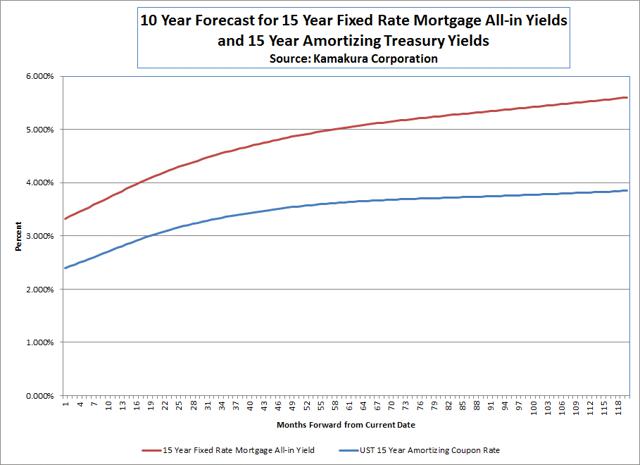

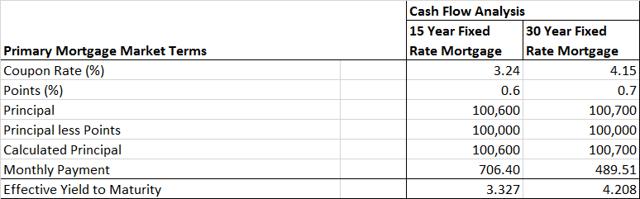

Kamakura Corporation projections for U.S. Treasuries and fixed rate mortgages this week show that the implied forward yields for 15 year fixed rate mortgages rise from a current effective yield of 3.327% (up 0.035% from last week) to 5.602% in 10 years, up 0.064% from last week. This rise came about despite the sharp fall in U.S. Treasury forward rates. The all-in yield on 30 year fixed rate mortgages rose 0.047% from last week. Up-front points rose on both 15 and 30 year fixed rate mortgages this week, contributing to the rise in all-in costs. The value of net servicing for both 15 and 30 year fixed rate mortgages fell relative to last week, dropping 0.04% and 0.14% respectively. Mortgages tend to react with an erratic lag to changes in Treasury market conditions. Here are the highlights of this week's implied forecast:

- The current all-in yield on a 30 year fixed rate mortgage is 4.208%, a change of 0.047% versus last week.

- The current all-in yield on a 15 year fixed rate mortgage is 3.327%, a change of 0.034% versus last week.

- The forward 15 year fixed rate mortgage rate is projected to reach 3.799% in 1 year and 5.602% in 10 years.

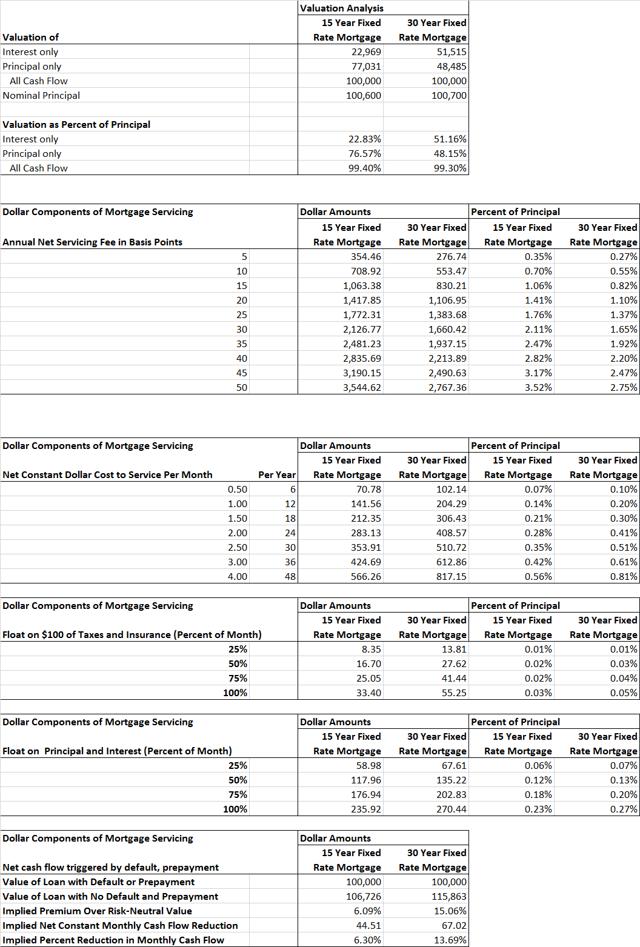

- The interest only portion of the value of a 30 year fixed rate mortgage this week was 51.16%.

