(Editor's Note: Investors should be mindful fo the risks of transacting in illiquid securities such as CRCTF. Crocotta's listing in Toronto, CTA.TO, offers stronger liquidity.)

Crocotta Energy (OTCPK:CRCTF) is splitting up into two pieces - the Edson, Alberta Cardium and Bluesky properties which provide the bulk of production and cash flow are being bought by yield-oriented Long Run Exploration (OTCPK:WFREF) (LRE.TO).

Crocotta's Montney natural gas play at Dawson Creek, British Columbia will be spun off into a new company (ExploreCo is the temporary name) after doing a $45 million public offering. Current management will focus on the Montney growth play and is putting $13 million into the "stub" for shares at $1.70 and free five year warrants.

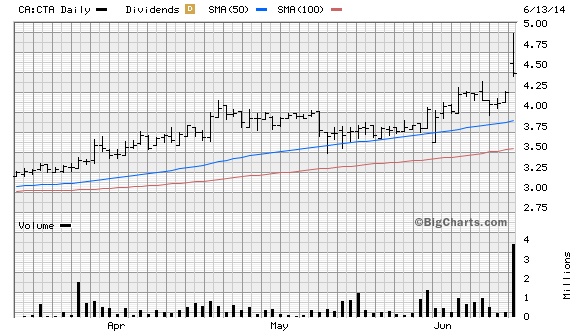

We wrote about the merits of Crocotta Energy in a Pro article on May 9 at $3.70 (All dollars Canadian). The stock plunged to $3.55 in a peculiar opening in early June and at that point I felt something was afoot at the company.

The stock was up 32% over our recommendation price to $4.88 at the opening. We were sellers in the $4.50-4.65 area due to the following analysis and the fact over half of the no-cash compensation is in shares of Long Run and the rest is a "Stubco" selling 52% more of its shares being marketed by a host of Canadian underwriters.

The stock early Friday afternoon was trading on the Toronto Stock Exchange in the $4.40 area on over 4 million volume.

This deal is very similar to Crew Energy's (OTCPK:CWEGF) sale of its Deep Basin Alberta assets to Long Run and purchase of more Montney acreage. That deal caused Crew to spike from $10 to almost $12 and we recommended selling that one. Crew subsequently dropped back to below $10.

I think the current arrangement could be a good deal for Long Run shareholders but the incremental cash flow on the acquisition is highly dependent on current netbacks and requires synergies to be achieved with the aforementioned Crew Energy assets.

Long Run will issue 44 million more shares (105.66 million fully diluted CTA shares x 0.415 LRE per share) and assume $115 million of Crocotta's estimated $130 million in bank debt.

According to Long Run, the deal values Edson at $10.03/boe of 32.6 million of 2P reserves and $43,600/boed of current estimated 7,500 boed production (30% liquids, 70% natural gas).

The Edson assets require annual $50-55 million in CAPEX to keep sustaining cash flow which is estimated at $82 million annualizing current production and $30/bbl operating netback (Q1 netback corporate wide for Crocotta was $39.74).

Annualized cash flow of Edson net of CAPEX is therefore $27-32 million.

Edson has a high 33% decline rate and that is one reason I believe Crocotta management wanted to realize its value and move into the Montney growth play exclusively. The Montney properties have 2,300 boe/d production but management will spend an estimated $90 million in 2015 to drill eight wells and increase that to 5,000/boed by the end of 2015.

The valuation of Crocotta now revolves around the value of the ExploreCo stub. The press release does not indicate the resource that the stub will have but in a previous presentation Crocotta said they held 35 sections each holding an estimated 60 bcf of gas equivalent, for a total of about 2 tcfe. Crocotta was active in Q1 buying $15 million in land and now has over 60 sections at Dawson-Sunrise, so the land costs about $1,000 per acre. Dawson also has a gas processing plant which is being expanded to handle the sour gas the area is producing, and ExploreCo will finish increasing the total capacity of the plant to 60 mmcf/day.

