Credit Suisse Gold Expert Tom Kendall sees Gold $1,000 in 2014. The theory he outlines is pretty much consistent with a theory I've been outlining in a series of articles. The key to understanding gold is understanding where real interest rates are headed. As rates head higher, the opportunity cost of holding gold will increase. People are unlikely to hold gold as rates begin to offer attractive rates. That is what I think is the most compelling argument against gold. As Mr. Kendall points out, it may take awhile, but if growth picks up in the 2nd half, he expects gold $1,000 by the end of the year.

The other theory Mr. Kendall posits is overhead supply. As he points out there are major holders of gold just waiting for an opportunity to exit. It is hard for me to imagine a scenario that would replicate or surpass the conditions of 2008 through 2011 going forward. The financial crisis was ideal for a gold rally, but those days are past. The days of extreme fear are not likely to return anytime soon. 2008 thru 2011 was a once in a generation opportunity to buy gold. Those days are past, and the problem now is exiting these positions of gold in an orderly fashion.

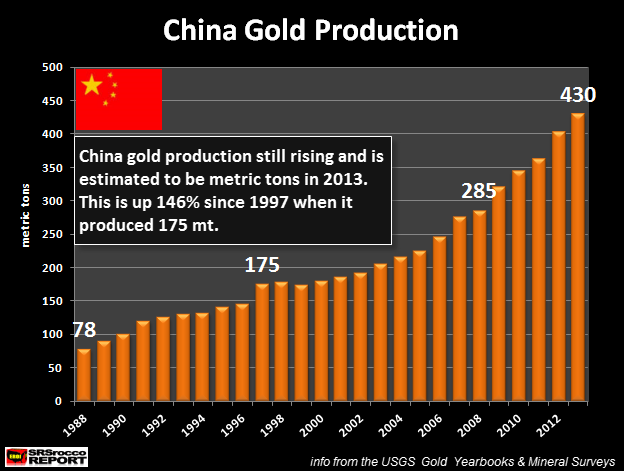

One other theory about gold making the rounds is that China is stock piling gold in order to create a global currency. In my opinion, there is zero chance the world will return to a gold standard. A dynamic and growing global economy requires flexibility. A rigid gold standard would work against the objectives of flexibility and growth. While China buying gold didn't impress me much, what did impress me was the amount of gold China is now producing. China is now producing twice the amount of the previous leader South Africa. If production trends continue, supply will start to overwhelm demand. A growing nation like China needs productive assets. Tying their capital up in gold is simply a waste. Why use all these resources to dig up gold only to have it sit in some bank vault?

In conclusion; the path of least resistance for gold is down. Credit Suisse has a 2014 target of $1,000. Overhead supply, increasing supply and rising real rates will likely put a ceiling on gold and lower the floor.

Disclaimer: This article is not an investment recommendation or solicitation. Any analysis presented in this article is illustrative in nature, is based on an incomplete set of information and has limitations to its accuracy, and is not meant to be relied upon for investment decisions. Please consult a qualified investment advisor. The information upon which this material is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore, the author cannot guarantee its accuracy. Any opinions or estimates constitute the author's best judgment as of the date of publication, and are subject to change without notice. Past performance is no guarantee of future results. For my full disclaimer and disclosure, click here.

Disclosure: I am long GLL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I also own calls on GLL.