- This represents an increase of 0.23% for the week.

- The interest only portion of the value of a 15 year fixed rate mortgage this week was 22.83%.

- This is an increase of 0.11% for the week.

- The risk-neutral value of each 0.05% of net servicing on a $100,000 30 year fixed rate mortgage this week was $276.74.

- For the 30 year fixed rate mortgage, this represents a decrease of $-0.40 or -0.14% for the week.

- The risk-neutral value of each 0.05% of net servicing on a $100,000 15 year fixed rate mortgage this week was $354.46.

- For the 15 year fixed rate mortgage, this is a decrease of $-0.13 or -0.04% for the week.

Other mortgage servicing metrics are given in detail below.

Note: Forward Rate Calculations are Not a Forecast

Many readers who are not familiar with forward rate calculations assume they are a forecast of interest rates with no more credibility than any other forecast. This is an error of understanding that we seek to clarify here. A forecast is a product of judgment, sometimes combined with analytics. Forward rates, which we often label an "implied forecast," involve no judgment. Forward rates are the mechanical calculation of break-even yields such that investing in any maturity U.S. Treasury and rolling it over for 30 years will yield the same amount of cash in 30 years as investing in any other maturity. For example, if one is given the 4 week U.S. Treasury bill yield and the 13 week Treasury bill yield today, one can calculate how much the 9 week Treasury bill must yield in 4 weeks for a strategy of buying the 3 month Treasury bill or the one month Treasury bill, followed by reinvestment in a 9 week bill, to yield the same amount of cash in 13 weeks. This calculation involves no more judgment than the calculation of the yield to maturity on a bond. In the mortgage context, forward rates can be calculated in order to understand the break-even interest rate that makes borrowing via two 15 year fixed rate mortgages equal in net present value to borrowing via one 30 year fixed rate mortgage.

How does one use forward rates to forecast interest rates or to simulate them forward for asset and liability management or other risk management purposes? A series of authors beginning with Ho and Lee in 1985 and then followed by Heath, Jarrow, and Morton in a number of papers beginning in the late 1980s answered this question. The future path of interest rates must bear a specific link to forward rates that depends on the number of random factors driving interest rate movements and the nature of the volatility of those factors. In general, researchers agree that forward rates are biased higher than the average actual rates that will come about because long-term investors earn a risk premium for their long-term commitment of funds. The "expectations hypothesis" taught in economics for at least the last five decades postulated that, contrary to recent findings, forward rates were on average an unbiased forecast of interest rates. This is now understood to be incorrect.

The empirical relationship between forward rates and actual rates, using actual historical data from multiple countries, is a subject we will return to in the near future.

The Analysis

The implied forecast allows investors to assess likely total returns and related risk over the next 120 months for these important classes of common stock:

Financial institutions who are heavy originators or owners of mortgages and mortgage-backed securities:

- Wells Fargo & Co. (WFC) and Eastdil Secured

- JPMorgan Chase & Company (JPM)

- Bank of America Merrill Lynch (BAC)

- KeyBank (KEY)

- PNC Real Estate (PNC)

- CBRE Capital Markets (CBG)

- Prudential Mortgage Capital Company (PRU)

Financial services companies with large portfolios of mortgage servicing rights:

- Bank of America

- BB&T (BBT)

- Citigroup (C)

- Green Tree Servicing LLC (WAC)

- JPMorgan Chase & Company

- Nationstar Mortgage Holdings (NSM)

- Ocwen (OCN)

- PHH Corporation (PHH)

- PNC Financial Services Group

- ResCap (privately held)

- SunTrust (STI)

- US Bank (USB)

- Walter Investment

- Wells Fargo & Co.

