Municipal bond CEFs, having enjoyed nearly two years of appreciation following the late 2010 muni panic, suffered a dramatic decline in mid 2013 following an increase in the 10- and 20-year treasury yields. Many funds, such as PIMCO Municipal Income Fund (PMF), have had their valuations cut to levels last seen two years ago. Bond investors are by nature a conservative lot, and watching their holdings lose 25% of their value has sent many of them running for the hills.

Given the current interest rate environment and uncertainty surrounding tapering of QE, caution is reasonable. Analysts at Goldman Sachs (GS) predict 10-year treasuries will hit 4% by 2016, keeping CEF portfolio value trends flat or negative until rates stabilize. For anyone who wants to trade bonds, the message is clear: stay away.

(figure: PIMCO Municipal Income Fund, 2006-2013)

But there is another kind of bond investor, one who doesn't mind the occasional dip in valuation. According to Vanguard, long-term income-oriented investors have historically benefited from rising interest rates. Individual investors who purchase bond funds with the intention of holding them indefinitely and collecting dividends should consider the current bloodbath to be a rare opportunity to buy reliable income on the cheap.

Anatomy of an unhealthy CEF dividend

When an income investor is looking to purchase shares of a closed-end fund, the foremost criterion should be whether that fund can continue to dispense its dividend. Unlike ETFs, closed-end funds do not receive capital after their initial offering, so it's vital that the fund be able to supply its dividend from earnings alone. Be wary of funds with dividends higher than their earnings: those high dividends aren't sustainable, and you have no idea how far they'll be cut during a bad year. One major red flag is a fund distributing "return of capital" rather than income; if the fund is returning your own capital to you, it's probably an attempt to prop up an unsustainable dividend.

Let's look at the financials for another PIMCO fund, PMX, to determine how safe its dividend is. PMX recently reported a quarterly income per share of 18 cents, with 4.96 cents per share of left-over income from previous quarter (Undistributed Net Investment Income, UNII). PMX pays a monthly dividend of 7 cents per share. Doing the math:

* The average monthly income per share was 18 / 3, or 6 cents.

* This is 1 cent below PMX's monthly dividend.

* PMX's buffer of 4.96 cents per share could sustain the current dividend shortfall for about five months.

Based on this data, a reasonable investor could expect PMX to cut its dividend by somewhere between 15-20% within months. I would not consider buying PMX at this time, due to its unsustainable dividend.

Finding sustainable dividends

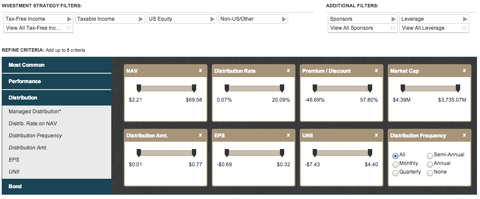

One of the major CEF holding companies, Nuveen Investments, operates a CEF screener at cefconnect.com. Their screener can be configured to show the financial data we care about in a single list, greatly simplifying the task of finding attractive funds.

(figure: CEFConnect.com screener, with dividend health configuration)

Before we investigate the results, I'd like to briefly discuss the "Premium / Discount" box. Most investors are familiar with exchange-traded funds ((ETFs)), which trade at prices equal to the values of their underlying portfolio. An ETF is never priced significantly above or below the net value of its assets. In contrast, a CEF is free to trade at valuations far above or below the actual value of its assets. Funds trading above their Net Asset Value (NAV) are trading at a premium; funds trading below their NAV are trading at a discount.

Many CEF investors only purchase funds which are trading at a discount, with the reasoning that higher discounts are equivalent to buying the underlying bonds for less than they would cost on the open market. While this is true, it's also important to remember that these funds are trading at a discount for a reason. Just as a stock trading under its book value might be a value trap, a CEF trading at significant discount may have major underlying problems that frighten away other investors.

Now, let's consider some funds with sustainable dividends and reasonable valuations. Remember, we want funds which have an EPS above their distribution amount, and a good thick buffer of undistributed income to ride out any tough quarters. A quick scan through the screener brings up a few interesting funds:

- PIMCO Municipal Income II (PML): Yielding 7.1% with a dividend of 6.55 cents against an EPS of 6.76 cents. The main attraction here is the 37.26 cents of UNII, a much higher figure than most other funds and a sign of PIMCO's focus on stable and consistent dividends.

- Nuveen Enhanced Muni Value (NEV): Yielding 7% with a dividend of 8 cents against an EPS of 8.18 cents. UNII is reasonable at 15.28 cents. This fund is trading at a nearly 2% discount to NAV, an unusual valuation for a healthy CEF, and possibly a good bargain for investors with higher risk tolerance.

- BlackRock Municipal Income (BFK): Yielding 6.9% with a dividend of 7.51 cents against an EPS of 8.56 cents. The large gap between income and distribution is a potential sign that the managers of BFK are taking a more defensive position toward their dividend than most other funds.

- PIMCO CA Municipal Income (PCQ): Yielding 7.2% with a dividend of 7.7 cents against an EPS of 8.47 cents. PCQ is a state-specific fund, holding only bonds issued within California. Most investors will not want to deal with the additional risk introduced by such a heavy dependence on a single state's economy, but California's unusually heavy income taxes make CA muni funds an attractive choice for investors living in the Golden State.

Once you have a short list of funds from the screener, use a more complete financial analysis service such as Morningstar to verify that your choices have portfolios matching your risk tolerance and income requirements. Aspects of a fund that you will want to verify are:

- What is the credit quality of the fund's portfolio? You may be paying more than you want for a portfolio full of junk bonds.

- Does the fund have any large exposures to risky investments? You don't want to be caught holding a bag full of Detroit.

- Does the fund have unusually high fees? Typical fees for CEFs are in the range of 1% to 1.4%; go much higher, and a big part of your potential returns are being sucked up by the fund management.

Bottom Line

The collapse of the municipal bond market has left many funds with heavy losses and at risk of cutting their dividends. A careful income-oriented investor can use this downturn as an opportunity to purchase high-quality funds at significantly lower valuations than what was available only a few months ago. Look for funds with sustainable dividends, and prioritize healthy financial statements over steep discounts.

Disclosure: I am long PCQ. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.