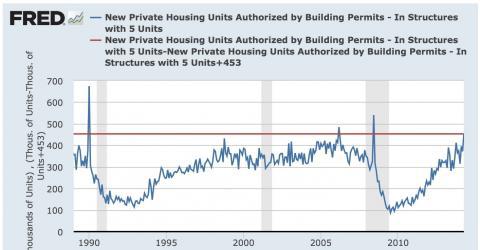

If the construction of single family homes has completely stalled for the last 16 months, apartment and other multifamily construction is on a tear. Here's the same graph comparing single family permits with multi-unit permits that I started yesterday's post with, showing that literally all of the improvement in homebuilding since then has been in multi-family units of five or more, typically apartments and condominiums:

In contrast to single family homes, apartment/condo building has completely recovered to its pre-Great Recession level:

In fact, as this above graph shows, more multifamily permits were taken out in April than at any point in the last 25 years except for three months. That is where the entirety of the continuing housing recovery is coming from.

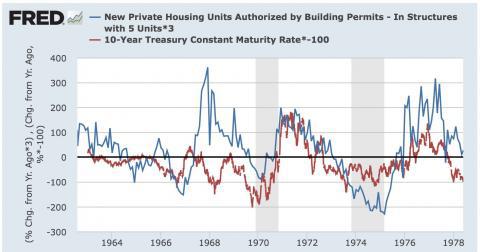

So let's look at the past relationship between interest rates and multi-unit dwelling construction. Here are four graphs, in chronological order, spanning the last 50 years, comparing interest rates (red, inverted) and multi-unit building permits. First, here's 1960s through late 1970s:

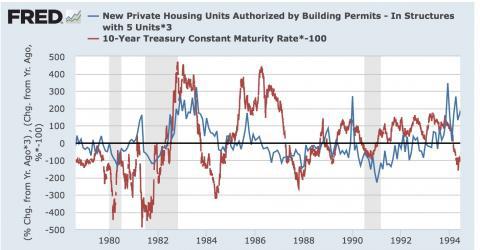

Here's the 1980s through mid-1990s:

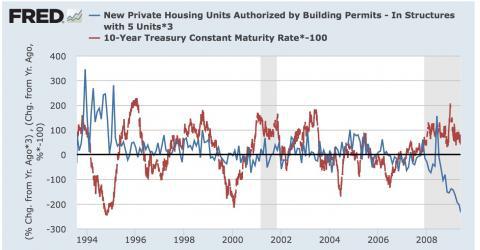

Here's the mid-1990s until the Great Recession:

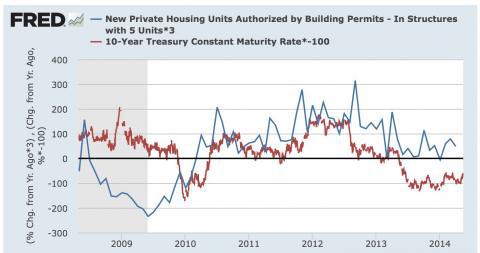

and here's the last five years:

While in general an increase in interest rates seems to correlate roughly with a deceleration if not decline in multi-unit residential construction, the relationship is not nearly so strong as that between interest rates and single family home construction. At least in part that is because apartments and condos are frequently a substituted good. In times of economic stress, such as with the high interest rates of the late 1970's and early 1980s, or when wages are squeezed. Like the present, apartments and condos serve as less expensive alternatives to the traditional single family home.

The relative high expense of single family homes has led to a big increase in rents and a big decline in apartment vacancies. The Census Bureau reported that in the first quarter only 8.3% of apartments were vacant, only 0.1% higher than their multi-decade low in the 4th quarter of 2013.

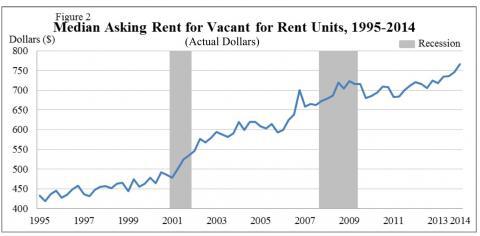

Further, nominal median asking rents are up nearly 6% YoY, as shown in this graph also from the Census Bureau release:

The above graph is not normed to wage or price inflation. Comparing the median asking rent with the median usual weekly wage shows us that in 1988, median rent was 86% of median wages. After rising to 92% in 1992, by 1996 that had fallen to 84%. It then rose again to 99% in 2004-05, its all time high. After falling back to 94%, it is back up at 96% in the first quarter of this year.

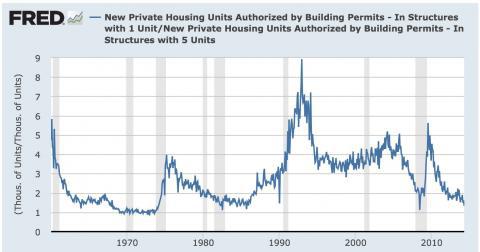

With tight supply and the ability to charge relatively high rents, it is no surprise that there is a boom in apartment construction. Here's a graph which divides single family permits by multi-unit permits, to show the ratio of building between the two, going back 50 years:

Roughly 1.5 multi-unit dwellings are being built for every single family home, close to the 50-year minimum for the ratio, which only equals or exceeds the mid-1960s to mid-1980s.

Still, when I first examined the relationship between interest rates and housing, I noted that 16 out of 21 times since the end of World War II, when interest rates went up by 1%, housing permits as a whole, including permits for multifamily units, declined by -100,000 within the next year. Three of the four exceptions were in the 1960s and 1970s - similar to the time frame in which lots of apartment and condo building was occurring.

Something else was going on then that might also shed light on the current housing situation.

Originally published on xe.com by New Deal Democrat.