Universal Technical Institute (NYSE:UTI) is a paradigm in the for-profit higher education industry. Virtually opposite to its collective peers often accused of rewarding shareholders at the expense of students, UTI has some of the most impressive student outcomes in the sector. But with weaker fundamentals, expensive valuations, and a stock price down 70% from its ten year peak, current or budding shareholders might step up and demand superior outcomes for investors as well.

Shareholder activism, which has seen a renaissance in recent years, could arguably be on the horizon for UTI, including the potential for a going private transaction or outright takeover bid. To be sure, my thesis is purely speculative, but one should expect if a quality operator fails at passing customer success to shareholders, the board of directors will ultimately feel some heat.

Let's take a look at UTI to see why it might be ripe for shareholder intervention, including an unforeseen company event such as privatization or takeover.

Company Profile

Headquartered in Scottsdale, Arizona, Universal Technical Institute, Inc. is a provider of post-secondary education for students seeking careers as automotive, diesel, collision repair, motorcycle and marine technicians. With more than 170,000 graduates in its 48 year history, UTI offers undergraduate degree, diploma and certificate programs at 11 campuses across the United States, as well as manufacturer-specific training programs at dedicated training centers.

Through its campus-based system, UTI provides specialized post-secondary education programs under the banner of several brands, including Universal Technical Institute, Motorcycle Mechanics Institute and Marine Mechanics Institute [MMI], and NASCAR Technical Institute (NASCAR Tech). (Source: Universal Technical Institute)

UTI operates campuses in eight states: California, Arizona, Texas, Florida, North Carolina, Illinois, Pennsylvania, and Massachusetts. In addition to commuter students, the company employs a destination campus recruitment program where students who live in areas outside a commutable distance from any of the 11 campuses are enrolled by a team of remote admissions representatives. Destination students then relocate to the campus of choice to complete their program. A majority of destination students are high school seniors. UTI also recruits non-traditional military and other adult learners.

All UTI campuses are accredited by the Accrediting Commission of Career Schools and Colleges (ACCSC), a national accrediting commission recognized by the U.S. Department of Education (USDOE).

Competitive Landscape: Highest Revenue Per Student

Of the 14 publicly traded higher education companies tracked by Country View Capital Research, Universal Technical Institute has the highest annual revenue per student at about $26,000. This is almost twice the industry weighted average of about $14,000. But UTI's operating margin is one of the lowest among its peers, in part due to the high cost of delivering on-campus automotive and related technology programs.

UTI's most recent one year total population growth of -5.3% bests the industry weighted average of -7.1%, but its new student one year start growth of -18.5% lagged the industry weighted average of -7.8%. As of its fiscal Q1 2014 results released on January 30, the company reported a total average student population of 15,400 (as of December 31, 2013) making UTI on one the smallest operators in an industry that averages over 75,000 active students per company.

Value Proposition: Investing in Satisfied Students

Despite relatively high tuition paid by it students, UTI did return 52.5% of that revenue to students through instructional spending, including faculty, campus facilities, and student services in its most recent fiscal year. This convincingly exceeds the industry weighted average of 45% of student revenue spent on education services and facilities.

According to College Prowler, UTI students apparently appreciate the company's level of reinvestment of tuition dollars, awarding an overall rating of 4.1 out of a possible 5.0, as interpreted by Country View Capital Research. UTI tied for highest student satisfaction in the sector along with American Public University and Career Education. Weighted industry student satisfaction is 3.9.

Employee satisfaction at UTI is 2.8 out of a possible 4.0 per respondents on Glassdoor. This also exceeds the peer average of 2.6.

Sector Risk: Exceptional Student and Regulatory Outcomes

Dominating recent headlines in for-profit education are high student loan default rates, excessive revenues derived from federal financial aid funds, and poor student graduation and employment rates. UTI defies the mainstream with exceptional student outcomes and regulatory records.

Graduation Rates and Employment

Reporting a recent student graduation rate of 65%, and a graduate employment rate of 85%, puts UTI far above the industry weighted averages of 31% and 64% respectively.

These outcomes not only keep regulators at arms length, but potentially create value in the form of new student referrals from successful graduates. The company's aggregate graduate achievement is another example of UTI's outstanding record in student success which is paramount to an education operator's inherent commitment to the public at large. However, investors may be asking where are the operating margins and cash flow from all this student success?

Bad Debt and Capacity Utilization

At just 1.4%, UTI's bad debt is another reflection of a well-run operation of satisfied students.

As would be expected of facility intensive automotive training, the company averages about 135 square feet per student vs. an overall industry average (and common target) of 40 square feet per student. But UTI does leverage outstanding corporate partnerships within their high end training environments.

(Source: UTI Investor Presentation March 2013)

Federal Loan Defaults and 90/10 Ratio

Last September, the USDOE released its 2010 3-Year Official Cohort Student Loan Default Rates. Universal Technical Institute's campuses averaged a 20% overall default rate. With sanctions from the USDOE targeted at institutions with consecutive years over 30%, UTI appears to manage its former student federal loan repayments in an effective manner.

