Annaly Capital Management Inc. (NYSE:NYSE:NLY) is one of the oldest and biggest of the mostly Agency mortgage REITs. Many consider it a blue chip. CYS Investments (NYSE:CYS) is also a primarily Agency mortgage REIT. It reported what can only be described as a great book value gain of +$0.63 per share for Q2 2014 and Core Earnings plus Drop Income (+$53.2 million or +$0.33 per diluted common share) on July 22, 2014 for the quarter ending June 30, 2014. The book value gain was especially impressive at +6.5% of book value for Q2 alone (or 26% annualized). If you add the dividend of $0.32 per common share to that you get a total economic return of $0.95 per common share or +9.81% for Q2 2014 alone (about 39% annualized). Investors won't find many income stocks that will beat CYS' performance.

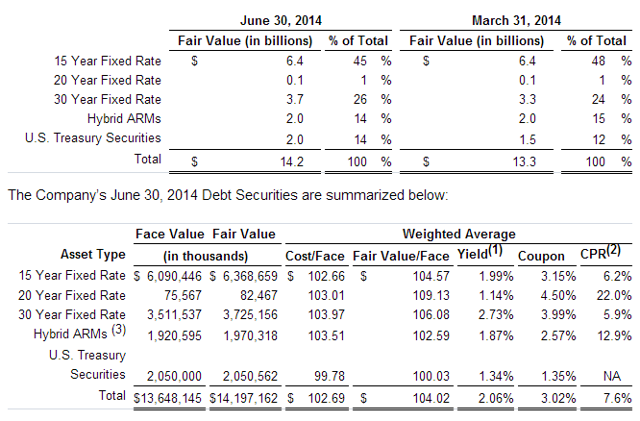

To make a comparison it is helpful to look at the portfolios. The end of Q2 2014 portfolio of CYS is below.

As readers can see, CYS has a large amount of 15 year fixed rate mortgages which amount to 45% of the portfolio's total. I should also point out that it has 14% in US Treasury Securities. These should go up in value as interest rates go down. If you look at the March 31, 2014 portfolio, it is easy to see the book value gains of the MBS, etc.

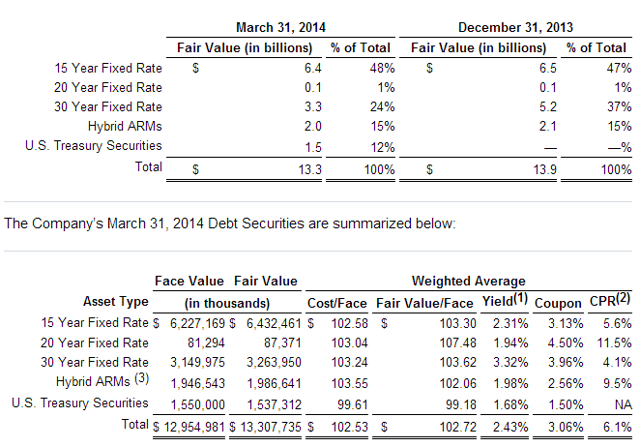

As readers can see virtually all values are up quarter over quarter. It is also worth noting that there has been a small redistribution of the portfolio away from 15 year fixed rate Agency RMBS. The mediation of these gains was the interest rate drop from March 31, 2014 to June 30, 2014. For the 10 year US Treasury Note, the yield dropped from 2.72% to 2.53% (-19 bps). It has dropped another -6 bps between June 30, 2014 and July 21, 2014. Therefore CYS investors are off to a good start for Q3 2014 too.

With the great Q2 2014 results for CYS, the only question is how does the future look for CYS? First CYS covered its dividend of $0.32 per share with its $0.33 per share of Core Earnings plus Drop Income. Investors probably have to be a little worried that Drop Income was $0.12 of the $0.33 total. This income is probably not quite as dependable as the Net Interest Spread Income. On top of that, the net interest spread income is still trending downward with still lower interest rates in Q3 2014. CYS' dividend could be susceptible to a cut in later quarters in FY2014.

