Earlier this week, AT&T (NYSE:T) reported Q4'13 earnings that generally disappointed the street. From low wireless subscriber additions to concerns about cash and empowered competitors, the second largest domestic wireless provider got hit hard initially. Ironically though, the stock snapped back on Wednesday to finish virtually even with the large 1% losses in the major averages.

AT&T is the classic example of a difficult to value large cap. The company is embroiled in a new war for 4G wireless network supremacy with Verizon Wireless (VZ) and facing pricing pressure from suddenly viable Sprint (S) and T-Mobile (TMUS). The wireless carrier is reportedly still working on a bid for global wireless power Vodafone (VOD), yet the company denied any interest to the London Stock Exchange. Besides the shifting wireless landscape, the company generates over $130 billion in annual revenues and has a market cap of around $175 billion. If wireless wasn't enough, AT&T is competing for high speed broadband customers and television subscribers against cable companies and other telecom providers.

How can an investor without a department of research analysts correctly value this telecom giant? The answer might seem complex, but in reality the data points to a clear and simple answer. Research shows that large companies returning capital to shareholders and shrinking assets tend to outperform the market by a significant margin. With the large dividend and stock buyback, AT&T is a prime example of the net payout yield concept. Unfortunately, a massive buyout of Vodafone would actually place the stock in the penalty box, so investors should hope the deal isn't a reality.

Q4'13 Highlights

The company provided the following highlights for the fourth quarter:

- For the fourth quarter, earnings were $0.53 versus $0.44, up 20.5%.

- Fourth-quarter consolidated revenues of $33.2 billion, up 1.8% versus the year-earlier period.

- The company added 566,000 wireless postpaid net adds.

- The company added 630,000 high-speed Internet subscriber net adds.

- The company added 194,000 U-verse TV subscribers.

- Fourth-quarter free cash flow totaled $2.5 billion after $5.5 billion of capital expenditures. For the full year, free cash flow hit $13.6 billion.

AT&T was able to increase the operating margins in part due to fewer subsidies due to lower wireless additions. While the trend is positive short term, the low customer additions will hit future earnings growth. In fact, the company guided towards free cash flow, dropping to only $11 billion in 2014.

Share Buybacks

While the above news is confusing and probably disappointing to most investors, the company was busy buying shares all year. During the quarter, AT&T bought 54 million shares for $1.9 billion. For the full year, the company bought 366 million shares for $13 billion, or roughly 7% of the current market cap.

With plans to continue repurchasing shares, the stock is attractive despite the reported numbers.

Net Payout Yields

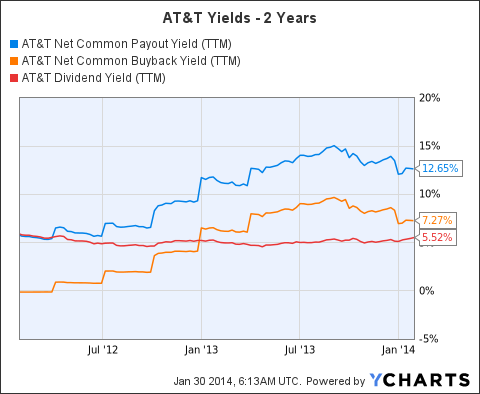

As the highlighted study shows, companies with high net payout yields typically outperform the S&P 500 by a wide margin. The net payout yield is calculated by adding the forward dividend yield with the net stock buybacks over the last year. As the chart below shows, AT&T has a current 12.7% net payout yield.

T Net Common Payout Yield (TTM) data by YCharts

Conclusion

According to the monthly data collected on the top net payout yields of stocks with market caps in excess of $10 billion, AT&T sits near the top of the heap. Even though the stock hasn't performed that well for the last year, investors now collect 5.5% to wait and eventually the earnings growth from the reduced share count will produce gains in the stock price. Investors can either spend days dissecting the quarterly filing and the importance of adding subscribers over saving money on subsidies, or follow the direction of management with intimate knowledge of the business prospects and load up on the stock alongside them. The preference of Stone Fox Capital is to enjoy the high yields and let the company repurchase cheap shares on dips.

Disclosure: I am long T. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.