The NYSE observed two minutes of silence yesterday morning before the opening bell, followed by a lone Marine playing TAPS. It was moving.

Subscriber T.M writes,

I don't understand HOW they inflate the dollar? How does that occur? Through the cost of the commodities?

T.M., inflation is simply more money without an increase of productivity or goods. The Fed has been printing (creating) money since 1913, when they were founded by congress, and loaning it to banks at low interest rates. When they create more money than is destroyed, they inflate the money supply. Keynesian economists believe this helps the economy and politicians. If the economy is growing, even falsely by money growth, unemployment is lower. Thus, politicians are re-elected because voters have jobs.

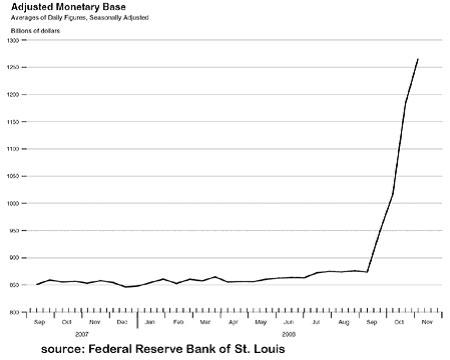

Since the banking crisis started, they have really outdone themselves. I have not shared the following chart with you, but it is sobering. This is from the St. Louis Fed. It shows the amount of money in circulation from Sept. 2007 to Dec. 2008; does this look like a problem?

All the extra money created has shored up bank balance sheets. Regardless of what the blow hards in congress say, the regulators do not want banks loaning money. They are sitting on the banks like a bunch of squirrels protecting their winter nuts. They want bank loans to be ‘super safe’. Regulators want banks to build their balance sheets and raise capital, so they have plenty of cushion to absorb losses. Over 100 banks have been closed this year, the regulators do not want any more banks to slip into insolvency.

When the banks start loaning money to businesses and people, the extra money will cause prices to increase because of SUPPLY AND DEMAND. From the above chart we know they have plenty of money to put to work. There will be more dollars wanting to buy the same supply of goods. Think of a giant auction. When more than one person wants an item and has plenty of money available, prices go up. The velocity of money moving through the economy, trying to buy assets before the asset increases in price creates inflation.

Sometimes the very hardest concept can be explained when we break it down to the smallest component. Two dirt-poor neighbors like each other and enjoy buying each other’s products. One grows vegetables, the other has fruit trees. Each buys from the other, or trades production ie: tomatoes for apples. One day the vegetable farmer finds a can of money his granddad buried, ten-thousand dollars in all. This is more money than he has ever seen. However, since he does not own a vehicle, he cannot go to town to spend his newfound wealth.

He decides to work up half his garden, because it is too much work. He goes to his neighbor to buy fruit, and counts out five dollars for four shiny apples. His neighbor is amazed, but takes the money. Next week when the neighbor wants some potatoes, the price has doubled, because the garden is smaller. He pays three dollars for the potatoes, because he has to feed his family, vowing to raise his prices for fruit to his old “best friend” neighbor. Thus, the inflationary spiral has begun. Commodities do not cause inflation, more dollars chasing commodities (necessities) cause inflation.

Has production increased? No, in fact the garden is only half as big. Has anyone increased their standard of living? No, because they can only spend money with each other. In fact, their quality of life will decrease, because the garden is smaller. Nevertheless, both neighbors will have “money” in their pocket.

Speaking of money, most of it seems to end up paying for a necessary commodity, crude oil. How would you like a new Mercedes Benz?

If you find money buried in the back yard,

order this 'one of a kind' White Gold Mercedes!

Four years ago, our family ‘vacationed’ at Mall of America in Minnesota (four daughters and wife). While driving in our RV, I listened to the roadway philosophers (truck drivers) talking politics. They were having a lot of fun criticizing President Bush. Diesel fuel prices were moving higher and the president got the blame.

One trucker reached a fever pitch with, “What has Bush ever done for us?” I keyed the mike, “Your wife isn’t wearing a Burka.” You could have heard a pin drop.

Thank a veteran.

Of course, our veterans cannot save us from the progressives that are working to destroy our Republic from the inside!

“By a continuing the process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”----John Maynard Keynes

Disclosure: No positions