The entertainment and communication services industries are expected to have a healthier future due to an increased demand for filmed entertainment, higher TV advertising spending by businesses and a significant growth in small-to-medium sized businesses. These factors are anticipated to benefit Comcast Corporation (NASDAQ:CMCSA) and its investors. The company's stock is already providing a handsome profit to its investors due to its higher dividend yield and upside potential.

Today, I aim to examine to what extent the company's stock could provide for its investors.

Company Profile

Comcast boasts a broad portfolio of services. It operates in five reportable business segments: cable communications, cable network, broadcast television, filmed entertainment and theme parks. During a six month period, which ended June 2013, the company generated 65% of its revenues and 80% of its operating income, before depreciation and amortization, from its cable communications segment. The cable network, broadcast television, filmed entertainment and theme park segments are collectively referred as segments of NBC Universal.

The company is the largest provider of video, high-speed Internet and voice services in the U.S. These three divisions fall under the cable communications business.

Revenue Growth

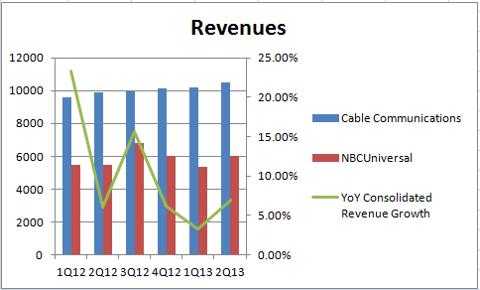

The chart below shows that Comcast's top line performance remains healthy, as its revenues have shown a positive growth over the last six quarters. The company's three-year revenue growth is higher than the industry average, with a growth of 20.5% compared to the industry average of 11.3%.

NBC Universal's revenues have shown a negative growth in the last quarter of 2012, and the first quarter of 2013, but cable communications' revenues are constantly growing. The cable communications segment consists of five reportable divisions, all of which have shown a year-over-year increase in revenues.

The revenue of its video division has shown a growth 2.7% during last three-month period and 3.2% during last six-month period, which ended June 30, 2012. The surge in revenue is primary contributed by higher prices and increased customers receiving additional and higher levels of service compared to the same periods of the previous year.

High speed Internet revenues increased by 8% after a three-month period and subsequently increased by 8.3% after a six-month period that ended June 30, 2013. These revenues increased year over year due to a higher number of residential customers, higher prices and additional customers receiving higher levels of services. The higher number of residential customers receiving discounted bundle offerings increased the revenues of voice division services by 2.4% and 2.5% after three- and six-month periods.

The highest percentage of growth was displayed by the business services division, whose revenues grew by 26.4% for the 2nd quarter and by 26.9% for the first half of 2013, due to an increase in the number of business services as well as the company's continued expansion to medium-sized business customers.

Advertising division revenues showed the least growth of 1.2% in the 2nd quarter and 1.9% in the first half of 2013, primarily due to an improvement in national and regional markets.

Similarly, the NBC Universal segment revenues have shown positive growth as the revenues in all its divisions increased year over year. The revenues of the cable networks increased by 7.7%, broadcast television increased by 11.6%, filmed entertainment increased by 12.8% and theme parks increased by 1.1%.

The revenues of NBC Universal segment dropped in the first quarter of 2013 due to a year-over-year decrease of 18.5% in the Broadcast Television division.

Company's Margins

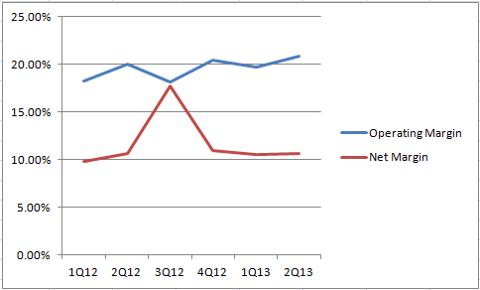

The operating margin of Comcast in the 2nd quarter of 2013 was 20.87%, which is the highest it has been in the last six quarters. The company's operating income still increased by 5.7% in the cable communications segment in comparison to second-quarter 2012, despite a year-over-year increase in programming and license fees; technical and product support expenses; customer service expenses; advertising marketing and promotion expenses; fees to secure rights for additional programming for customers and franchises; and other regulatory fees.

The operating margin of the NBC Universal segment increased by 21.3% in comparison to the operating margin of the second quarter of 2012. The costs and expenses increased in this segment on a yearly basis as well.

