(Editor's Note: Shares of FUAIY have limited liquidity. The company's main listing is as 6839 on the Tokyo Stock Exchange.)

I like investing in net-nets since they offer value on an absolute basis instead of being undervalued compared to other companies. This famous strategy was first described by Benjamin Graham. Later many researchers confirmed that the statistical returns of net-nets are indeed high. Moreover, this strategy is still just as profitable as in Graham's time.

Unfortunately, net-nets are rare in today's market. That is, net-nets with a sufficiently high margin of safety are rare. What does that mean? Graham recommended that a company's current assets minus all liabilities should be 50% more than the market value of all common and preferred shares. Victor J. Wendl found that a portfolio of stocks with a margin of safety of at least 33% still delivers annualized returns of around 30%. At the moment, only a few US-listed stocks satisfy Wendl's criterion. As far I have seen these net-nets are always Chinese smallcaps with significant fraud risks. Even if you decide to run these fraud risks it is good to be a bit more diversified. So, if you want to invest your portfolio in net-nets then you have to look at stocks listed outside the US as well. The question is then what is the best place to look. That comes down to a search for the least wanted and least covered region in the world that still has reasonable enforcement of ownership and good corporate governance practices.

Japanese net-nets

After reading Steven Towns' book I figured out that Japan could be a good place to look for net-nets. Indeed Japan has good equity and company laws. Unlike less developed countries such as Russia the Japanese society respects and protects individual property. However, it is difficult to invest in Japan. Especially if you live in Europe, since the Tokyo Stock Exchange is only open when I sleep: from 1 AM until 3:30 AM and from 4:30 AM until 7:00 AM. Furthermore, many companies don't publish their financial reports in English. And then Japan has a high currency risk. At the moment, the Bank of Japan is printing yens at an annual rate of about 15% of the Japanese GDP. So the yen might lose some of its value. Of course, many professional investors see the quantitative easing as a bonus for most stocks and will short the yen simultaneously. Most retail investors, however, don't like the yen-risk. They don't like to cover this risk with a short position in the yen either. Most of them don't have a margin account necessary to do this anyway. Furthermore most net-nets are too illiquid for professional investors as well. However, it turns out that many Japanese net-nets are large enough to be investable for professional investors. For example, the company discussed below has a market cap of about $400 million.

Funai Electric

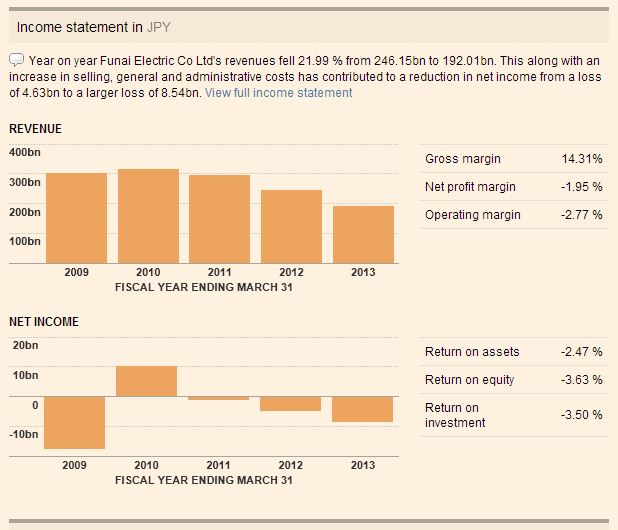

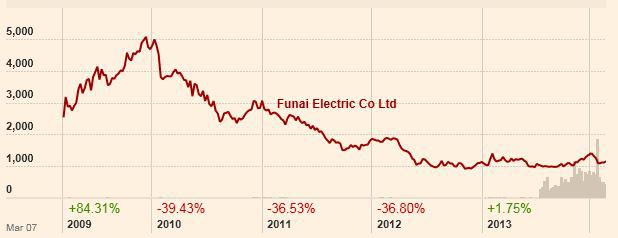

Indeed, I found a number of Japanese net-nets that seemed to be companies with a high margin of safety. Some of them seemed to be of a surprisingly decent quality such as being profitable and paying a dividend. Actually, most Japanese net-nets I found seem to be paying a regular dividend. However, the companies with the highest discounts to NCAV often show many years of losses. See, for example, these diagrams for Funai Electric from markets.ft.com.

Funai Electric is a manufacturer of consumer electronics, such as LCD TVs, DVD recorders and players, blu-ray disc players and printers. The company sells 70% of its products in the US. The founder has still a majority of slightly more than 50% of the shares. In 2008, he retired as the CEO but he is still the chairman of the board. The company produces at various locations, but about 70% of the products are made in China. For a net-net Funai's market cap is huge: about $400 million. This is approximately half of its NCAV. So this stock is a deep value investment, even when comparing it to other net-nets. It is traded on the Tokyo Stock Exchange (6839) and in the US as an ADR (FUAIY). I don't recommend buying the ADR due to the low trading volume in the US.

