In the "Referendum against Mass Immigration," the Swiss decided that there should be continuing limitations on European immigration into Switzerland. For us this means that the Swiss have opted for less labor supply, hence with the upcoming Swiss boom, salaries and inflation will rise.

With the Yes to the "Referendum against Mass Immigration" on Sunday 9th February 2014, the Swiss want to renegotiate the "freedom of movement" part of the 2002 Swiss-EU bilateral agreements and maintain quotas on immigration. In its final stage, this contract allowed an unlimited number of Europeans to move to Switzerland. Some details are:

Once a person has created a business or found an employment with the length of one year, she/he may stay for five years, no matter if she/he loses the job (annex1) Moreover, the contract allows moving to Switzerland in order find an employment and benefit of unemployment aid during a period of six months. (annex1, art. 6) (source text)

European leaders immediately responded with "freedom of movement is not negotiable," a phrase they regularly employ, e.g. in response to David Cameron. The bilateral agreements seem to be dead now, in particular because the EU is able to apply the so-called "Guillotine rule." With this rule, they are able to cancel all parts of the bilateral agreements when the Swiss do not comply with one of them.

Like in any free trade and cooperation agreement, it is a question of whether a cancellation of the other six contracts is a problem rather for the EU or Switzerland. The bilateral agricultural agreement opened Switzerland for more (rather cheap) agricultural imports from the EU and the EU for (rather expensive) imports from Switzerland to the EU. The bilateral overland transport agreement establishes rules that allow European lorries to cross Switzerland. A failure in the Swiss power system led to a blackout in Italy in 2003. As usual, the employer-friendly NZZ and the monopolistic Swiss state TV and radio were scaremongering. The Financial Times even tried to suggest that the referendum also would be an end to the 1972 Free Trade Agreement. But as for free trade, only previously regulated areas like agriculture and electricity are contained in the bilateral agreements.

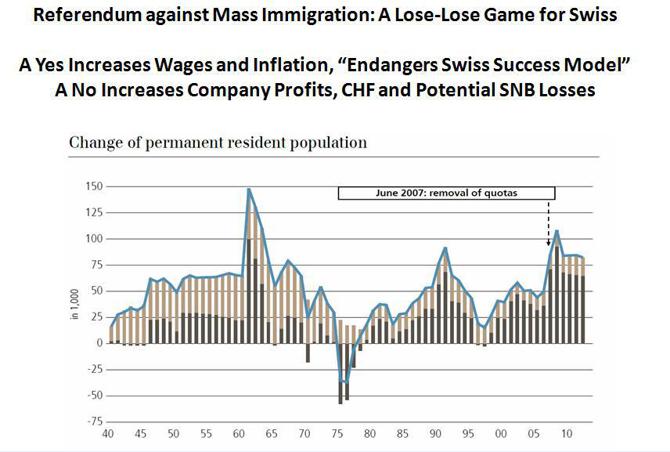

First press reactions were between a "Swiss lecture for Brussels" (BBC), a "Swiss Say 'Fu.k the EU'" (Die Zeit) and "Switzerland is the Land of Money and Angst" (Der Spiegel). We think that Der Spiegel forgot to consider that 80 or 85 thousand net immigration per year in Switzerland is the equivalent of one million net immigration per year when applied to Germany. But already the relatively small 350,000 net immigration to Germany triggered a big discussion about immigrants that want just to take advantage of the German social safety net.

Moreover, the quality of immigration into Switzerland has apparently decreased. In the early days of the bilateral agreements, from 2002 until 2009, immigration was driven by Germans and Brits, often managers, engineers and computer experts. Thanks to low unemployment in Germany and the recent recovery in the U.K., this picture has changed. Since 2010, more and more people from the suffering EU regions have arrived. Those often do not speak German or English well, the lingua franca of the Swiss multi-nationals and global banks.

As often Italian entrepreneurs were innovative: they have created companies in the Southern Swiss region Ticino that employ commuters from Italy at (for Swiss standards) dumping wages, just to take advantage of the cheaper Swiss tax regime and the efficient administrative system. A reason why the Ticino voted by 70% in favor of the initiative. The Swiss unemployment rate is still relatively low, but it has already overtaken the one of the German Bundesland Baden-Württemberg, as the economist of the Swiss unions Daniel Lampart had explained last year.

