Since my last article examining the offshore drillers, there has been a market sell-off which has further depressed the price of these industry leaders. My view on the offshore drillers discussed in Part I remains unchanged. I believe the industry as a whole is experiencing short-term weakness, but long-term strength within the industry remains strong and the short-term weakness creates a great opportunity to get in at a decent price. The purpose of this article will be to determine which company separates itself from the others and which company is poised to benefit the most from this decline.

Industry Comparison

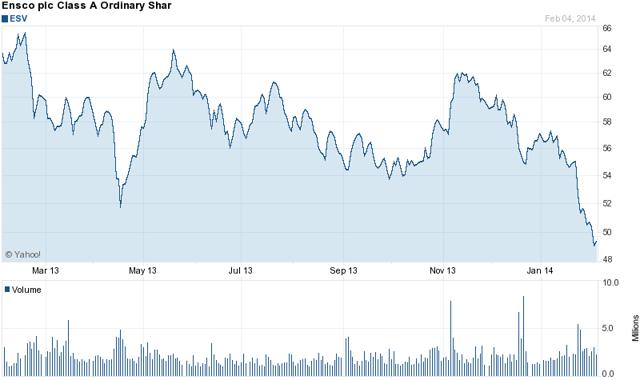

Part I covered Transocean (RIG), Seadrill (SDRL) and Noble Corp (NE). Part II will cover Ensco (ESV), Rowan Companies (RDC), Atwood Oceanics (ATW) and Diamond Offshore (DO). The industry has seen continued weakness with the recent market sell-off and questions continue to pester on how weakness in new contracts will affect offshore drillers in early 2014. Noble and most recently Atwood Oceanics have expressed concern of potential downward pressure on day rates in the floater market and E&P companies scaling back spending.

| RIG | SDRL | NE | ESV | RDC | ATW | DO | Peer Average | |

| Share Price (2/5/14) | $ 41.54 | $ 34.47 | $ 30.59 | $ 48.46 | $ 31.31 | $ 45.10 | $ 46.55 | N/A |

| Revenue per share (TTM) | $ 26.29 | $ 10.06 | $ 16.28 | $ 20.60 | $ 12.48 | $ 15.64 | $ 20.86 | $ 17.46 |

| Market Cap ($mil) | $ 16,080 | $ 17,360 | $ 8,150 | $ 11,920 | $ 4,030 | $ 3,060 | $ 7,040 | $ 9,663 |

| Forward P/E (12/31/14) | 8.4 | 10.31 | 7.73 | 7.62 | 10.22 | 7.94 | 7.5 | 8.53 |

| Price/Book | 1.0 | 2.48 | 1.02 | 0.96 | 0.85 | 1.41 | 1.53 | 1.32 |

| Profit Margin | 17.2% | 50.8% | 19.0% | 26.8% | 16.7% | 34.4% | 23.9% | 27.0% |

| Total Cash ($mil) | $ 3,560 | $ 867 | $ 114 | $ 325 | $ 1,010 | $ 132 | $ 1,220 | $ 1,033 |

| Total Debt ($mil) | $ 10,730 | $ 13,930 | $ 5,560 | $ 4,790 | $ 2,010 | $ 1,270 | $ 1,500 | $ 5,684 |

| Debt/Equity ratio | 0.65 | 1.79 | 0.61 | 0.38 | 0.42 | 0.57 | 0.32 | 0.68 |

| Current Ratio | 1.95 | 0.45 | 1.32 | 1.61 | 5.74 | 2.89 | 4.31 | 2.61 |

| Yield | 5.1% | 10.1% | 3.0% | 5.8% | 1.2% | 0.0% | 1.6% | 3.8% |

| Diluted EPS | 4.49 | 4.95 | 3.05 | 5.46 | 1.61 | 5.32 | 5.00 | 4.27 |

| Backlog ($billion) | $ 29.8 | $ 19.5 | $ 15.4 | $ 11.0 | $ 4.4 | $ 3.7 | $ 8.9 | 13.24 |

| Revenue ($billion ttm) | $ 9.48 | $ 4.72 | $ 4.12 | $ 4.75 | $ 1.54 | $ 1.02 | $ 2.88 | $ 4.07 |