Its overall 90/10 Ratio, or the percentage of net revenue derived from federal sources, was most recently reported at 68%, significantly below the industry weighted average of 76%. By focusing its recruiting efforts on high school seniors and military veterans, UTI enjoys a safe ratio that otherwise can lead to sanctions including the loss of authorization to award federal financial aid to students. Having nearly 33% of net revenues secured from non-federal sources such as cash payments, puts UTI in a position of strength in a regulatory vulnerable industry.

Regulatory Exposure

In September 2012, the company received a Civil Investigative Demand (CID) from the Attorney General of Massachusetts related to a pending investigation in connection with allegations that UTI caused false claims to be submitted to the Commonwealth relating to student loans, guarantees, and grants provided to students at its Norwood, Massachusetts campus. The CID required UTI to produce documents and provide written testimony regarding a broad range of the company's business from September 2006 to the present. UTI says it responded timely to the request, as well as to follow-up requests for additional information made in December 2012 and February 2013.

In October 2013, UTI announced the closing of a related investigation by the U.S. Department of Justice regarding the same false claims action, and entered into a settlement of such claims with a former employee. Nonetheless, it appears the Massachusetts attorney general CID remains open.

Attorney general investigations of for-profit educational institutions have been ramping up in recent months. In a coincidental, yet ironic twist in the face of the Massachusetts AG CID, UTI's Norwood, MA campus recently earned the Neponset Valley Chamber of Commerce (NVCC) "Large Business of the Year" Award. According to the NVCC:

This prestigious "Large Business of the Year" award is presented to an NVCC business member who demonstrates outstanding achievement in general management, employee relations, business growth, product innovation, and community and social responsibility.

Another classic example where the business community and government are in apparent disagreement about the quality and professional intent of a local profit motivated business entity. Because of the federal level dismissal and company settlement of the related false claims action, plus UTI's otherwise impeccable regulatory record, investors could understandably rate the Massachusetts inquiry as low risk.

Fundamentals, Valuation, and Margin of Safety

This is where UTI's leading educational products and strong campus operations seem to hit a brick wall in the context of its company stock.

As of the market close on March 6, 2014, UTI was a $327.6 million market cap, small value company, with a 3.00% dividend yield. Its stock price of $13.29 was down 5.4% YTD. The stock has been languishing in the low to mid teens since August 2011.

Select Fundamentals

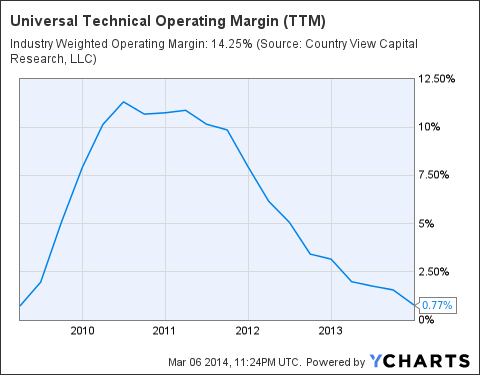

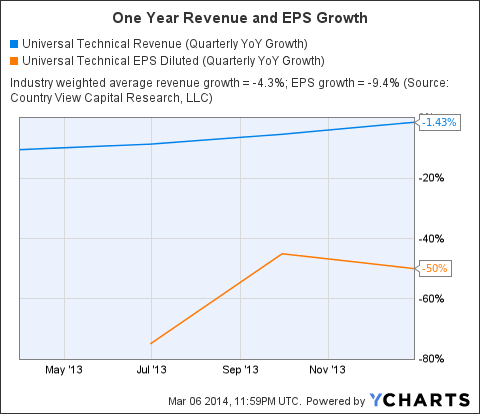

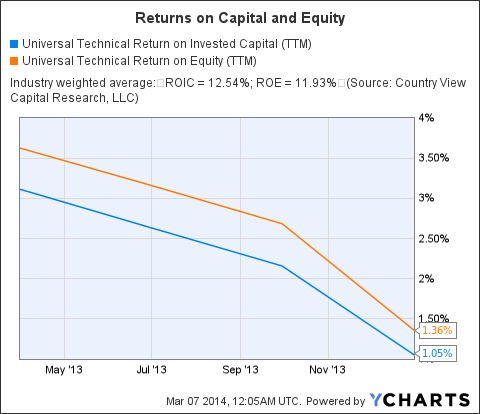

One year revenue growth (although negative) being the exception, earnings per share growth plus returns on invested capital and equity each trail the industry weighted averages.

Also of note, UTI's trailing current ratio (current assets/current liabilities) is 1.44 vs. a industry weighted average of 1.74.