I believe the ExploreCo stub, once public, could become an easy piece of takeover bait for a larger adjacent player, of which there are several. In the short term however, there is the question of how high a premium investors should pay over the $1.70 offering price.

The projected 2015 42 cent annual dividend requirement on the newly issued LRE shares will total $18.5 million and at 6% p.a. interest on the assumed debt would be about $7 million. Net the deal finance costs, the acquisition is only accretive to remaining LRE shareholders to the tune of $2-$7 million, not including synergies with nearby assets bought from Crew.

Technically the deal valued Crocotta at $4.06 in LRE stock (0.415 shares at Friday's $5.69 opening price) including the $1.70 notional value for ExploreCo.

Under the "Arrangement" as the deal is coined, Crocotta shareholders would also get one fifth of a warrant to buy ExploreCo at $1.70 for a month after the deal closes, so the promoters of the deal hope they get exercised to generate another (21.1 million x $1.70) $35.9 million in cash.

Crocotta went to an immediate 20% premium based on speculation that the ExploreCo deal would be sold out and and the purchase warrants would be exercised.

I don't ascribe much value to this warrant, as it is effectively a rights issue for shareholders to buy more shares and I don't think there is an appetite for that due to the upsized offering (see below).

The many brokerages led by National Bank Financial on the deal are underwriting an offering of $45 million bought deal of ExploreCo @$1.70, which was "upsized" from $30 million yesterday evening.

Given the number of underwriters in the syndicate (I count 14), the deal will probably be sold rather easily given its small size.

Management is putting $13 million into ExploreCo "Units" at $1.70 per unit which will include one share but also one five year warrant at $2.04. The 7.65 million purchase warrants are therefore free to management and priced at only 20% over the share deal price giving away plenty of the upside after vesting in three years. I am not sure there is a particular reason for rewarding management with another "freebie" just because the energy market is "hot" right now.

After paying off $15 million in assumed Crocotta debt and raising the maximum above of $94 million, I estimate total cash on the balance sheet in ExploreCo would be about $79 million. Before the financings are executed, Crocotta says the Net Asset Value of ExploreCo shares would have been $144.6 million or $1.37 per share with 105.6 million outstanding.

I calculate that net of 32.6 million boe 2P reserves in Edson (assumed gross) being sold to Long Run, ExploreCo should have the 13.65 million boe left, but this number is not in the press release, begging the question why isn't the resource in ExploreCo identified?

If the share issuances are done and the public warrants are exercised, I calculate there would be 161 million shares outstanding and NAV will be somewhere between $1.37 and $1.70. Adding the potential exercise of 7.65 management purchase warrants gives us dilution of 60% over the 105.6 million one-for-one ExploreCo shares Crocotta investors will be receiving if the deal is approved.

Typically small-cap energy shares trade at a discount to NAV but already the market has decided the success of the company is in the bag and they should trade at a premium. Effectively, this is a new company being floated, and its success depends on continuing hot investor appetite for more pure Montney natural gas and liquids exposure.

In the short term, I thought Crocotta was overbought on Friday at over $4.50 per share. Long Run recently did a $67.7 million share issuance at $5.35 and had 150 million outstanding at the end of May, so this deal will dilute the equity even further by 29%. Much of the ability of the deal to get sold is dependent on the current strong bull market in oil and gas stocks maintaining its momentum. We are currently bullish in the space and have been successful picking winners.

The share offering is targeted to close in early to mid-July as subscription receipts in case the deal does not close on time in mid-August (i.e. you'd get your money back). The deal requires 2/3 shareholder approval but 31% already is committed from a major shareholder and current management.

Crocotta must pay a $10.5 million break fee to Long Run if the deal unravels for whatever reason.

We took profits on Crocotta this morning and will reevaluate the deal once the dust settles on the new issue of stock. It is possible the deal will be oversubscribed and the purchase warrants exercised. But at the premium for ExploreCo already implied in the Crocotta share price ($2.32 or 36.5% at $5.50 LRE) we felt there was time to wait and see.

Disclosure: The author is long CWEGF. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.