| Backlog/Revenue | 3.14 | 4.13 | 3.74 | 2.32 | 2.86 | 3.63 | 3.09 | 3.27 |

Source: Yahoo Financials

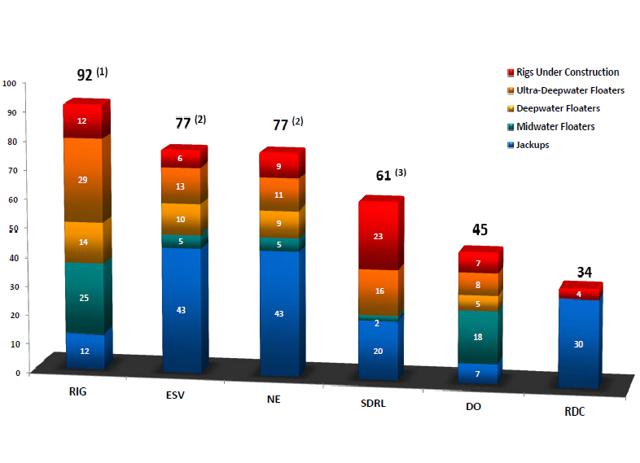

Source: Transocean Investor Day (11/21/13)

Ensco

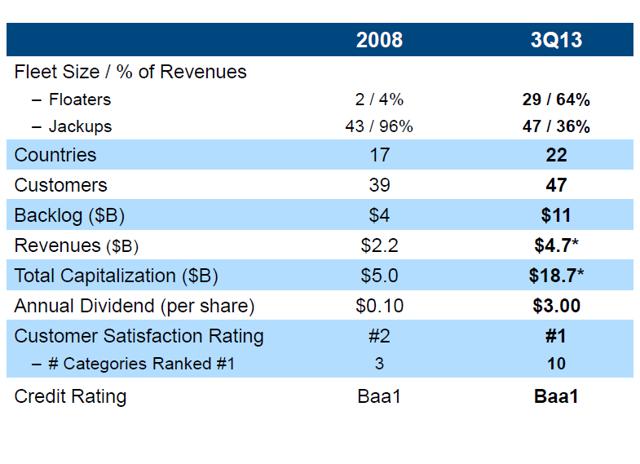

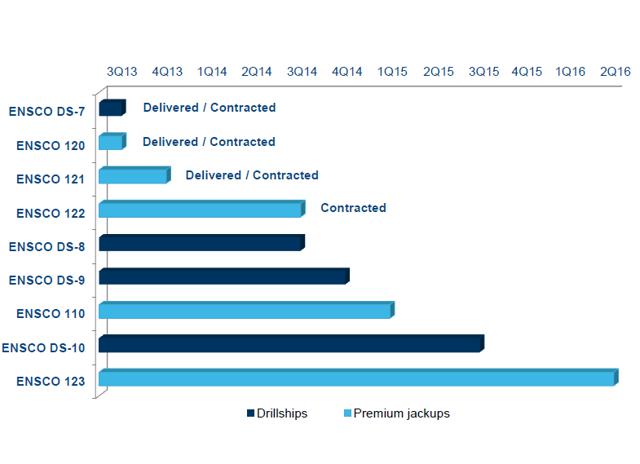

Ensco is the second largest offshore driller by active rig count with 71 and 6 under construction. The company has the largest premium jackup fleet and the second youngest ultra-deep water fleet. Ensco continues its strategy of divesting older rigs and reinvesting in more modern, premium rigs. On February 5, 2014 Ensco sold two jackup rigs for $33 million for a profit of $24 million. During the past four years the company has sold 13 older rigs and reinvested in a more modern fleet.

Source: Ensco Goldman Sachs Global Energy Conference January 2014

Ensco has done a remarkable job growing their fleet over the past 5 years and are diversified across 22 countries and 47 customers. The company does have 22 contracts set to expire in 2014 with an average day rate of $176,818, but 14 of those have additional 1-3 year options which the company has stated they are very optimistic their clients will exercise. Ensco also delivered 3 new rigs in 2H2013 with attractive multi-year contracts with an average day rate of $366,000. The company is set to deliver 3 more rigs in 2H2014, only 1 of which has a contract in place.

Source: Ensco Goldman Sachs Global Energy Conference January 2014

Ensco has an excellent management team in place that has given the company some of the best fundamentals in the industry. Ensco has the lowest forward P/E, the highest EPS, 2nd highest dividend yield, the 2nd lowest debt/equity ratio, and the 2nd lowest dividend payout ratio. The company has a good history of returning value to share holders and in 2013 increased its dividend and by 50% to $3.00/share. The company also approved a $2 billion dollar share buyback program over a 5 year period. This buyback program has the ability to remove nearly 15%-20% of shares, which will have a positive impact on EPS and make the dividend increases even easier to sustain.

