At heart, Tucows (NASDAQ:TCX) is a stable, rather stagnated, business. It's a mixture of legacy businesses including a wholesale and retail internet registrar, plus a portfolio of domain names and a download website.

In regards to the the wholesale internet registrar, Tucows manages over fourteen million domain names and millions of value-added services through a reseller network of over 13,000 web hosts and ISPs.

Tucows "legacy" businesses throw off reliable if uninspiring cash flows and earnings year after year. They're enough for Tucows to be profitable and debt-free (on a net basis). This part of Tucows' business is likely to continue rather unchanged or growing slowly over time.

The thesis

The reason why Tucows merits an article, however, is not due to its legacy business. The legacy business just provides a measure of safety, providing revenues of $126.6 million on a TTM basis.

The true reason to highlight Tucows is its new initiative, Ting. Ting is a MVNO (Mobile Virtual Network Operator) running on Sprint's (S) network. Ting launched in February 2012 and as of last quarter (September 2013) it had 36,000 accounts and 56,000 devices, having gained 11,000 accounts and 16,000 devices during the quarter. This represents an acceleration since the gain for the last 9 months was 26,000 subscribers and 41,000 devices.

Also, according to Tucows, Ting expects to reach breakeven in Q4 2013 (which will be reported on February 12).

But why is Ting so relevant? The reason is simple: it brings with it the promise of growth. And maybe even profitable growth at that. For a company doing $126.6 million in revenues, launching a mobile operator is bound to lead to significant revenue growth as long as it can gather the subscribers. And seemingly, Ting is being able to grab those subscribers.

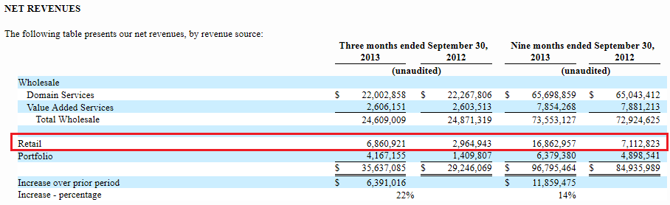

This becomes readily apparent if we look at the latest quarterly report (red highlight is mine):

The "Retail" segment includes Ting, and Ting is the reason why it's expanding quickly - it grew 131.4% to $6.86 million (or 19% of revenues) in the latest quarter. And more importantly, this growth is bound to continue due to the expansion of the subscriber base.

Given the size of the "Retail" segment, it is now large enough that as it grows, it pushes the entire company into sustainable double-digit revenue growth. In a market starved for growth stocks, Tucows is becoming one, yet it's not trading as one at this point, since it trades for just 1 times sales. Tucows thus stands a good chance of being re-priced as a growth stock in the near future, as the market becomes aware of this dynamic.

Furthermore, public awareness might be helped by Ting's advertising, such as the one where Ting offers a free Starbucks coffee to all 200 million mobile customers in the U.S.

Other developments

While not central to the thesis, there are a couple of developments which I ought also to cover. These include:

- Tucows moved to Nasdaq and did a 4:1 reverse split. This is best covered in a recent Seeking Alpha article by Christopher F. Davis, "Tucows Takes 2 Major Steps To Benefit Shareholders";

- While the September quarter included what seemed like a large jump in profitability, this was helped by a one-off transaction where Tucows withdrew its applications in the ICANN New gTLD Program for .media and .marketing. Thus, the ongoing improvement in profitability is likely to be slower than what's implied in the September quarter.

Main risks

I see two main risks to Tucows:

- First, its legacy business runs the risk that some of its customers might get their own accreditation as registrars and thus no longer rely on Tucows' wholesale registrar operation. This risk is minor given that Tucows customer base is very dispersed (no customer over 10% of revenues at this point);

- Second, the MVNO business, while it will help growth tremendously, is not likely to be hugely profitable. It's both competing on price and reliant on having a mobile operator to gain access to a network.

Conclusion

Tucows has a profitable and stable business in its legacy business operations. This provides it with the base to attain growth, something which it is in the process of achieving through the launch and nurturing of Ting.

Ting makes it likely that Tucows will show sustained double-digit revenue growth over the foreseeable future. This might lead to a re-rating of Tucows as a growth stock. Tucows presently trades at just 1 times sales, so the re-rating could entail significant upside.

Disclosure: I am long TCX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.