Astute SA reader happyguy posed a question regarding Bank of America's (NYSE:BAC) asset values on its balance sheet in a previous article of mine. He wondered aloud if BAC's assets, particularly its mortgages, may still be carried at inflated values or if the bank has taken its lumps and written down its bad mortgages to something close to their respective fair values. In this article, we'll take a look at BAC's asset quality on its balance sheet and specifically, we'll look at the company's credit loss provisions on its balance sheet for the past 10 years as a percentage of total loans and leases in order to answer happyguy's question.

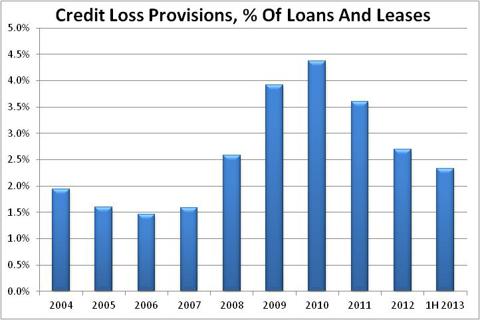

To begin, for this exercise I selected BAC's provisions for credit losses on the balance sheet at the end of each year and at the midpoint of 2013 as a proxy for asset quality. BAC is required to accrue provisions for losses it feels are reasonably likely to occur and BAC (and all other banks) do just that. This is a way to understand just how much the bank thinks it is likely to have to write off as a result of loans souring. I took this number and divided it by the amount of total loans and leases outstanding at the same time and calculated a credit loss provision number as a percentage of total loans and leases. This value is the proxy I used for asset quality at BAC. Note: all data are from company SEC filings while calculations and the graph below are mine.

Here we have my proxy for BAC asset quality over the past ten years. I selected this time period because it encompasses "normal" years leading up to the financial crisis and also shows what happened during that time and since. There are some very interesting notes to take away from this chart and we'll take a look at them now in order to determine what we may learn from BAC's provisions for credit losses.

First, it is apparent that in "normal" years, BAC's provisions were around 1.5%. Year 2004 saw higher provisions than that but based on my data set, that year is a bit of an outlier. After the credit crunch hit in 2008 we see BAC's provisions for losses spike about 100 basis points over 2007 and then another 200 basis points in the next two years! BAC ended up tripling its loan loss provisions in a three year stretch; this metric alone can tell you just how bad it was for lenders during that time period. Consider that most any bank cannot survive an extended period of 4%+ loan losses and you can understand why BAC (and others) needed capital infusions to stay solvent.

Since 2010, we see provisions for losses rapidly declining back to some state of normalcy, including less than 2.5% of total loans and leases taken as provisions for losses at the end of June. This is undoubtedly an enormously positive event for BAC and shareholders as it means that credit quality has improved vastly and the gargantuan write offs of the financial crisis are history. However, we can also see that BAC's asset quality still isn't back to what I would consider normal so we'll take a look now at what that could mean for shareholders.

At the end of June BAC reported $910 billion of loans and leases on its balance sheet and the company's allowances for credit losses were just over $21 billion. We can see above that this ratio works out to about 2.3% of the loan portfolio and according to the data I collected and the rapid pace with which provisions are declining, I think the ratio will go lower. If we assume the bottom, or "new normal", for BAC is 2% of the loan portfolio as provisions for losses that equates to a further reduction in loan loss provisions of $3 billion from current levels. If we assume BAC will improve asset quality to pre-crisis levels, a reduction in loan loss provisions of $7.6 billion would be in the cards.

This would have important implications for shareholders on a few levels. First, it would serve to indirectly increase the company's book value. When BAC takes provisions for loan losses it has to subtract that value from its loan portfolio value, thereby reducing the book value of the company. Saving an additional $7+ billion on loan loss provisions would add that amount directly to the book value of the company.

Second, provisions for credit losses come straight off of the income statement. For instance, BAC has written off nearly $3 billion as provisions for credit losses in just the first six months of this year. This is a direct result of the metric we've been discussing here and it takes a tangible toll on net income each quarter. As asset quality improves, so will net income as these costly write downs diminish in size.

Perhaps the biggest, and most intangible, benefit of provisions coming down is simply the fact that BAC's balance sheet is almost repaired from the financial crisis. Asset quality is clearly and materially improving and continues to get better with each passing quarter. BAC has taken enormous write downs but with the concerted effort to improve asset quality I think we'll see lower asset write downs in the coming quarters until we reach "normal" again for BAC. We don't know what that is until we get there but look for between 1.5% and 2% of total loans being provisioned for losses. There is also no reason provisions can't drop below 1.5% but in order to be more conservative, I'd use that level as a kind of best case scenario.

The bottom line is that lower loan loss provisions have several benefits for shareholders. First, book value will increase as fewer loans are written down. Second, the income statement will show higher net income as fewer loans are written off as losses. Finally, it means that the credit quality issues from the financial crisis are nearly behind BAC and the loan portfolio is on its way to being high quality once again. All of these are unequivocal positives for shareholders as all should serve to increase the share price through higher book value, higher net income and greater confidence in BAC's asset quality.

Disclosure: I am long BAC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.