Source: Ensco Goldman Sachs Global Energy Conference January 2014

One area of concern for Ensco is their backlog. At $11 billion in backlog contracts, it appears the company is well positioned going forward, but with trailing 12 month revenues at $4.75 billion the backlog represents only 2.3 years of guaranteed revenue. This is the worst among its peers in the industry. It will be important to monitor whether or not existing clients exercise their options on current contracts in 2014.

Recommendation: BUY Ensco is at 52 week lows and is trading at a P/B below 1.0. Management has been historically shareholder friendly and does so in a responsible manner. It easily covers its dividend payout and has done so without taking on large debt loads. While the backlog is of concern, I believe management will continue its 25+ year successful track record of gaining new contracts. Management is also dedicated to continually divesting from older, less profitable assets and reinvesting the proceeds in premium assets to fuel growth. While Noble Corp. and Rowan Companies are my 2 favorite picks, Ensco is close behind.

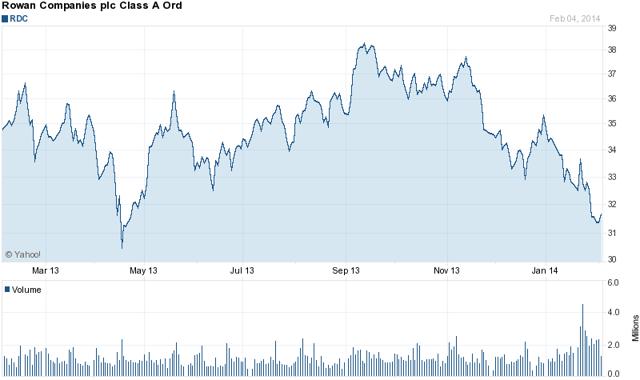

Rowan Companies

Rowan Companies is one of the smaller offshore drillers with 30 jack-up rigs active. The company recently entered the ultra-deepwater water market with the delivery of its first UDW drillship in December 2013. The company also has 3 UDW drillships under construction with the 2 being delivered in 2014 under contract.

Ultra-Deepwater drill ships | Location | Customer | Day Rate | Delivery | Commence drilling |

Rowan Renaissance | West Africa | REPSOL | $ 619,000 | Dec-13 | Apr-14 |

Rowan Resolute | Gulf of Mexico | Anadarko | $ 608,000 | Jun-14 | Sep-14 |

Rowan Reliance | Gulf of Mexico | Cobalt | $ 602,000 | Oct-14 | Jan-15 |

Rowan Relentless | N/A | N/A | -- | Mar-15 | -- |

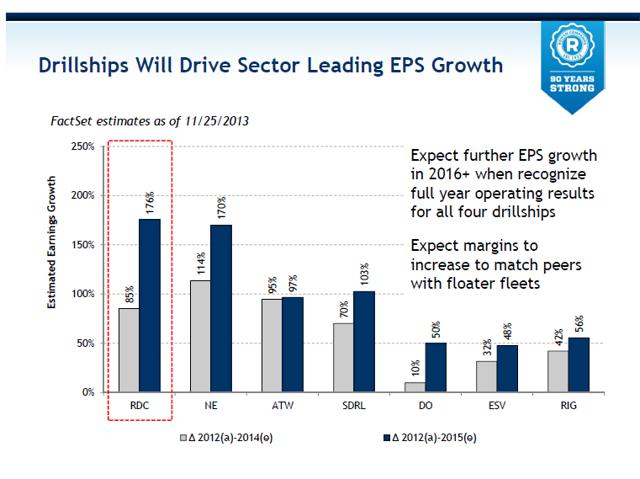

With the addition of these UDW drillship and its focus on high-specification jackups, the company has the highest projected EPS growth over the next 2 years. Of the company's 30 jackups, 19 are high-spec jackups which is the highest percentage in the industry. 11 of these high-spec jackups were built in a 5 year period from 2006-2011, giving the company one of the youngest fleets in the industry and the youngest UDW drillship fleet when the company finishes its ambitious UDW drillship newbuild program.

