I read an interesting theory about investing in China stock ETFs. Since the yuan is all but certain to climb against the greenback; and since there’s a risk of other forms of credit tightening in China, investors may wish to sell China stock assets.

I’ve read this in a few different places now. And yet, I always find myself thinking, “Yeah, but do we really prefer investing in countries that are spending like crazy deficits be damned rather than countries that are responsibly tightening their monetary belts?”

As crazy as this sounds on the surface, the answer by the investing public may be, “Affirmative.”

Consider the carnage that we call Japan, the world’s 2nd largest economy. Its yen has been so strong throughout the financial crisis, and remains too strong today. This has been killing the export-dependent country with a culture of limited consumption and high personal savings.

Yet take a look at the CurrencyShares Yen Trust (FXY) in 2010. As of mid-March, it has finally, finally begun to weaken. And a weaker yen makes for happy exporters/more profitable Japanese companies.

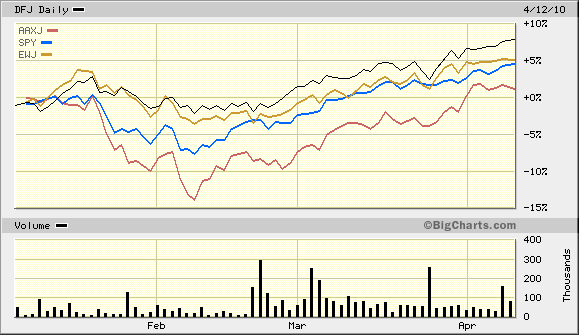

In fact, both iShares MSCI Japan (EWJ) and WisdomTree Small Japan (DFJ) are outpacing the S&P 500 SPDR Trust (SPY) this year. In 2010, Japan funds are outmuscling China-heavy, iShares All Asia excl Japan (AAXJ) as well.

So that brings us right back to the original theory about bailing on China stocks. Apparently, a weakening yen benefits Japan stock ETFs, while a strengthening yuan hampers China stock ETFs.

Of course, the U.S. dollar has gained 10% over the last 4 months against world currencies. U.S. stocks have been outstanding throughout the currency gains. Similarly, the euro has weakened considerably, and it has not been helpful to European stock ETFs.

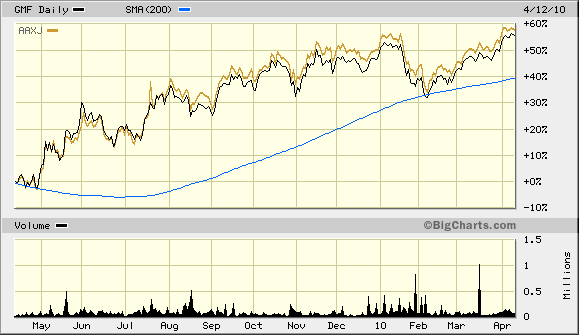

It follows that, currency factors alone cannot predict the direction of a country’s or region’s stock assets. For me, then, you should NOT bail on China-heavy funds in technical uptrends, like AAXJ or Emerging Asia (GMF).

Disclosure Statement: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. The company and/or its clients may hold positions in the ETFs, mutual funds and/or index funds mentioned above. The company receives advertising compensation at the ETF Expert web site from Invesco PowerShares Capital Management, LLC. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.