For instance the interest rate spread net of hedging was 1.40% as of June 30, 2014. This was down from 1.67% as of March 31, 2014. This is worrisome. Also the Drop operations represent a risk in themselves. For Q2 2014 approximately 17.1% of CYS' investments in securities (about $2.4B) were deployed in TBA transactions. This was up dramatically from the approximately 12.0% (about $1.6B) in Q1 2014.

Still the book value is looking great. The stock closed at $9.00 on July 21, 2014. This is $1.31 below the book value as of June 30, 2014. The stock has to appreciate +14.56% just to get to its book value. This is a lot of possible gain; and it makes CYS a buy, especially with the current flight to quality mentality due to the many serious geopolitical events. At the very least, this discount provides a huge buffer for any book value losses that could occur if interest rates rise in 2H 2014. The CPR (Constant Prepayment Rate) of 7.6%, which is relatively low, is further encouragement for investment. The leverage of 6.35x as of June 30, 2014 is low enough to give investors some sense of security. Don't forget the approximate 14% annual dividend. All told, CYS is a buy.

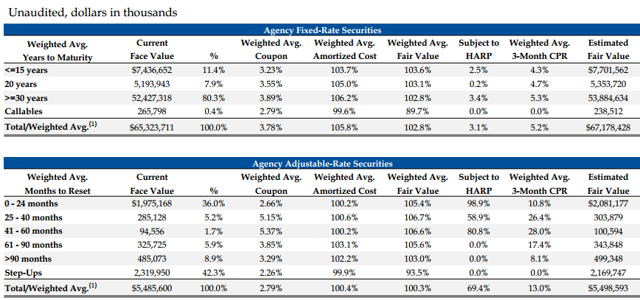

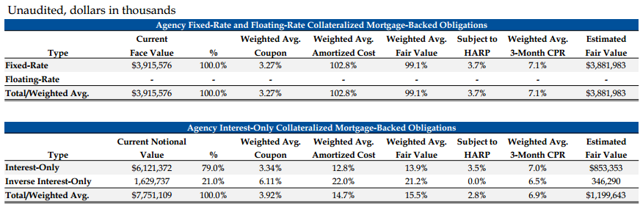

The above bodes well for NLY's Q2 2014 results. To see how comparable they might be, it may help to look at NLY's Agency portfolio as of March 31, 2014 (see below).

As readers can see 80.3% of NLY's fixed rate Agency securities are 30 year fixed rates (or greater). This is substantially different than CYS' approximately 26%. NLY's should appreciate more in a declining interest rate environment; but both the repos and the hedges for these are more expensive relative to those of 15 year fixed rate Agency RMBS. I am not sure how the exact numbers come out; but they could easily not be to NLY's advantage, even though the 30 year fixed rate Agency RMBS appreciated more in value in Q2 2014.

Still the -19 bps drop in the yield of the 10 year US Treasury Note should lead to a book value gain for NLY in Q2 2014. To ballpark the Q2 2014 gain, the Q1 2014 book value gain was +$0.17 (from $12.13 to $12.30 per share as of March 31, 2014). That gain was mediated by a -31 bps drop in the 10 year US Treasury Note yield during Q1 2014. Since the drop was only -19 bps in Q2 2014, one might reasonably expect the book value gain to be less than that in Q1 2014.

In CYS' case, some of the book value gain was due to its US Treasury investments. Some was also due to the lower cost hedging. CYS had $14.2B of fair value in securities as of June 30, 2014. Yet it had only about $10.0B in notional amount of hedges. This amounts to only about 70% hedging.

