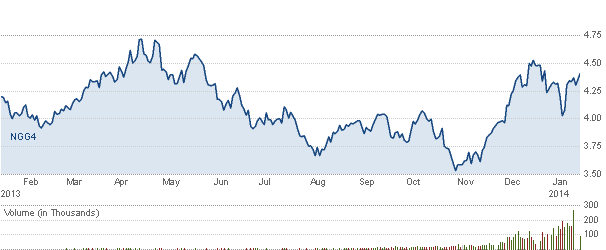

It appears that there may be another bad winter storm that will affect the United States and could help natural gas prices. We have seen natural gas remain strong in the last few sessions after finding support at the $4/MMbtu level and we could envision the bulls pushing their case on further cold weather.

We continue to believe that those who wish to be long oil should do so in WTI Crude terms, especially as the gap between WTI and Brent has widened and continues to do so. One could even go long WTI and short Brent in a trade and see potential profits of 30% moving forward, in our opinion. As gold becomes less of a trade for speculators we would expect that momentum money to rotate into oil to play the US growth story.

Chart of the Day:

Natural gas might be ready to test the $4.50/MMbtu level and if we see a strong move higher through that level it may be time to shift our focus to the 52-week highs. This is a momentum trade right now and the traders are looking at short-term pricing based on weather. With that said, there is a lot of momentum behind the trade and if the cold weather does hit the US hard once again then we would not be surprised to see another leg up in the trade.

Source: CNBC

Commodity prices this morning are as follows:

- Gold: $1,241.00/ounce, down by $10.90/ounce

- Silver: $19.89/ounce, down by $0.414/ounce

- Oil: $94.60/barrel, up by $0.23/barrel

- RBOB Gas: $2.6463/gallon, up by $0.0259/gallon

- Natural Gas: $4.409/MMbtu, up by $0.083/MMbtu

- Copper: $3.352/pound, up by $0.0075/pound

- Platinum: $1,448.50/ounce, down by $5.60/ounce

Woes At Shell?

Lately the news from Royal Dutch Shell (RDS.A) (RDS.B) has left us a bit confused. Most of the issues facing the company seem to be in stark contrast to what the rest of the industry is facing and has left us wondering whether there is a management issue at the company.

We are not simply talking about the profit warning, but about the continuing issues in Nigeria as well as recent revelations about certain areas that the company is active in not being nearly as lucrative as believed. In the past few months we have seen the company move to exit a few areas, with the company announcing yesterday that they would be exiting the Whetstone LNG project in Australia via a $1.14 billion deal.

With the recent run in Shell shares and the warning last week, could we see the shares correct further?

Source: Yahoo Finance

The company continues to discuss its goal of needing to find ever larger projects, with this being the reason for the recent shedding of assets. We can understand this as other names in the sector, including BP (BP) and ExxonMobil (XOM), have also dealt with the same issue, but have not been plagued with the same transition issues. We are still trying to figure out how Shell's shale assets were not attractive and where they are going to find these future elephants to develop down the road.

Currently it appears that the game plan is to do much like BP and sell non-core assets while focusing on current large projects that are already in the pipeline. The issue that concerns us the most is that while all of Shell's competitors are investing in shale exploration here in North America, Shell is looking elsewhere. With the shale boom about to be exported around the globe it would seem that Shell should be partaking in the exploration in North America like its large competitors.

Drilling Profits ...

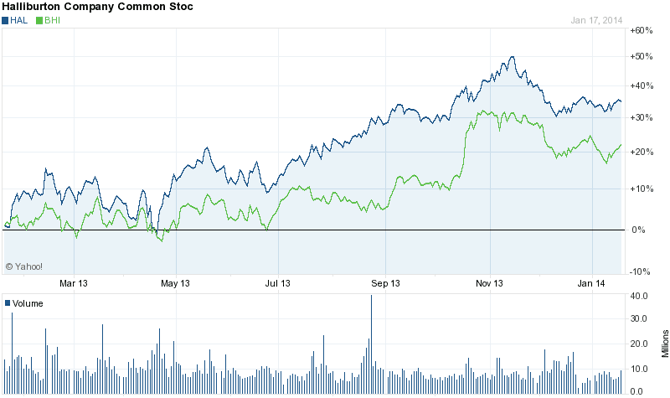

Both Baker Hughes (BHI) and Halliburton (HAL) reported results this morning. Baker Hughes beat by a penny per share on its EPS while beating the consensus revenue figure by $200 million. Among the company's markets, Baker Hughes saw the most improvement in Latin America and expects to see rig count growth of 10% for international markets this year. North American markets remain weak, with Halliburton's results also backing that up.

Both Baker Hughes and Halliburton have seen strong moves in their share prices on the back of international markets. There continues to be weakness in the North American market, but the strength of the companies' international segments is more than making up the difference.

Source: Yahoo Finance

The results from Halliburton also highlighted the strength of international markets as the company's international segment picked up the slack created by North America. Halliburton beat by $0.04 per share on its EPS and beat the analysts' consensus on revenues. Halliburton, like Baker Hughes, sees rig counts growing in North America with wells rising as well. The shares are down due not to the current results, but weaker than expected guidance moving forward.

From both companies' reports it is apparent that both North America and Latin America face headwinds moving forward but that the growth in the near-term remains in the European, African, Asian and Middle Eastern regions. Weather has played a role in some North American issues that the companies have faced and that could be a recurring theme moving forward.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.