Since Funai's products don't seem to be very exciting either I can imagine that few investors will consider to buy Funai's shares. The company may suffer from increased competition. Nevertheless, I do invest in companies like this one. I do this on a statistical basis. That means that I invest at most 5% of my portfolio into each net-net. Before I buy I verify the balance sheet of each net-net by looking at the financial reports. I don't judge the quality of the business since I know that I am extremely good at avoiding distressed winners. In the example of Funai Electric the huge discount to NCAV might compensate me for the perceived low quality of this business. In addition the valuation based on the NCAV neglects the value of the non-current assets, which usually provides an even bigger margin of safety. In this case the book value of the tangible non-current assets is another 75% of the market cap. The dividend may also provide a bottom for the stock price. This dividend seems to be paid once a year. This year, Funai will pay ¥35 per share, which corresponds to a yield of about 3%. The ex-dividend date is March 27, 2014. I like the ownership structure in combination with the company's consistent dividends.

Recent developments

Fortunately, Funai discloses much in English. It turns out that many changes are being made. Last year the company tried to buy Philips's Lifestyle Entertainment business but the transaction was not completed. See here. This failed transaction has resulted in a one-time loss of ¥1,166 million ($11.3 million). On top of that Philips submitted a request for arbitration with the International Chamber of Commerce. That may result in a huge claim to be paid to Philips although I doubt it. The company did succeed in buying inkjet printer technology and an inkjet printer factory in the Philippines from Lexmark. The company has announced it will start selling new products based on the newly acquired technology during the second quarter of 2014. Funai is spending heavily on R&D as well: about $90 million in fiscal year 2013. After seeing a picture of their walking support device for the elderly I am not impressed with the originality of their R&D. Still, this product might become a big winner in aging Japan.

The company recorded about $11 million one-time costs for a restructuring of its LED business during the first half year of 2013. In November 2013, the company got a new CEO. This CEO was the sales manager from April 2013. He has worked for the company since 1992, something I like. I don't think the new CEO will follow a completely new course though since the majority shareholder and founder is still the chairman.

Outlook

Apart from the one-time losses due to the failed transaction with Philips and the restructuring the company seems to be profitable. Over the last 6 months before December 31, 2013, the earnings per share were ¥51, which is not bad compared to a share price of ¥1,162. Moreover the company has given a quite optimistic outlook. They see higher sales in the US and Europe as a result of the ongoing economic recovery in these regions. In addition they try to expand sales to new geographic regions such as India and Mexico. The acquisition of the Lexmark inkjet printer business will also increase sales. Furthermore, they project the sales in Japan to grow as well due to the effects of Abenomics. These projections are supported by upward trends in revenue and operating profit during the last 2 quarters. Indeed, apart from the discount to NCAV Abenomics is the second reason that the risk-reward ratio of this stock is excellent. The Japanese are printing much more money than the Fed did, so it is almost inevitable that the yen weakens against the dollar and even more so against the euro. That will make Funai more competitive outside Japan.

Therefore, I suppose this company will turnaround in a few quarters. After that the stock price will follow. Moreover, you could consider making this trade a bit more exciting, as I have done. It is easy to simultaneously short the yen when you buy this stock using a margin account. If you do this then you won't suffer from the declining dollar value of your shares when the yen (inevitably) weakens.

Another catalyst for a higher stock price could be a more efficient use of Funai's cash pile. However, I don't think the company will increase the dividend and neither that it will buy back stock, although you never know with a new CEO. I think it is more likely that the company will keep looking for a new acquisition as it has done in 2013. I guess they can easily borrow ¥40 billion against their Account Payable and use another ¥30 billion of excess cash to finance another acquisition. A reasonably successful acquisition for ¥70 billion might increase the profit with ¥5 billion, which is almost ¥150 per share.

Furthermore net-nets with huge discounts to NCAV are more often acquired than other companies. This is for a good reason since the huge discount to NCAV allows an acquirer to liquidate the company for a profit. The founder and majority shareholder will probably block such mergers, but he might try to take the company private himself.

Last but not least, the stock not only fits into Graham's net-net investment strategy but it also satisfies Walter Schloss's main selection criteria:

- The company is trading at a large discount to its assets,

- Management, that is the chairman and founder, has a big stake in Funai,

- The stock is trading at a multi-year low. So it is less likely that current buyers of the stock are too early,

- The company has little debt.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I'm long 6839:TYO (Funai Electric on the Tokyo Stock Exchange).