The net margin of the company has been similar throughout the last three quarters. The interest expense increased slightly over the three and six month periods, which ended June 2013, in comparison to the corresponding periods of the last year. This increase can be attributed to an increase in outstanding debt that was partially offset by a reduction in the average cost of debt.

Both the operating margin and the net margin of Comcast are better than the industry average. Its operating margin is 20.1% compared to the industry's average of 18.9% while the net margin is 10.6% compared to the industry's average of 7.9%.

DuPont Analysis

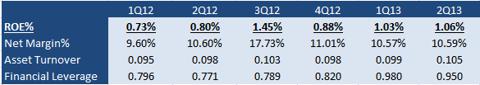

The company's financial leverage has increased in the last two quarters, compared to the earlier quarters, as it added a 24.98% increase in debt to its balance sheet in 1Q13 and a 25.6% increase in debt to its balance sheet in 2Q13 in comparison to the corresponding quarters of the previous year. Although the debt value has increased significantly the company's debt-to-equity ratio of 0.95 is below the industry average of 2.8. The company's interest coverage ratio has also improved in the last reported quarter, compared to the 2nd quarter of 2012, due to a higher operating income. The interest coverage in 2Q13 was 5.4 compared to 4.82 in 2Q12.

Due to an increase in the company's revenue, its asset turnover ratio is improving. This denotes that management's efficiency at using its assets has improved. The asset turnover was the highest in the last reported quarter.

Together these factors have improved the company's returns on its equity. However, management still has facets of its efficiency to improve since the company's ROE is lower than its peers.

Valuation

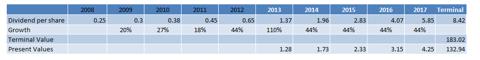

To derive the fair value of the company's stock I employed the dividend discount model. To calculate the required rate of return I used the CAPM and used 5.6% as the market risk premium, 2.69% as the risk free rate from the 10-year U.S. Treasury yield and 1.3 as beta of the company.

The table below shows the calculation of the dividend discount model. Comcast started to pay dividends in 2008 and since then the company is constantly increasing its dividend payments. In the first quarter of 2013, Comcast increased the dividends to $0.78 per share from $0.65 in 2012. In the second quarter it increased by 25% to $0.195 per share. If we assume that the company will pay $0.195 in the next two quarters then it has the potential for a 110% annualized growth compared to 2012.

The company's dividend yield, 1.6%, is better than the industry average of 1.2%.

To anticipate the dividends for the next four years, 2014 to 2017, I took a conservative approach. I grew the annual dividends by taking the average of the last five years growth rate rather than growing on the current rate.

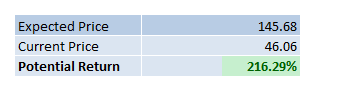

Thus a target price of $145.68 is derived with an upside potential of 216.29%.

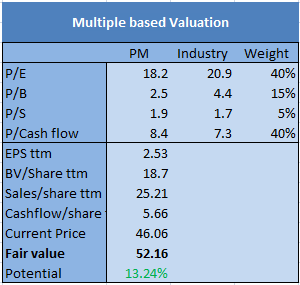

Since the model above offers a very high value to verify the calculations I have used a multiple based valuation. The stock is undervalued based on P/E, P/B and P/S ratios when compared to the industry average. As P/E and P/cash flows depict a fairer value of the company's financial health I have given higher weighting to these ratios while calculating the price.

According to the multiple based valuation, the stock has an upside potential of 13.24% with a potential price of $52.16.

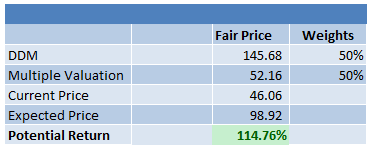

By combining the results of these two models, the fair value of the company's stock equals to $98.92 in comparison to the current price of $46.06. It also boasts an upside potential of 114.76%.

Final Thought

The company's financial position is highly stable as its revenues have shown positive growth throughout the last six quarters. Despite year-over-year increasing costs and expenses its operating and net margins have improved and are better than other companies in the industry. Currently, the increasing debt should not be a cause for concern as the company's interest coverage is also improving and its debt profile is still better than other industry players.

Moreover, the company's stock has a great upside potential as evident from the aforementioned valuation models. The dividends paid by the company are also increasing every quarter making it an even more attractive investment opportunity. So, in my opinion, the stock is a must buy for both short- and long-term investors.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.