Mortgage Real Estate Investment Trusts (mREITs):

Data Used in the Analysis

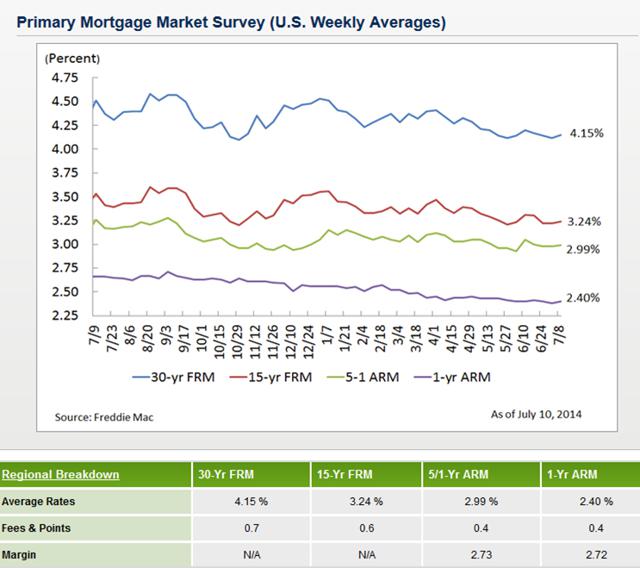

Today's forecast for U.S. Treasury yields is based on the July 10, 2014 constant maturity Treasury yields that were reported by the Department of the Treasury on the same day. The forecast for primary mortgage market yields and the resulting mortgage servicing rights valuations are derived in part from the Federal Home Loan Mortgage Corporation Primary Mortgage Market Survey ® made available on July 10, 2014.

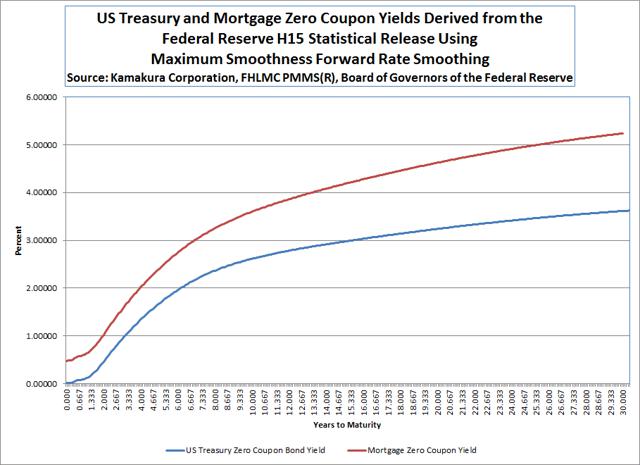

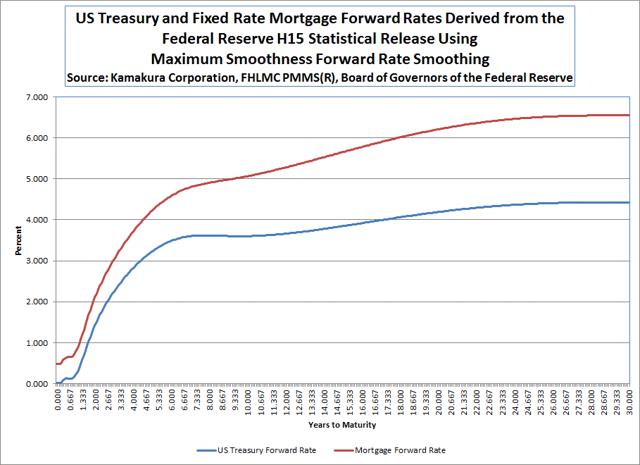

The U.S. Treasury "forecast" is the implied forward coupon bearing U.S. Treasury yields derived using the maximum smoothness forward rate smoothing approach developed by Adams and van Deventer (Journal of Fixed Income, 1994) and corrected in van Deventer and Imai, Financial Risk Analytics (1996). Kamakura Corporation recently announced new research by Managing Director Robert Jarrow which confirms that the maximum smoothness forward rate approach is consistent with the no arbitrage conditions on interest rate movements derived by Heath, Jarrow and Morton [1992]. There are other yield curve smoothing methods in common use which violate the no arbitrage restrictions. Among the methods which cannot meet the "no arbitrage" standard are the Svensson, Nelson-Siegel, and Merrill Lynch exponential smoothing approaches.

The primary mortgage yield forecast applies the maximum smoothness approach to primary mortgage market credit spreads, which embed the market-implied risk neutral probabilities of mortgage default and prepayment risk. References explaining this approach are given below.

Mortgage Valuation Yield Curve and Mortgage Yield Forecast

The zero coupon yield curve appropriate for valuing mortgages in the primary mortgage market is derived from new issue effective yields reported by the Federal Home Loan Mortgage Corporation in its Primary Mortgage Market Survey ®. The maximum smoothness credit spread is produced so that this spread, in combination with the U.S. Treasury curve derived in the link above, correctly values new 15 year and 30 year fixed rate mortgages at their initial principal value less the value of points. The next graph compares the implied 15 year fixed rate mortgage yield with the implied 15 year U.S. Treasury fixed rate amortizing yield over the next ten years.

