Wells Fargo (NYSE:WFC) is one of the few big banks that actually receive love from Wall Street. In fact, it is one of the few big banks that is not part of the Wall Street, which makes this a bigger accomplishment for the company. The bank's clear and conservative business plan attracts a lot of investors from all walks of life regardless of the fundamentals.

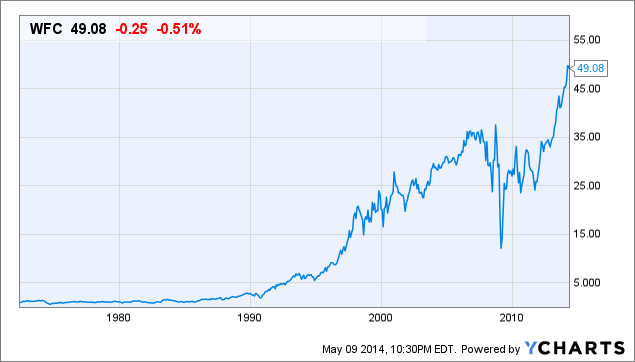

Currently, as the company's share price approaches $50 for the first time in its public history, many investors are excited about the opportunities laying ahead.

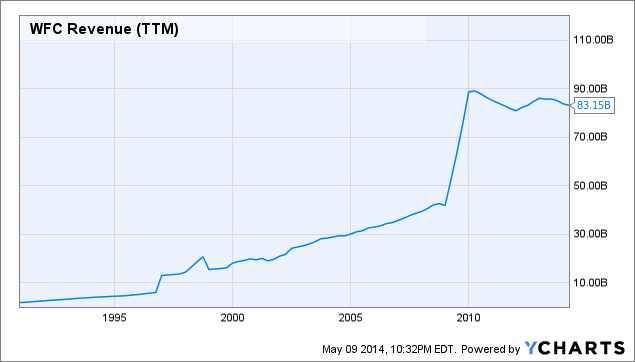

While the revenue growth has been lacking in the last few years, we see a much better picture when we look at the big picture. In the last decade, Wells Fargo was able to grow its revenues from $28 billion to $83 billion, which represents an increase of 197%. The revenue growth hasn't always been consistent; however, it's always been there in the long-term. In the recent years, the drop in total revenues is mostly a result of the Fed's policy of keeping interest rates near zero. This policy effectively reduced Wells Fargo's net interest income; however, the company did a good job of retaining value during this period.

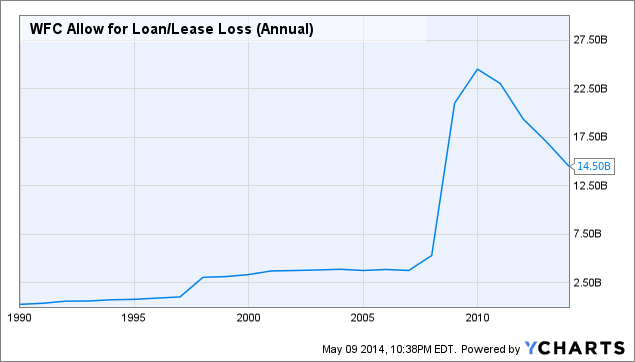

Currently, Wells Fargo enjoys a historically high allowance for loan losses even though this figure has been trending sharply. During the peak of the recession, this metric was as high as $23 billion but now it is approaching pre-recession levels due to more conservative loan issuing practices as well as improving economy. Since Wells Fargo has nearly no exposure to the problematic markets like Greece, Italy and Spain, its risk exposure is lower than other major banks.

Currently, Wells Fargo enjoys a historically high allowance for loan losses even though this figure has been trending sharply. During the peak of the recession, this metric was as high as $23 billion but now it is approaching pre-recession levels due to more conservative loan issuing practices as well as improving economy. Since Wells Fargo has nearly no exposure to the problematic markets like Greece, Italy and Spain, its risk exposure is lower than other major banks.

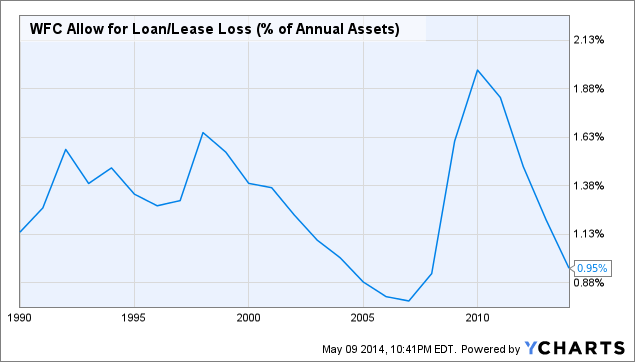

In fact, the chart above doesn't show us the full picture because as a company's assets grow, its allowances for loss will also grow in a similar fashion. A better apples-to-apples comparison would be the chart presented below. The chart below shows us Wells Fargo's allowances for loan losses as a percentage of its assets. Notice that the number now looks really small and much lower than the historical standards. In other words, when we account the growth in Wells Fargo's assets, the company's provisions for loan losses look really tiny compared to almost any other time in its public history.