Source: Rowan Investor Presentation December 2013

With attractive 3 year contracts wrapped up for 3 of its 4 new UDW drillships and a company record $4.4 billion backlog, the company decided to issue its first quarterly dividend of $0.10/share payable in the second quarter of 2014. While this only gives a projected forward dividend yield of only 1.2%, it gives the company plenty of room to further increase payouts in the future.

Year Ending | Q1 (EPS) | Q2 | Q3 | Q4 | Fiscal Year |

2015 | 1.20 | 1.13 | 1.13 | 1.31 | 4.79 |

2014 | 0.37 | 0.62 | 0.94 | 1.14 | 3.11 |

2013 | 0.55 | 0.57 | 0.42 | 0.42 | 1.96 |

2012 | 0.47 | 0.51 | 0.39 | 0.44 | 1.81 |

Source: Rowan Earnings

Nearly two-thirds of Rowan's jackups are scheduled to end their contracts in the next 12-18 months. However, 8 out of the 18 jackups scheduled to end their contract in 2014 are with Saudi Aramco and have one year options with day rates higher than their previous contract price. In the company's 3Q2013 conference call the executive vice president, Mark Keller said:

"The bulk of the demand increase in the region is projected to come from Saudi Aramco. Their fleet of 43 jack-ups is forecast to increase significantly over the next 18 months. We have 8 jack-ups completing contracts with Saudi Aramco in 2014 and we believe we will secure additional work at favorable day rates as Aramco strives to meet stringent production demands."

Management went on to say that Saudi Aramco has been renewing contracts and they expect many of the rigs to have contract extensions between 3-10 years.

The company took a hit when they announced additional downtime to jackups Gorilla VI and Gorilla VII of 31 and 23 days respectively. These rigs have an average day rate of $302,000 and were delayed due to continuing inclement weather in the North Sea. The company expects operational downtime to be between 7%-9% for jackups and 5% for drillships in 2014.

Recommendation: Strong BUY I've been bullish on Rowan for several months and believe the decline in stock price presents an excellent entry point. Credit Suisse and Barclays have recently picked Rowan as their pick for best offshore driller in 2014. Rowan may be a riskier pick than Noble or Ensco, but its high growth potential makes the trade off acceptable.

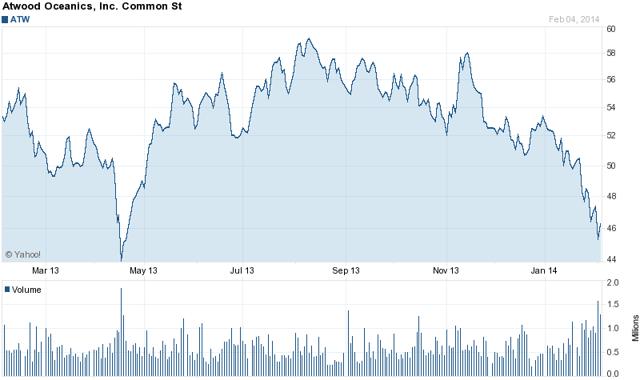

Atwood Oceanics

Atwood is the smallest offshore driller in my analysis with revenue just over $1 billion and a market cap of roughly $3 billion. However, the company is rapidly expanding its fleet with 6 UDW floaters and 3 jackups being built between 2011 and 2015. Most recently, Atwood beat on earnings when they announced $1.30 EPS vs. $1.28 EPS estimate. The quarter could have been even better, but 2 rigs experienced unforeseen downtime and fleet-wide efficiency was reduced to 92% from 97% the previous quarter.