Still, the right-wing People's party SVP won the referendum against a phalanx ranging from unions and socialists to employers. According to the SVP more and more less qualified Swiss and citizens from non-EU countries are replaced by European immigrants. The major economic argument is that Swiss social systems will be overcharged soon.

Betting on a weaker franc (FXF) is premature

Last week the always strong Swiss trade balance surprised on the downside. The monthly trade surplus was just around 0.5 billion instead of the regular 2 or 2.5 bln. francs. Other fundamental data, e.g. the UBS consumption indicator, job creation in banks and rising credit, confirmed that the fall in the trade surplus is connected to an upcoming boom in the country. With the apparent end of the euro crisis and the recovery of the United States, Swiss companies, in particular banks, have become optimistic. The weak trade surplus reflected the investments and purchases companies are making. A similar rise in investments and a falling trade surplus is visible in the closely connected Germany. This picture is mirrored by rising exports from the United States to Europe, e.g. exports of capital goods.

Some pundits have already bet on a weaker franc, but this is premature. In the same way, markets shrugged off the weaker Swiss trade surplus, they will not consider the referendum result as bad news for CHF. The important thing for markets is that Switzerland might be moving towards a boom more rapidly and investors want to participate in rising Swiss spending. Spending that is sustained by years of accumulated current account surpluses, years of high savings and rising real estate prices. Less labor supply from immigration will help to increase Swiss salaries, which again will sustain spending.

Assuming that profits of Swiss companies are in danger ignores that this might be just the long-term consequence of the referendum. But in the short and medium term it means that the Swiss boom should continue and even intensify because the Swiss will now have more job security.

History repeats: 1975-1978, the first CHF cap and the first exodus of foreign workers

People familiar with Swiss monetary history, will remember well the Swiss franc cap to the German Mark in 1978. This central bank measure was also a response to the sharp fall in Swiss GDP after the Swiss administration wanted the many foreign workers to leave Switzerland during the recession years of 1975 and 1976.

In the end, the central bank was able to maintain the DEM/CHF rate above the minimum of 0.80, but the exodus of foreign workers translated quickly into a lack of labor. Once the recession was finished, wages and inflation started to rise quickly. Later, SNB president Fritz Leutwiler declared in private discussions with the chief economist Kurt Schildtknecht that the cap on the CHF was a severe mistake. A stronger franc would have limited money supply and subsequent inflationary pressures.

In the 2014 referendum, the Swiss do not require that many foreigners go home (like in 1975/1976), but they want to reduce the pace of immigration and that they are able to choose which persons come.

The SNB will need a stronger franc to fight inflation

Still for us the referendum was a no-win game for Switzerland:

- A No would have implied that more and more foreigners wanted to invest in Swiss multi-nationals, that do not need to pay higher wages and would preserve their profits.

- The Yes means that (finally) Swiss salaries will rise, but so will inflation. The real estate boom will continue, this time in order to hedge against rising inflation.

In May, the minimum wage referendum will be the next event that could increase inflation, the exit from nuclear energy is another upcoming inflation driver.

We reckon that the SNB should hike interest rates as soon as possible, e.g. when CPI inflation moves to 0.5% or 1% and the period of very low U.S. and global growth is finished.

The bank might need to accept losses on the CHF exchange rate. In recent years, Swiss money supply was increasing by 7.7% per year. This number is far higher than the zero growth in money supply in the euro zone. A stronger franc would help against inflation and prevent that the Swiss real estate bubble from bursting once Europe has finally recovered in maybe ten to fifteen years. Avoiding a real estate bust is for us more important than preserving the profitability of the central bank.

As Nouriel Roubini recently explained, the counter-cyclical capital buffer only helps against the bankruptcy of banks but not against falling house prices and its dire consequence: low spending for years. (Larger version of image in link above)

George Dorgan is from the European Union and lives in Switzerland.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.