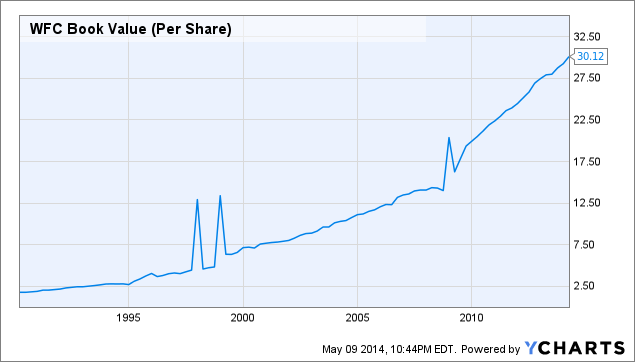

Speaking of assets, one of the most important metrics for a bank is its book value. In the chart below, we are looking at Wells Fargo's book value in the last 25 years. Notice how the figure keeps climbing up almost consistently with the exception of a few speed bumps here and there. Currently, Wells Fargo's book value is $30.12 per share, which is below the company's share price of $49 but this is not a big deal since Wells Fargo is highly profitable.

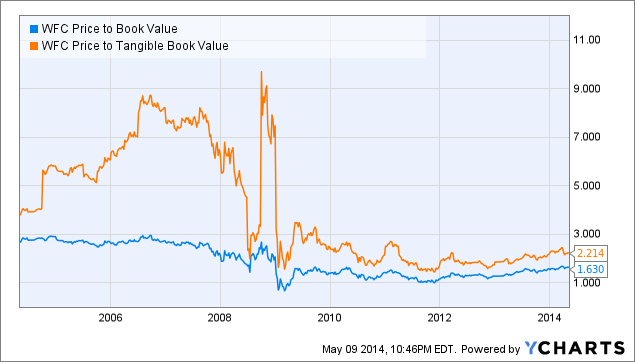

Next, we are looking at how the market has always valued Wells Fargo in comparison to its book value and its tangible book value. Tangible book values tend to be more volatile than book values, and we can see this in the chart below. Historically and on average, the investors have been comfortable with trading Wells Fargo at 2 times its book value and 3 times its tangible book value, whereas, the bank currently trades for 1.6 times its book value and 2.2 times its tangible book value, which tells us that Wells Fargo is historically cheap.

When we look at the company's price in comparison to its earnings, we notice that Wells Fargo is trading at 12.2 times its past earnings, which is lower than the historical average which ranged from 14 to 17 for the most part of its public history.

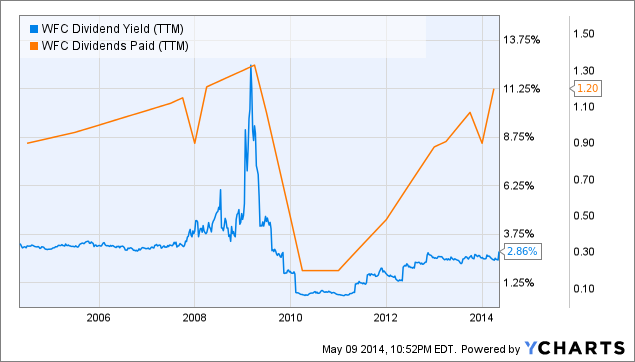

Since the Great Recession, Wells Fargo has been working hard on restoring its dividends to values it had before the recession. Many big banks (for example Bank of America and Citibank) are currently held up by the Fed, hoping to gain permission to raise their dividends; however, Wells Fargo is free to raise its dividends however it pleases, which speaks volumes to the company's risk-management. This is just one more reason this bank receives so much love from the Wall Street. Currently, the dividend yield might not be much to write home about, but we can blame the rising share price for that and I am not sure if any of the bank's investors would complain about that for a moment. Having a relatively low yield (compared to 3-4% zone) due to strong stock price performance might be a good problem to have.

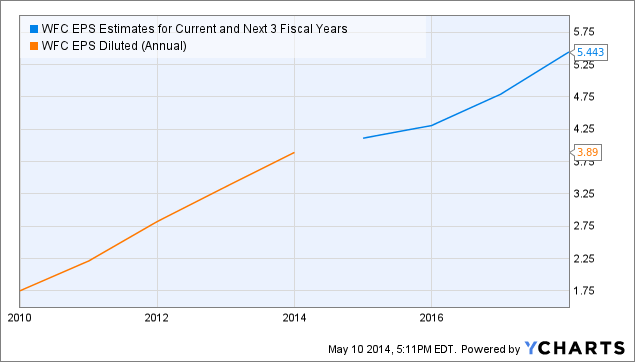

Despite not having much international exposure, Wells Fargo has a highly diversified business with multiple products and services. The company has shown its resiliency by posting earnings-per-share growth for 17 quarters in a row despite being in a low-interest environment which can be very challenging for companies that earn a lot of interest income. The analysts expect Wells Fargo to continue outperforming the market and grow its earnings to $5.44 per share within 3 years. This would mean that we are looking at a solid bank with solid growth potential with a forward P/E of 8-9.

Wells Fargo might be one of the best investment opportunities in the market today due to its proven track record, low valuation and strong future potential (not to mention the dividends).

Disclosure: I am long WFC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.