The current market is flush with liquidity as speculative traders search for opportunity. Growth and speculative companies are especially attractive due to the potential high returns if the economy really is on track for a full recovery. Faithful readers of ZachStocks know that I am hesitant to buy into the “full recovery” argument, but that doesn’t mean we can’t make money trading this speculative environment.

The ample liquidity has allowed new companies to raise capital to build their businesses, and has also allowed private equity investors to unload positions at a profit as the public market snaps up shares. Last week Citigroup (C) took the position of a private equity player by selling a large portion of its position in Primerica Inc. (PRI). The stock was issued to the public at a price of $15.00 and quickly began trading near $20.

Investors are likely very happy with their 30% plus gain in a single day and it looks like Citi may have sold itself short, as it could easily have collected $17 or $18 for the stock and still made investors very happy. Fortunately for the company, it still owns roughly 40% of the company so it should be able to write up the value of its holdings.

The transaction has certainly benefited Citi as the company was able to raise roughly $300 million. That number is actually very conservative because as part of the convoluted transaction, Citi issued warrants to Warburg Pincus LLC, and also was the lead underwriter for the stock – meaning Citi was able to keep a large portion of the underwriting discount usually paid to brokers who place IPO stock.

Primerica could be considered a “low-tier” financial services company whose primary business is selling life insurance. The target client includes middle income families with $30,000 to $100,000 in annual income. The prospectus lists these client as:

- Having inadequate or no life insurance coverage

- Needing help saving for retirement

- Needing to reduce consumer debt

- Preferring face-to-face meetings for financial decisions.

While this target market covers a large percentage of households (Citi estimates the demographic at 50% of US households), the margins on this segment of customers is usually relatively low. That is why Primerica was considered the perfect solution for Citi – allowing middle income households to be served by Primerica while the Citi financial professionals focused on the bigger and more profitable clients.

The problem that I have with the Primerica business model is that the representatives often take a multi-level marketing approach to building their client base. In the prospectus, Primerica speaks of “independent entrepreneurs” who are responsible for building and operating their own businesses. These representatives are classified as independent contractors and are not official employees of Primerica. Many of these “financial representatives” are part-time workers and Primerica actually encourages this aspect in order to attract more representatives.

The end result is that many of these representatives have little experience, a deficient knowledge base, and may not be giving the best advice to clients who need financial information. While there are of course exceptions, Primerica has become known as the “Amway” of financial services – a reputation Citi would like to distance itself from.

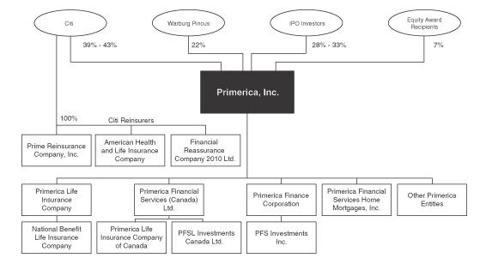

I must say that I am a bit surprised at how well the IPO has been accepted by the market. Financials are still a bit sketchy as it is difficult to understand the pro-forma numbers presented in the prospectus and account for the adjustments. Below is a flowchart of the organizational structure which shows the convoluted state of the offering.

(Click to enlarge)

With this much complexity, I would avoid buying the IPO at this point as the market hates uncertainty and once the hype of the IPO wears off the stock could drop quickly. Farther down the road, I expect Citi to unload the rest of its shares and Warburg will likely exercise its warrants and liquidate the shares as well.

Aggressive traders might consider shorting below $19.60 but don’t get too greedy. Citi will defend this stock vigorously as they still have a vested interest in the deal working. So the stock could drop to $17 or even $16, but the IPO price is important for Citi to defend so I would expect them to start buying aggressively at the $16 level.

Typically an IPO that trades well out of the gate is likely to continue its positive trend. But Primerica is a different animal and I wouldn’t put too much confidence in the positive initial reaction.

(Click to enlarge)

Disclosure: No positions