On 2/20/14, Murphy USA (NYSE:MUSA) released solid Q4 2013 and full year results. The headline number of $2 EPS for the quarter is not comparable to the prior year, since GAAP results were boosted by one-time gains and discontinued operations. Digging a little deeper, it's clear that Q4 was somewhat challenging for the company. This is not totally unexpected, given that Q4 is a seasonally weak time for driving as well as heating needs resulting in a rising price environment for oil and other fuels. Although the blowout headline number of $2 in Q4 EPS was lifted by the benefit from the sale of the Hankinson ethanol plant and a $0.25 benefit from discontinued ethanol operations, the remaining $0.63 from continuing operations still looks OK in a quarter stifled by lower fuel volume and a compressed fuel sales gross margin.

This article intends to show that Murphy continues to deliver strong operating performance, methodically sell non-core assets to raise cash, and is on track to achieve targets identified in our Bull case valuation - a potent combination likely to yield significant return to patient investors.

Note this article will focus on operating performance and model details. For more background on the Company and definitions for key terms, please see our prior article here.

Solid 2013 Results, Growth Expected for 2014

For the full year 2013, Murphy earned income from continuing operations of $3.34 per share. With recent prices right around $40 (up ~8% since our previous article), Murphy can still be owned for a fair 12x trailing earnings.

In 2013, Murphy added 39 new stores, including 18 in the fourth quarter. This rapid expansion is a key driver behind our positive outlook for the company and expectations for higher profits and a higher stock price in the coming year. On the conference call, CEO Andrew Clyde noted that in 2014 the company has completed 5 new stores with an additional 15 under construction. If the company can push this pace throughout 2014, it remains on track to achieve growth near the upper end of our expected range. Note that Clyde specifically mentioned that stores in the larger format, the majority of new units, earn cash on cash return right around 9.5% after taxes. With locations at only a small percentage of Wal-Mart stores, clearly there are strong growth prospects ahead for Murphy USA.

It's important to note that not everything went Murphy's way in the recent quarter. Due to more volatile oil prices and increased price competition, the company achieved a somewhat disappointing gross fuel margin of 10.4 cpg, bringing the full-year number down to 13.0 cpg. This is a critical data point to watch as it is the most significant factor in projecting Murphy's gross profits. Still, CEO Clyde noted that this gross margin does fluctuate and is seasonally weak in the winter quarter. Note that 13.0 cpg is the margin used in estimating the BULL case, our scenario with the most upside. If Murphy can consistently achieve even 12.0 cpg, strong profits will continue. Given management's industry experience and Murphy's low cost leadership, the company should be able to manage through these occasional rough periods and achieve consistency over time.

Balance Sheet Update

As some observers conjectured prior to the release of Q4 results, Murphy used a significant portion of free cash to pay down the outstanding term loan facility last year. From an initial draw of $150mm due to the spin-off, only $70mm remains as of year-end. In addition to the $500mm note outstanding plus cash on hand, Murphy's net debt of ~$275mm looks quite manageable compared to its steady operating cash flow and annual interest expense of ~$32mm. With EBIT well over $200mm, Murphy can cover interest expense approximately 7x. At this pace, it seems likely that Murphy can pay down the remainder of the term loan facility by the end of 2014.

Model Updates

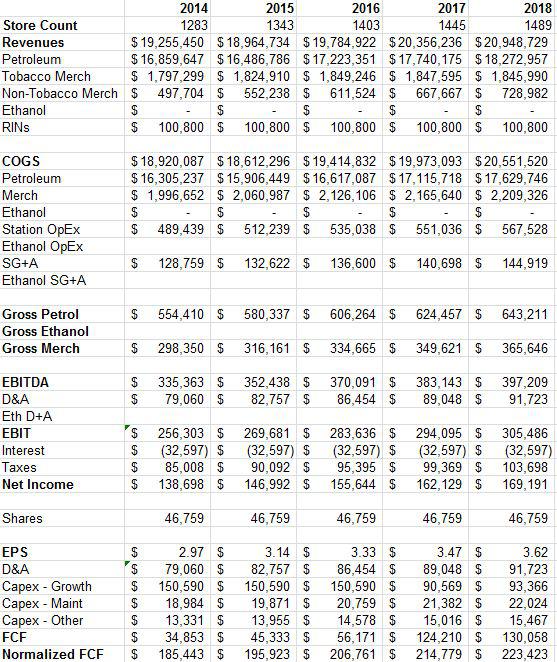

Based on the recent results, asset sales, and guidance and other information discussed in the conference call, we have updated the model and continue to see significant upside potential with limited downside for shares in Murphy USA. A few key changes to the model:

· Assume sale of Hereford for $110mm, thus no ethanol operations

o The change to operations decreases EPS estimate by ~$0.04

· In the Base scenario, revenue from tobacco merchandise is projected to decline 4.5% per store-month per year, while 6% per store-month growth per year in non-tobacco merchandise yields roughly 3% growth in topline merchandise revenues

· As non-tobacco merchandise sales grow as a percentage of the total, gross margin in that segment will improve; merchandise margins expanded 30bps in the last report

o Total merchandise margins increase by 30bps per year until 2016, reaching a peak of 13.6% gross margin, to reflect this sales transition

· RIN sales held steady at 12m RINs per month; this is a conservative estimate based on Murphy's report of 13.5m RINs per month in the seasonally slow Q4 and the 170m+ RINS sold for the 2013 full year period, translating to around 14.2m RINs per month.

· Base scenario uses $0.40 RIN price; note that Murphy management estimates a RIN price of $0.05-$0.10 for conservative cash flow planning, compared to recent prices in the $0.40-$0.50 range. On the conference call, CEO Clyde responded to a question on this, stating "we're just being extremely conservative in our cash flow planning." The model continues to use higher RIN prices, reflecting the view that regulation over gasoline consumption is unlikely to abate, and may in fact increase over time. Current RIN prices stand at 46 cents.

· Decrease fuel sales per store-month by 3k gallons in all scenarios; to 267k/272k/277k

· Other model maintenance to adjust remaining debt outstanding, cash balances, and one-time spin-related costs

· In addition, a key change to Bull scenario assumptions is an improved discount rate of 9% compared to 10% previously. This change reflects better clarity around future growth plans, a more focused asset base, and a deserved lower rate due to Murphy's stable operating profile and reliable cash flow

Bull Case Model:

Scenario Analysis on Bull Case:

| Scenario Analysis | Fuel Margins | ||||

| $ 0.120 | $ 0.125 | $ 0.130 | $ 0.135 | ||

| RINs | $ 0.30 | $ 47.94 | $ 51.83 | $ 55.72 | $ 59.60 |

| $ 0.40 | $ 50.79 | $ 54.68 | $ 58.57 | $ 62.46 | |

| $ 0.50 | $ 53.64 | $ 57.53 | $ 61.42 | $ 65.31 | |

| $ 0.60 | $ 56.50 | $ 60.38 | $ 64.27 | $ 68.16 | |

| $ 0.70 | $ 59.35 | $ 63.24 | $ 67.12 | $ 71.01 | |

| $ 0.80 | $ 62.20 | $ 66.09 | $ 69.97 | $ 73.86 | |

Conclusion

After reviewing the latest quarterly report on Murphy's operations and updating the model to reflect those results, we remain strongly positive on Murphy's business prospects going forward. It seems clear to us that Murphy's intrinsic value is higher than the current market cap, and we expect this discount to narrow over time.

Patient investors will see this business achieve significant growth in earnings and cash flow as management executes its strategy. These investors will be rewarded as the stock price converges to our bull case estimate for intrinsic value, which remains approximately 70% above recent prices.

Downside appears to be limited as well. The worst-case scenario is a much tighter gross margin on fuel sales and rock-bottom RIN prices (which we continue to think is unlikely). With brutal assumptions for these key inputs, the model calculates an approximately 33% decline in intrinsic value for the company. With a greater than 2:1 upside/downside based on the Bull and Bear scenario analysis, we reiterate our bullish stance on shares of Murphy USA.

Additional Notes:

It's interesting to note that analyst estimates for next quarter average 30.3 cents per share of EPS with 3 analysts now covering the name. We think that Murphy can easily beat this target. Considering profits from RIN sales alone, Murphy can earn ~$14mm or $0.31 EPS this quarter. This assumes Murphy sells only 12mm RINs per month (in line with 2013 sales) at a price of $0.40 per RIN. Note that the lowest price seen so far in 2014 has been $0.30 and prices ranged as high as $0.57, for an average price right around $0.40. With these seemingly quite reasonable assumptions, it appears highly likely that Murphy can handily beat current consensus estimates.

Additionally, although the news in no way influenced the independent analysis above, we were pleased to observe the recent open market purchase of shares in MUSA by CEO Clyde of 5,000 shares at a cost of approximately $200k. This brings Clyde's ownership in the company, excluding options, to 11,000 shares, worth just under $500k at recent market prices. It is said that insiders may sell stock in their company for any number of reasons, but they buy shares for one reason alone.

Disclosure: I am long MUSA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.