Goldcorp(GG) has been operating 11 mines in Mexico, Canada and in Central and South America. The company recently announced gold production and preliminary cash costs for 2013. The company also provided its production outlook for the next five years. In the wake of the production outlook it shall be desirable to discuss the future prospects of the company.

Top Line Growth: Increased Production will Enhance Future Growth

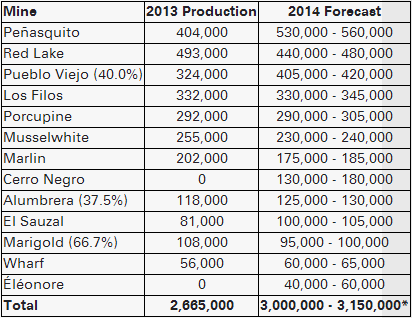

The mines in Mexico, Canada and in Central and South America delivered a total production of 767,000 ounces during the fourth quarter resulting in gold production of 2.67 million ounces for 2013. The increased production reflects an increase of 11% from 2012. Similarly the company forecasts its 2014 gold production to grow by approximately 13-18%reflecting a total production of 3.0-3.15 million ounces. The table mentioned below demonstrates the company's actual production in 2013 and 2014's forecasts.

Source: Company's Investor Relation

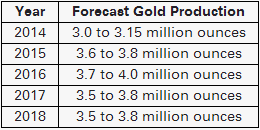

In addition to the increased production in 2014 the company is aiming to increase its annual gold production to 3.9 million ounces by 2018 reflecting a 75% increase from 2012's production. The increased production is expected to be met by the completion of various ongoing projects such as the Cerro Negro project, Eleonore project, and Cochenour project.

Goldcorp is expecting that the Cerro Negro and the Eleonore projects will contribute to the total production by late 2014. Similarly production from the Cochenour project is expected to start in the mid of 2015. Goldcorp is expecting that these three projects will contribute at least 1.3 million ounces to the total production after completion.

Bottom Line Growth: Cost-Saving Efforts

In the wake of lower gold prices gold miners have been pushed to undertake cost-cutting initiatives to strengthen their earnings. The company also plans to reduce its all-in sustaining cost to make it between the range of $950 to $1000 per ounce in 2014. The reduction in the forecasted all-in sustaining cost is mainly driven by increasing grades and by product production. Moreover, the low-cost production at Peubo Viejo and Cerro Negro will help the company to reduce all-in sustaining cost by almost 15-20% over the next two years.

Goldcorp's most expensive mine is Marigold. The mine produced 25,000 ounces of gold during the third quarter at an AISC of $1476 contributing a loss of almost $200 per ounce of gold. During the third quarter the company produced 637,000 ounces of gold at an AISC of $992. If we make adjustment for the Marigold mine the company would get an AISC of approximately $848 per ounce.

So selling off or shutting down the Marigold mine would make sense for Goldcorp as operating a mine that is contributing losses on every ounce of gold produced would mean higher costs and lower margins.

Dividends

The company has increased its dividends four times during the last four years. After declaring a monthly dividend of $0.05 per share the annual dividend of Goldcorp equals $0.60 per share. The company is currently offering a forward yield of 2.68%. The dividend growth over the last five years makes this stock a highly attractive option for income-seeking investors.

Strong Balance Sheet

Despite lower gold prices and increasing operational costs Goldcorp has been able to maintain a solid balance sheet coupled with a healthy credit outlook. The company has been operating with minimal debt. It has a debt to equity ratio of 12% whereas Barrick Gold and Newmont Mining have debt to equity ratios of 96% and 44%, respectively. Moreover, the company has also beaten the average industry debt equity of 35%.

Owing to minimal debt, Goldcorp has been able to keep interest expenses to a minimum level. In addition to the lower interest expenses the lower debt allows the company to negotiate for more debt given the potential growth opportunities.

Concluding Remarks

Goldcorp is one of the most attractive growth companies among gold miners. The company can provide huge growth prospects over the next few years. The development projects are progressing well with all of the projects expected to start first gold production within the next 12-18 months. The company has made big capital expenditures in 2013 that are expected to decrease in 2014.

Similarly, the company has also implemented a cost-cutting program in 2013 resulting in $280 million in cost savings. The lower cost is also reflected in the company's bottom line. Moreover, the company has been able to keep its debt level to a minimum level and that allows it to maintain interest expenses at the lowest levels.

In a nutshell, new projects are positioned to deliver growth and significantly reduce the company's all-in sustaining costs. Going forward, the company is poised to capture top line growth and cost reduction will improve bottom line growth. In addition, the higher dividend yield makes the company a potential investment to consider.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.