Three months ended 12/31/13 | |||

2013 | 2012 | Y/Y % change | |

Revenue($thousands) | $ 284 | $ 245 | 15.9% |

Expenses | $ 182 | $ 156 | 16.7% |

Operating Income | $ 102 | $ 88 | 15.9% |

Net Income | $ 83 | $ 72 | 15.3% |

EPS | $ 1.30 | $ 1.11 | 17.1% |

Cash | $ 132 | $ 88 | 50.0% |

Long-term debt | $ 1,602 | $ 1,263 | 26.8% |

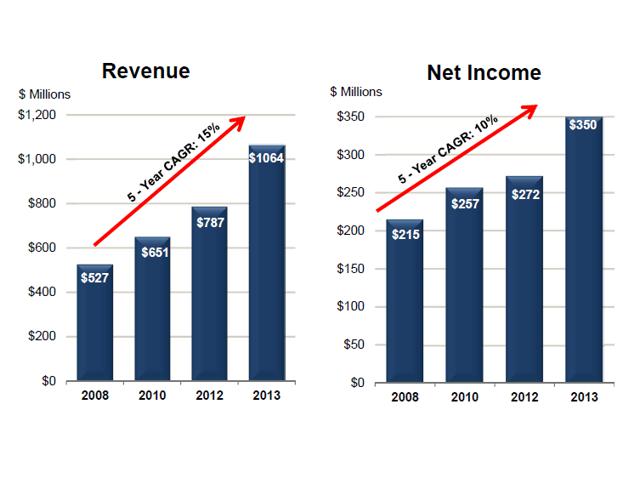

Source: Atwood Wells Fargo 2013 Energy Symposium

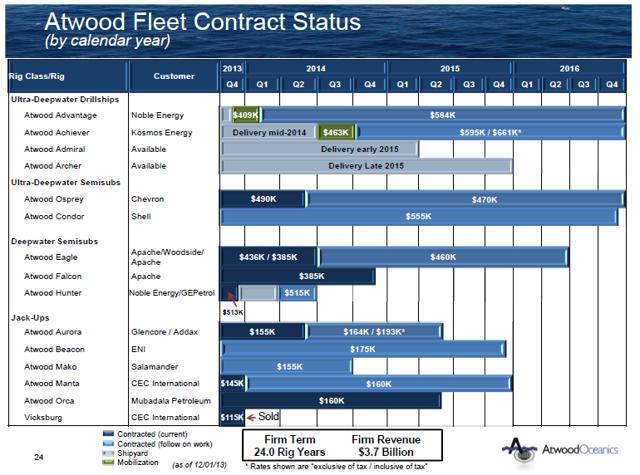

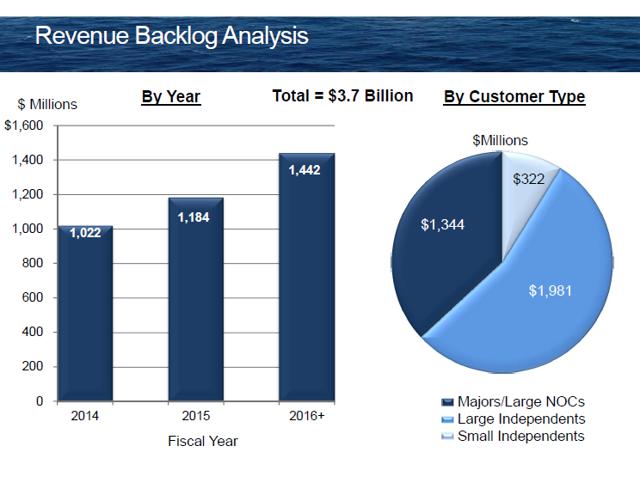

Atwood has done a good job of growing revenue and net income over the past 5 years and with the addition of the Atwood Advantage and Achiever in 2014, this growth will continue. With a backlog of $3.7 million and revenue of just over $1 billion, Atwood is second in the analysis with roughly 3.6 years of guaranteed contract revenue. During their quarterly conference call on February 4, 2013, management warned of potential weakness in the deepwater floater market due to uncontracted newbuilds and E&P operators looking to improve margins and decrease cost, causing operators to delay or cancel drilling programs expected to take place this year. This forecast is similar to what Noble Corp. warned of in their conference call as well. However, Atwood expects to weather this potential weakness due to the majority of their floater fleet being under contract through 2014. The Admiral Hunter's contract expires in mid-2014, but the company has already identified 3 opportunities for the rig in Africa that could commence shortly after the contract expires, which would limit its downtime. One bright note on the conference call was management's view of a relatively strong high-spec jackup market continuing in 2014 with minimal downward pressure on day rates.

Source: Atwood Wells Fargo 2013 Energy Symposium

As you can see the majority of Atwood's rigs are contracted out to 2015 and 2016. As with Rowan and Noble Corp, Atwood has done a good job of getting contracts in place for their newbuilds in 2014. Management said they are pursuing opportunities in West Africa and the Gulf of Mexico for the Atwood Admiral which is expected to be completed in mid-2015.

