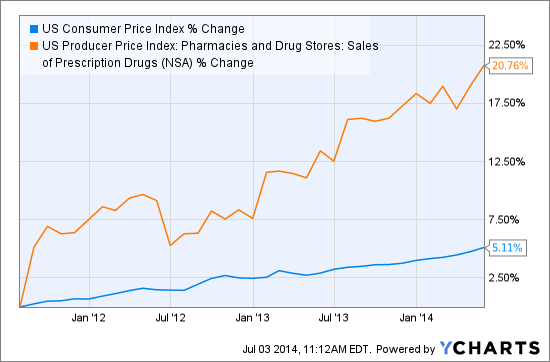

Express Scripts (ESRX), the largest pharmacy benefit manager, is a rare opportunity at this market juncture. It has a rock-solid demographic tailwind -- aging Baby Boomers -- in addition to an expected pick-up in prescription demand as more Americans gain coverage through the roll out of the ACA.

US Consumer Price Index data by YCharts

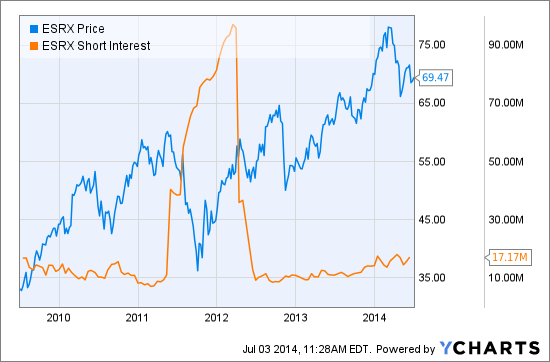

Yet some short-term operational issues have kept a lid on price appreciation of late.

ESRX data by YCharts

And the shorts have been circling a bit, as short interest is 50% higher year over year. Still, that's a lot lower than past bouts:

ESRX data by YCharts

For the patient investor, the current clouds sure look like opportunity. In a market where finding great companies selling at even a fair price is ever harder, Express Scripts trades at more than a 20% discount to its estimated fair value, according to Morningstar (MORN). The 150 or so other companies Morningstar bestows a "wide moat" rating currently trade at a 3% premium to fair value. (Full disclosure: Morningstar is an investor in YCharts.)

In the latest reconstitution of the Market Vectors Wide Moat ETF (MOAT) only Western Union (WU) and eBay (EBAY) had wider discounts to fair value. And it's a whole lot harder to argue they enjoy any sort of embedded demand tailwind akin to Express Scripts' positioning as the drug dispenser to Baby Boomers just beginning to enter the years where medication and interventions are highest.

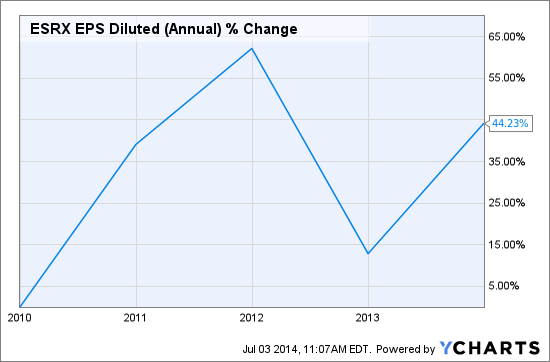

The short-term problem is that Express Scripts' integration of its mega $29 billion acquisition of Medco in 2012 has been slower than anticipated. In its first quarter release, CEO George Paz conceded it's going to take the rest of this year to get all the back office technology aligned. The company lowered its full year EPS guidance from $5.00 at the high end, to $4.94.

Still, that just means slightly less robust growth, not some sort of huge retrenchment.

ESRX EPS Diluted (Annual) data by YCharts

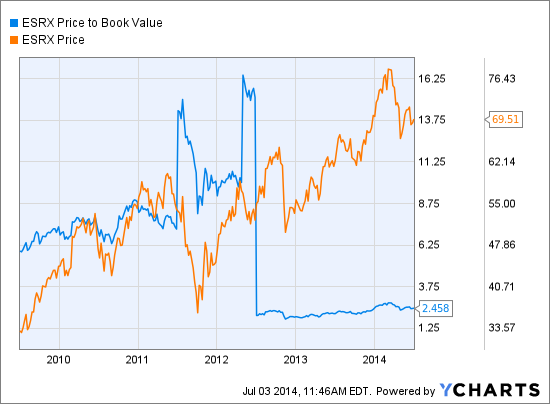

While the stock price has doubled over the past five years, price-to-book value remains attractive, as the value gain from the Medco acquisition hasn't been bid up.

ESRX Price to Book Value data by YCharts

While you typically need to venture into off-cycle cyclicals to find sub 15 forward PE ratios these days -- Chevron (CVX) and Exxon Mobil (XOM) for example - Express Scripts currently trades at 14 times its estimated 2014 earnings after the pay-me-now crowd got annoyed with the downward growth revision for the remainder of 2014. If you're a bit more patient, that might be cause for further investment research.

Carla Fried, a senior contributing editor at ycharts.com, has covered investing for more than 25 years. Her work appears in The New York Times, Bloomberg.com and Money Magazine.

Disclosure: None