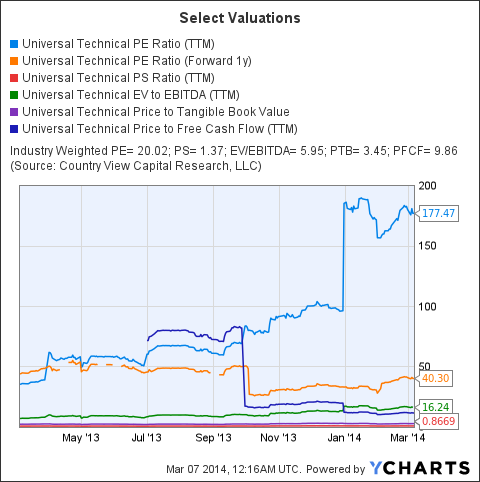

Select Valuations

UTI's tuition is not cheap, and neither is its stock. Its trailing price to earnings of 177.47 and forward P/E of 40.30, far exceed the education industry averages. In fact, with the exception of trailing price to sales at 0.87, and price to tangible book of 2.78; its enterprise value to EBITDA of 16.24, and price to cash flow of 11.64, are significantly higher than the industry weighted averages. Yet another reminder to individual investors that low priced stocks do not always equate to good value plays.

Margin of Safety

Free cash flow notwithstanding, select margins of safety in UTI perhaps mirror its strong education operations. The company has no long-term debt; beta of 1.33 is on the low side of the industry; analyst consensus is a sector equivalent "hold;" and market risk is deemed below the weighted average of its peers.

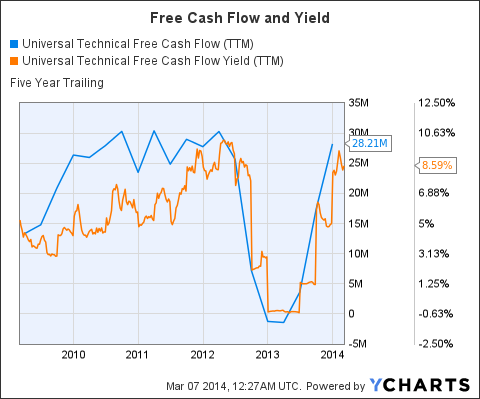

As hinted earlier, a prominent laggard is the company's free cash flow and corresponding yield, although certainly returning to its five year averages after a precipitous drop in 2013.

Calling All Icahn's, Loeb's, and Ackman's

Naturally, I am not aware of any interest in UTI from infamous activist investors like Icahn Enterprise's Carl Icahn, Third Point's Daniel Loeb, Pershing Capital's Bill Ackman, or anyone else. I only mention them as prominent metaphors of what may be necessary to unlock the value of UTI's lagging stock price despite its quality education services operation.

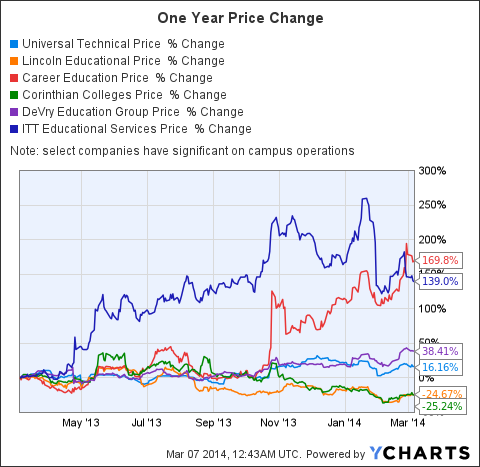

Some may argue UTI is simply an innocent bystander in the wake of a regulatory beaten down industry. But that does not explain UTI's generally counter stock performance in an otherwise surprise comeback for education stocks over the past year:

Independent board members and/or senior management, led by CEO Kimberly McWaters who also serves as chairman of the board, may need to step up to the plate in regards to generating investor friendly returns to match impressive student centered outcomes. Failure to do so, or at least lend an impression of heightened shareholder advocacy, could make the company ripe for an activist investor to take a significant position, and a stand. Becoming an acquisition target or going private initiative could be feasible alternatives if not the underlying objective of a potential activist.

Until that happens, if indeed it ever does, Universal Technical Institute can proudly stand tall as a quality operator in an industry many pundits have portrayed as anything but worthy.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Education industry weighted averages calculated as of December 31, 2013 courtesy of Country View Capital Research, LLC (CVCR). Industry data for illustrative purposes only. Accuracy of data, including YCharts, cannot be guaranteed. Narrative and analytics are not intended for portfolio construction. CVCR and its founder, David Waldron, are industry experts and data providers, not investment advisors, and to maintain independence do not directly invest in any education companies followed. Article not intended as investment advice nor as a recommendation to buy/hold/sell/short or avoid UTI or any other securities. Readers should always engage in further research and/or consider consulting a certified financial planner, licensed broker/dealer, or registered investment advisor before making any investment decisions.