Source: Atwood Wells Fargo 2013 Energy Symposium

What is most promising about Atwood's backlog is it's spread out with consistent improvement over the next two years. This takes out much of the risk that many companies in the offshore drilling market are experiencing. Even if the company doesn't get a single contract extension or new contract in place over the next year, revenues will still increase from 2014 to 2015. As long as Atwood can keep operational downtime to a minimum, the company should see solid growth going forward.

Recommendation: BUY What keeps Atwood from being a strong buy is its size and lack of a dividend. Any operational downtime affects Atwood more than a larger company like Ensco or Noble and when companies have strong dividend yields, investors can sit back during times of market weakness and reap the benefit of quarterly dividends and wait for a turnaround. However, I believe Atwood may be the company best poised to see solid growth through 2014 since it has limited exposure to contract renewals in 2014.

Diamond Offshore

Diamond Offshore is a Houston based offshore drilling company with 45 rigs, seven of which are under construction. Before all the negative news started coming out on the offshore drilling market, Diamond was already facing its own dilemma from a client who declared bankruptcy. Brazilian oil company, OBX, filed for bankruptcy in late 2013 and caused Diamond to take a $70 million revenue hit. Diamond had 2 rigs under contract with them and managed to get one resigned through February 2014 and the other has been idle since.

While the company has 7 rigs under construction, Diamond has the oldest fleet in the industry with an average age over 30 years old. And the majority of these rigs are floaters, which have been experiencing more downside pressure than jackups and more specifically high-spec jackups. Of the 7 rigs under construction four have contracts and three of which are expected to be delivered in mid-to-late 2014 with an average day rate of $493,000.

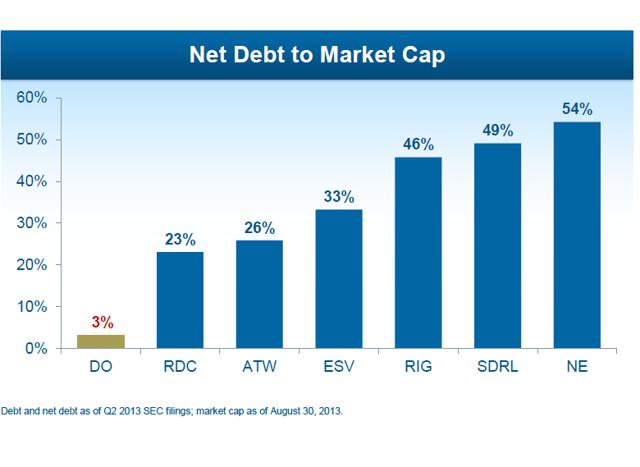

Despite an aging fleet and more exposure to the downtrodden floater market, Diamond does have some unique advantages when comparing it to its peers. Diamond has an impressive forward yield of nearly 7% when taking into account its special dividend payout. In 2013, the company issued a standard quarterly dividend of $0.125 and a special quarterly dividend of $0.75/share. This made for an impressive $3.50/share dividend in 2013. The company is also the least leveraged in the industry. The company has done a good job of keeping its debt down and its cash on hand high. However, this policy has lead to minimal reinvestment into a newer fleet and has caused the company to have by far the oldest fleet in the industry, which could negatively affect day rates during the recent market weakness.

Source: Diamond Barclays 2013 CEO Energy-Power Conference

Recommendation: HOLD Diamond has been the worst performer in the offshore drilling industry over the past year. If you got in anywhere close to the current price of $48, I'd recommend selling. Otherwise it's almost never a good idea to sell when a stock is down nearly 40% for the year but has decent fundamentals and pays a good dividend. Newbuilds commencing operations later this year will help a little with revenue, but its old fleet gives the company too much risk to think about buying at this point. If you have a long-term (5+ years) time range for Diamond as an investment, I think it's worth holding onto for a turnaround and to collect the dividend.

Conclusion

As reports continue to come out on a decline in the offshore drilling market, stocks in the industry are taking a beating. This is music to my ears. My philosophy in investing is to keep things simple; buy low and sell high. When stocks with good fundamentals and strong track records are at 52 week lows, I see this as a long-term buying opportunity. Investors with time frames under 12 months should probably stay away from the offshore drillers at this point, but the mid to long-term investors should see this weakness as a good buying opportunity. Noble and Rowan are my favorites in the industry with Ensco and Atwood close behind.

"Be fearful when others are greedy and greedy when others are fearful"

-Warren Buffett

Disclosure: I am long NE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.