Mortgage Analysis for This Week

Today's forecast for the mortgage valuation yield curve is based on the following data from the Federal Home Loan Mortgage Corporation Primary Mortgage Market Survey ®:

Only fixed rate mortgage data is used in this analysis for reasons explained in a recent Kamakura mortgage valuation blog.

Applying the maximum smoothness forward rate smoothing approach to the forward credit spreads between the mortgage valuation yield curve and the U.S. Treasury curve results in the following zero coupon bond yields for the primary mortgage market, relative to U.S. Treasuries:

The forward rates for the mortgage valuation yield curve and U.S. Treasury curve are shown here:

Implied Valuation of Mortgage Servicing Rights

Using the insights of Kamakura Managing Director of Research Prof. Robert Jarrow noted below, we have derived the risk-neutral values of mortgage cash flows, which are based on market implied default risk and prepayment risk. We use these zero coupon bond prices to value mortgage-related cash flows relevant to mortgage servicing rights. These zero coupon bond prices, when multiplied by current primary mortgage market terms, value new mortgages at their principal value less the value of points:

We apply the same mortgage valuation yield curve zero coupon bond prices to various aspects of mortgage servicing cash flows to arrive at the risk-neutral present value of these cash flows:

- The risk-neutral valuation split between interest-only and principal-only cash flows.

- The levels of net servicing fees.

- The net cost to service, assuming costs are a constant dollar amount.

- The float per $100 of taxes and insurance on the underlying home. We assume that float is invested at the matched maturity U.S. Treasury forward rate for the matching float period below. The risk-neutral present value of the interest earned is calculated using the mortgage valuation yield curve, since an event of default or prepayment on the underlying mortgage ends this source of value. Value for a constant $100 amount is given below for "float periods" ranging from 1/4 of a month to a full month.

- The value of float on the payment of interest and principal for various lengths of the "float period."

- The net impact of cash flows to the servicer from the events of default and prepayment. We can analyze this by asking this question: what would be the value of the mortgage if there were no events of default or prepayment? The answer is obtained by applying U.S Treasury zero coupon bond rates to the scheduled mortgage cash flows. The final table shows the net reduction in certain monthly cash flow that would be necessary for the value of the mortgage to adjust downward from this "no default/no prepayment value" to its current market value, discounted by the U.S. Treasury zero coupon bond prices. This adjusted basis converts the random probability of losses from prepayment and default to a known, certain cost of prepayment and default in the form of this "implied net constant monthly cash flow reduction." The division of this negative cash flow impact between the servicer and other parties depends on the terms of the servicing contract.

The results of the analysis are shown in the following series of tables:

A 50 Year History of Forward Rates on Video

Younger readers may not be familiar with the dramatic movements in interest rates that have occurred in modern U.S. economic history. Older readers were once familiar with these rate movements, but they may have forgotten them. Kamakura Corporation has provided a video that shows the daily movements in forward rates from 1962 through August 2011. To view the video, follow this link.

Background Information on Input Data and Smoothing

The Federal Reserve H15 statistical release is the source of most of the data used in this analysis. The Kamakura approach to interest rate forecasting, and the maximum smoothness forward rate approach to yield curve smoothing is detailed in Chapter 5 of van Deventer, Imai and Mesler (2013). The smoothing process for the maximum smoothness credit spread, derived from coupon-bearing bond prices, is given in Chapter 17 of van Deventer, Imai and Mesler (2013). The maximum smoothness forward rate technique was recently shown to be consistent with best-practice no arbitrage assumptions of Heath, Jarrow and Morton in an important paper by Prof. Robert A. Jarrow.

The problems with conventional approaches to mortgage servicing rights valuation and Kamakura's approach to mortgage valuation yield curve derivation are also outlined here, along with the reasons for smoothing forward credit spreads instead of the absolute level of forward rates for the marginal bank funding cost curve. The academic paper by Prof. Robert A. Jarrow and Donald R. van Deventer outlining the Kamakura approach to mortgage yield curve derivation was published in The Journal of Fixed Income.

The mortgage valuation yield curve insights depend heavily on Prof. Robert A. Jarrow's paper "Risky Coupon Bonds as a Portfolio of Zero-Coupon Bonds," published in Finance Research Letters in 2004.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.