Ford (F) is scheduled to release Q1 earnings this Tuesday April 27th, before the market opens. Average analyst estimates for the US automaker are $.31/share in EPS and $30.49 billion in Revenue. Twelve analysts track the stock with two upward EPS revisions in the last 30 days and no downward EPS revisions in the last 30 days. Last quarter, Ford beat average analysts expectations by .17/share, .43/share vs. .26/share.

I always find this a tough period waiting to see if the company is going meet, exceed, or miss their earnings estimates. One thing I have discovered of value is to analyze sentiment moves in a stock ahead of the company’s earnings release. In the case of Ford, I will use the piqqem sentiment index for Ford to see how sentiment has changed in the last quarter, for the months within that quarter, and from the end of the reporting quarter through today.

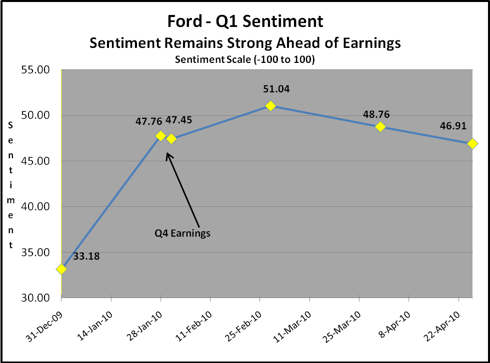

I’m looking for moves or changes that may foreshadow the earning release. (piqqem leverages the ‘wisdom of crowds’ by allowing its users to vote on the price direction of a stock and then applies its own propriety factors to calculate sentiment for a security. In their model, -100 is the lowest and 100 is the highest sentiment).

Sentiment for Ford

Source Piqqem

Will Ford follow the growth path of Tata Motors (TTM), or is Ford ready to breakdown with the likes of Toyota (TM)?

The above chart shows Ford’s sentiment increasing by 14 points from the beginning of the quarter through today. As a comparison, sentiment for the S&P index dropped 17 pts in the same period, which makes Ford’s sentiment increase even more impressive. On the Piqqem scale, Ford’s sentiment rating of 46.91 is considered a buy and its absolute sentiment indicates a high quality stock. Only Ford knows their actual results, but current sentiment points to the US Automaker delivering good news on Tuesday.

Disclosure: No positions