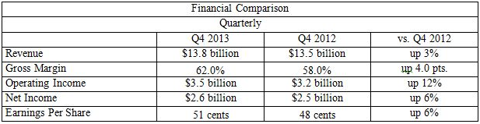

Intel Corporation (NASDAQ:INTC) released their earnings yesterday, noting that they had revenue of 13.8 billion alongside the following information:

- Operating income of $3.5 billion, up 12 percent year-over-year

- EPS of 51 cents, up 6 percent year-over-year

- PC Client Group revenue of $8.6 billion, flat year-over-year

- Data Center Group revenue of $3.0 billion, up 8 percent year-over-year

Unfortunately for Intel, the numbers missed the earnings per share guidance for the quarter by a single penny. This has caused the pre-market trading on INTC to nosedive a full -3.84% (at the time of writing).

Just shortly before the earnings release, on January 15th BMO Capital upgraded Intel to an outperformer and JP Morgan upgraded it from neutral to Overweight on January 14th.

JP Morgan noted two factors that they liked about Intel prior to the earnings release, which came 3 days later:

We believe the PC market will remain relatively stable in 2014, and we believe Intel's new CEO will continue to provide realistic guidance and focus on areas where Intel has an advantage - thereby improving margins and returns.

So, is JP Morgan right? Should you buy some Intel shares today on the dip?

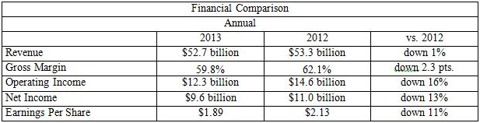

Before considering buying shares, also consider the negative aspects of Intel's report. The negative aspects are mostly associated with 2013 over 2012 annual performance.

Here is the breakdown:

2013 saw relatively negative performance when compared against the annual numbers from 2012. However, perhaps Intel is improving. Here we have the quarterly numbers from the last quarter of 2013 and the last quarter of 2012.

Positives from 2013 versus 2012 are mostly associated with increased revenues coming from its Data Center Group which saw a year-over-year increase of roughly 8%.

Perhaps JP Morgan's analysts are correct. If the new CEO Brian Krzanich can capitalize on Intel's strengths, as seen in the Data Center Group, then perhaps Intel will do very well in 2014. I would certainly consider buying Intel on the dip.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in INTC, over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.