By comparison NLY had about $60.8B in notional amount of hedges for an Agency RMBS and Debentures portfolio of about $82.5B. This amounts to roughly 73.7% hedging, although the portfolios are not exactly comparable. In other words NLY spent more by having a higher percentage of notional hedging. Plus it spent more by having to hedge a much higher percentage of more expensive 30 year fixed rate Agency RMBS (see portfolio tables above). From NLY's Q1 results, it is hard to believe that NLY will come close to approaching CYS' book value gains on a percentage basis or even on an absolute basis. This may seem bad news; but NLY should still record a good book value gain for Q2 2014.

Further, NLY is continuing to progress in its commercial real estate investments strategy. On May 8, 2014, NLY announced that its subsidiary Annaly Commercial Real Estate Group, Inc. has commenced an initiative to acquire net leased commercial real estate assets across a wide array of markets and industries, including industrial, office, retail, and restaurant properties. Annaly will purchase commercial properties of a certain size and profile sourced and managed exclusively for Annaly by affiliates of the Inland Real Estate Group of Companies ("Inland'). NLY expects to prudently grow its commercial position to roughly 25% of its equity allocation. It is unclear at this time how leveraged this position will become. It currently yields about 9.13% as of March 31, 2014. However, leverage would certainly enhance this yield.

NLY has already stated in its Q1 2014 Conference call that it feels comfortable with the dividend at $0.30 per common share for the quarters ahead. This should ease some investors' minds. The net interest rate spread in Q1 2014 was on 0.90%; and this seems likely to have gone down in Q2 2014 with the -19 bps fall in the 10 year US Treasury Note yield. Perhaps NLY increased the leverage in its portfolio in Q2 2014? Otherwise its Core Earnings in Q1 2014 of $239.7 million (about $0.23 per common share) seem woefully inadequate to sustain a $0.30 per common share dividend, especially if the Core Earnings are likely to fall in Q2 2014 due to the likely still lower net interest rate spread. Investors will have to watch this closely. If leverage (5.2x as of March 31, 2014) increases significantly in Q2 2014, investors will have to decide for themselves if they are comfortable with the new leverage.

However, NLY will likely increase its book value in Q2 2014 by about $0.10 per common share or more. This will give it a book value on June 30, 2014 of about $12.40. The stock price was $11.27 per share as of the market close on July 21, 2014. This means the stock price would have to rise approximately +10% to reach its book value. This should make NLY at least a hold (if not a buy) in the current market.

We are seeing a flight to quality currently due mostly to the worrisome geopolitical events. In such an environment, Agency securities are "more secure" or safer than most other investments. NLY is not as impressive as CYS has been of late, but it is probably still a high hold. Plus its commercial strategy might soon start to look better to investors, especially if NLY uses leverage for it. Investors will have to wait for the Q2 2014 earnings information on August 4, 2014 in order to see this information. It could well be the determining factor investors use to decide whether or not to buy NLY.

The one year charts of CYS and NLY provide some technical direction for these trades.

The one year chart of CYS is below.

The slow stochastic sub chart shows that CYS is neither overbought nor oversold. The main chart shows that it is attempting to form a new uptrend. With the great results CYS put up in Q2 2014, CYS should easily be able to continue to climb toward its new book value of $10.31 per share.

The one year chart of NLY is below.

The slow stochastic sub chart for NLY shows that it is nearer to oversold levels. The main chart shows that it is mostly consolidating sideways. The results from Q2 2014 seem likely to help it move up a little. However, they should not provide a huge impetus. Therefore a very small move up and/or a sideways consolidation seems a likely scenario for NLY. Given that its dividend is only 10.65% annually compared to CYS' 14%+ annual dividend, most investors will probably prefer CYS at this time. CYS is a buy; and NLY is likely a hold, unless I see a marked improvement from the estimates I made above on the actual earnings report on August 4, 2014. NLY's relative underperformance versus CYS is a negative, especially when there is still the significant possibility of interest rate increases (book value losses) in the near future. QE3 is likely coming to an end in October 2014; and the Fed has said it will likely begin to raise its Fed Funds rate about six months after that.

NOTE: Some of the above fundamental fiscal data is from Yahoo Finance.

Good Luck Trading.

Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in CYS over the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.