of Molybdenum

As a tertiary metal for Northern Dynasty Minerals, molybdenum is of some importance to its future cash flow.

The price of Molybdenum Oxide has languished ever since the 2008 financial crisis--beforehand the price was significantly higher.

(This and the following chart are courtesy of General Moly's corporate presentation.)

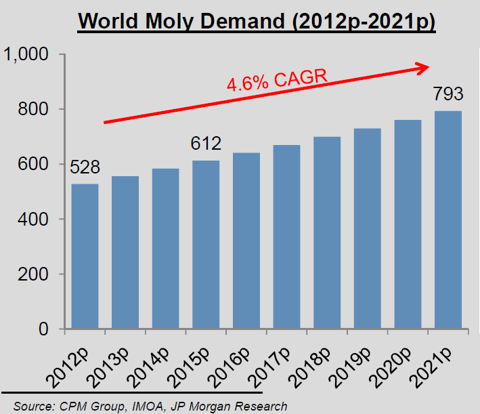

Like with gold, many molybdenum producers cannot turn a profit at the current price. This suggests that a bottom may be in, or close, for molybdenum oxide prices. This thesis is supported by the rise in demand for molybdenum, which is illustrated in the following chart.

With rising demand there is simply no way that the price of molybdenum oxide can remain below production costs for a sustainable period of time.

With these bullish fundamentals in mind, it is necessary to point out that the price of molybdenum oxide can stay depressed for a sustained period of time. Furthermore, if there is an economic slowdown then the price can continue to languish.

E: Timeline Risk

As I mention above, even in a best-case scenario the Pebble Project will likely not produce until 2020. But this date may be pushed back even further. While it is true that investors are being rewarded for waiting given the large amount of cash-flow that awaits them, for many investors 7 years is simply too long to wait. Too much can happen to adversely impact the company's fortunes.

F: Northern Dynasty Minerals' Capital Needs

Northern Dynasty Minerals needs about $1.85 billion to construct its share of the Pebble Project. This is more than nine times its current market valuation. Normally this would be a huge red flag. But I believe that the company will be able to borrow a lot of the money it needs. The size and economics of the project make it relatively low risk once the company gets the necessary permits. Also it has a large, well-funded partner in Anglo American, and the risk that the company will abandon the project is very low as a result. Still, the company's capital needs are large, and it has the following options to raise this capital:

- It can issue stock

- It can issue debt

- It can sell a royalty or a stream

- It can sell a portion of its stake in the property

Ultimately I think that it will use some combination of the first two with an emphasis on the latter.

G: Northern Dynasty Minerals' Size

Northern Dynasty Minerals only has its joint venture in the Pebble Project. If it cannot mine here then it is worth the cash on its balance sheet, which is about $23 million.

Conclusion

An investment in Northern Dynasty Minerals has more or less been equated to a bet on an EPA decision regarding the company's rights to mine its Pebble Project. While there is no doubt in my mind that this is a pressing issue for the company, I believe that the value of the property itself has been overlooked as a result. As we saw above, if we ignore the environmental battle for a few moments and just take a look at the property, it is clear that it is incredibly valuable. If it goes into production it will be comfortably profitable and it will produce for decades. It also offers incredible leverage to the price of copper (and to a lesser extent gold and molybdenum).

Of course we cannot ignore the environmental issues surrounding the project, and there is a significant risk that the project will not be built, or that it will not be built for many years. In this sense Northern Dynasty Minerals is a deteriorating investment, and it is high risk, or even speculative. But every risk, at some level of reward, is worth taking. For copper and metal bulls I think this point has probably been reached. These investors have a unique opportunity to purchase shares in a company that a large group of investors simply want nothing to do with.

Ultimately an investment in Northern Dynasty Minerals offers a chance to potentially earn more annual cash flow than the current market capitalization, or even the market capitalization after some dilution. Investors who have the patience to wait several years, and who do not mind committing a small amount of their capital to an investment that may lose all of its value, should seriously consider an investment in Northern Dynasty Minerals.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.