Editor’s Note: This article covers a stock trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.”

CGG Veritas (CGG) has become the largest seismic services provider (for the oil and gas industry) in the world. There is a lot of competition in this market segment and CGG is compared with its peers such as Schlumberger (SLB). For the short term, CGG is not a good investment, but it does have potential for the long term when CGG is able to increase its market share.

CGG Veritas

CGG Veritas is a French company that was created in 2007 by the merger of French CGG - which was founded by Conrad Schlumberger in 1931 - and Canadian Veritas DGC. CGG Veritas is active in the acquisition, analysis and interpretation of geological and geophysical data for oil and gas fields, but also for minerals or ground water.

Seismic services (or geoscience) is capital intensive because specialized aircraft and ships are required to acquire geological data. The largest clients for seismic services are in the oil and gas industry. Geoscience services range from acquiring 3D and time-lapse (4D) seismic surveys and processing this data. This is done during the entire life span of exploration, production and finishing exploration of oil and gas fields.

CGG Veritas1 | 2013 | 2012 | 2011 | 2010 | 2009 |

Revenue | $3,767.9 | $3,414.1 | $3,180.9 | $2,904.3 | $3,109.1 |

Net income | -$691.2 | $92.4 | -$14.3 | -$60.4 | -$361.4 |

EBIT | -$394.9 | $330.6 | $205.5 | $87.4 | -$224.3 |

EBIT% | -10.48% | 9.68% | 6.46% | 3.01% | -7.21% |

FCF | $5.0 | $63.1 | -$94.2 | -$108.0 | -$517.8 |

EPS | -$3.95 | $0.46 | -$0.18 | -$0.47 | -$2.34 |

Although EBITDA was up with 15%, the 2013 results were severely impacted by asset impairments:

- $139M fair value of vessels

- $582M because of a planned fleet downsizing plan and a change in market outlook

CGG has the following divisions:

Division 1: Acquisition and Division 2: GGR (Geology, Geophysics, Reservoir), which used to be the Services division. In order to be able to compare these divisions with peers and previous years, the financial data of Acquisition and GGR are added.

Services | 2013 | 2012 | 2011 | 2010 | 2009 |

Revenue | $3,522 | $2,828 | $2,290 | $2,083 | $2,379 |

EBIT | -$427 | $203 | $9 | $37 | -$259 |

EBIT% | -12.12% | 7.19% | 0.39% | 1.78% | -10.88% |

Acquisition and GGR are clearly the weak part of CGG Veritas. The market where it operates is price-driven because of the competition.

The shallow water and ocean bottom surveys [SWOBS] segment of the high-end acquisition market - which were key drivers for the performance in 2012 - are transferred to the JV Seabed Geosolutions. This doesn't look good for future Acquisition division results, although the results will be consolidated in the financial results.

JV Seabed Geosolutions with Fugro

After acquiring the Geoscience business of Fugro (FURGF) in 2012, part of the acquisition agreement was the startup of a joint venture Seabed Geosolutions with Fugro where CGG holds a minority position of 40%.

In this JV, the Ocean Bottom Cable [OBC] and Ocean Bottom Node [OBN] projects of the SWOBS were transferred by CGG. Fugro's deep water OBN and CGG's shallow water OBN complement each other.

Instead of being competitors, the JV Seabed Geosolutions became an instant market leader. Especially the OBN are revenue generators, according to Fugro's CEO at the presentation of the 2012 results.

Division 3: Equipment, which develops and produces of seismic acquisition systems for land or marine use with the brand name Sercel.

Equipment | 2013 | 2012 | 2011 | 2010 | 2009 |

Revenue | $1,045 | $1,204 | $891 | $821 | $731 |

EBIT | $293 | $380 | $182 | $156 | $134 |

EBIT% | 28.04% | 31.59% | 20.45% | 18.99% | 18.31% |

Although revenue is declining, the EBIT% is healthy.

Peers

Peers that are active in the seismic services are PGS (PGSVY) from Norway, Polarcus (PLRUF) from the UK, WesternGeco [which is part of US/French Schlumberger ] and Fugro from The Netherlands. These companies combined have a market share of about 90% in the seismic services segment according to CGG.

Fugro has sold its Geoscience division to CGG Veritas in 2012/2013 and is no longer a player in the seismic services segment. Since Fugro was not able to become market leader, it divested its activities.

WesternGeco is reported as part of Schlumberger's Reservoir Characterization Group1. In recent financial reporting, it is not clear how much of the revenue is generated by WesternGeco. From previous financial reporting, it can be deduced that it is about 20% of the Reservoir Characterization Group. Revenue and EBIT is deduced using this percentage. WesternGeco-Schlumberger is included for comparison purposes.

Multi-Client Library

Collected seismic data is often collected and stored in a multi-client library, so the data can be sold to multiple clients. Fugro was the first company to do this, but is finishing its multi-client activities in the next few years.

A multi-client library is profitable for the seller of seismic data as it can be sold several times and profitable for the buyer because it is not as expensive as dedicated acquisition. There are also companies such as Norwegian TGS (OTCPK:TGSGY) that don't collect seismic data, but only sell it.

When calculating the Free Cash Flow, the investments in the multi-client databases are also taken as capital expenditures, because they are an integral part of the business and retain value over a number of years.

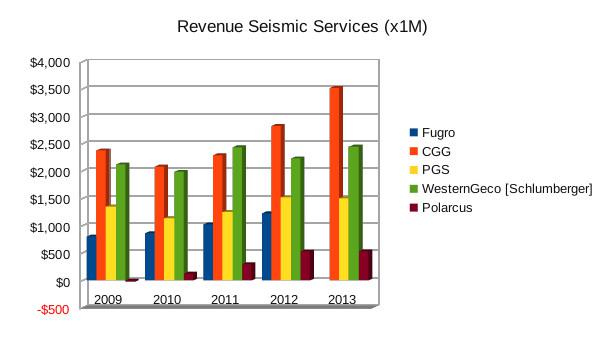

(Source: Confero1 x1M)

| Revenue | Fugro | CGG | PGS | WesternGeco | Polarcus |

| 2009 | $805 | $2,379 | $1,350 | $2,122 | -$25 |

| 2010 | $865 | $2,083 | $1,135 | $1,987 | $123 |

| 2011 | $1,028 | $2,290 | $1,253 | $2,435 | $299 |

| 2012 | $1,227 | $2,828 | $1,518 | $2,232 | $529 |

| 2013 | $0 | $3,522 | $1,502 | $2,449 | $532 |

By acquiring the Geoscience division of Fugro, CGG has become the market leader in seismic services.

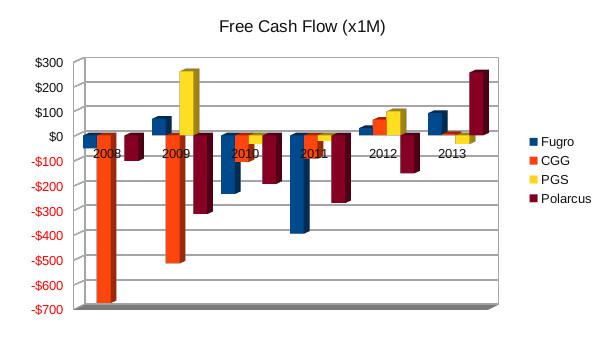

(Source: Confero1 x1M)

FCF | Fugro | CGG | PGS | Polarcus |

2008 | -$53 | -$678 | $0 | -$104 |

2009 | $67 | -$518 | $258 | -$319 |

2010 | -$237 | -$108 | -$36 | -$196 |

2011 | -$398 | -$94 | -$23 | -$274 |

2012 | $29 | $63 | $97 | -$154 |

2013 | $91 | $5 | -$36 | $255 |

The free cash flow shows that seismic services requires a lot of capital for its business.

Only Polarcus has a significant free cash flow because of the sale of one of its vessels.

Fugro has a positive cash flow (on Geoscience) because of the sale to CGG.

Investing

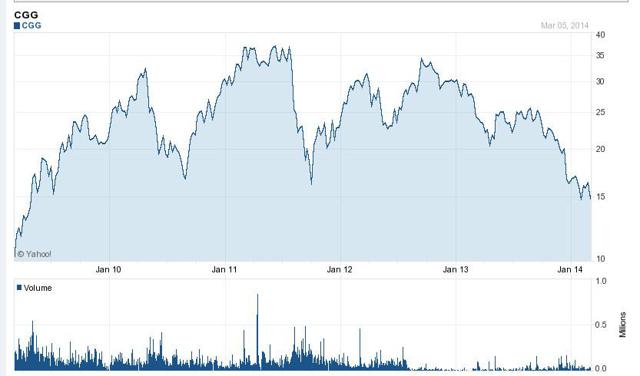

Although CGG has become the largest seismic service provider in the world, investing in CGG could be a bumpy ride. The stock is volatile as the chart shows:

CGG is not a good buy and hold stock:

- No dividend

- Increasing revenue

- Declining EBIT

- Requires a lot of capital for its business

- A lot of competitors

For CGG, it would probably be better to divest seismic services and focus more on Sercel, the equipment division. Although revenue is declining (for now), the EBIT is healthy.

It is not likely that CGG will do this. Acquiring the Geoscience division from Fugro was a strategic decision. CGG is very good at analyzing acquired data and if CGG is able to enlarge its market share (through organic growth or acquisition), the future could be very bright.

2013 seems to be a restructuring year with a reorganization of the company and depreciation of assets at fair value. CGG will have to prove that its strategy works.

Footnotes

1. All (financial) data used is from reports and other publications published by CGG Veritas. The FY 2013 results can be found here.

When a comparison with peers is done, the data published by these companies is used.

Disclosure: I am long FURGF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.