Goldcorp (NYSE:GG) and Pan American Silver (NASDAQ:NYSE:PAAS) have reentered the Victory Formation system's Top 10 list this past week. Both continue to score as the best performing and uniquely situated fundamental value stories in the precious metals mining sector, just as they have since gold and silver prices rebounded from multi-year lows in December 2013. Goldcorp scored as high as #4 on my overall stock market list in March, and Pan American was ranked as high as #1 in February, before both fell in price between April-June.

You can read my Seeking Alpha article posted in April explaining the growing odds of a gold and silver bottom in 2013-14 here. It is full of tidbits, data points, and logic you cannot find anywhere else. An honest evaluation of gold's underlying long-term worth to investors, measured against 50 years of relative valuations and dollar based trading, is hard to find. Wall Streeters would prefer you NOT read this post, as gold's long-term performance has been much better than explained by the mainstream media the last several decades.

Goldcorp

Goldcorp is likely the best "risk-adjusted" miner choice for investors wanting leveraged precious metals upside for years into the future, without (1) the hassle from expirations of futures and options on the metals directly, (2) oversized investment capital risks created from a poor company balance sheet, high mining costs, declining reserves in the ground, weak managers, or (3) needless production profile risks caused by a lack of diversification in "safer" mining jurisdictions and regular/predictable physical ounce output from a large portfolio of properties. When you size up all the risks investing in a gold/silver mine, outside of the expected fluctuations in actual metals pricing, Goldcorp represents the single best choice today. The company is one of a few miners that pays a dividend, is profitable at current depressed metals quotes, has a strong balance sheet with very little debt, is increasing production at existing mines using internally generated cash flow each year, plus holds assets in the safe mining nations of Canada, Mexico and the U.S.

The truly good news for investors is Goldcorp can be purchased with a minimal premium valuation to other large gold/silver miners, and is now ranked #10 by the Victory Formation system for its combination of intrinsic fundamental value and climbing investor awareness. With many gold and silver miners losing money at $1300 gold and $21 silver during 2014, it is hard to argue the company's long-life reserves (decades of production at present rates), $0.80 in Wall Street analyst estimated EPS for 2014 and current 2.2% dividend yield are overvalued against others in the sector. Today's $28 stock price is about 14x estimated cash flow per share for 2014, which is below its 10-year average of closer to 20x annual cash generation. Other majors are trading under 10x cash flow presently, but it is very hard to find a true "peer" to Goldcorp's overall asset, risk and liability setup. Goldcorp is priced just above book value per share in a similar fashion to the other majors.

The upside for investors will come from rising gold and silver quotes in the future. If conventional wisdom on Wall Street proves incorrect, and precious metals are outlining a long-term bottom in 2013-14, investors in Goldcorp and most other miners will be richly rewarded soon. A coming jump in earnings, dividends and cash flows per share is not discounted in the related precious metals mining equities at all. So if such a scenario occurs, ALL of the value rise of in-ground reserves/resources and expanding annual business income will have to be reflected in advancing stock prices going forward. Moving from a depressed/pessimistic investor evaluation of gold and silver's future to a more realistic one would likely produce a 50% or more increase in Goldcorp's share price, before any gold/silver rise is even contemplated! Tack on climbing interest in precious metals investments to a reappraisal of the assets at higher metals quotes, and you can see the potential for a large stock gain the rest of 2014 into 2015. If you are long-term bullish on gold and silver, Goldcorp remains a real bargain.

Charts courtesy of StockCharts.com

Acquisition Targets

Now is a great time to expand mine and resource asset ownership after a crushing 3-year decline in precious metals pricing. Goldcorp tried and failed to acquire the Canada-focused Osisko Mining (OSKFF) company in early 2014, outbid by a second group of miners. The remaining two strongest candidates that fit Goldcorp's business model of safe nation, large resource deposit, low projected cash mining cost, and reasonable upfront purchase price are clearly, in my mind at least, NovaGold (NYSEMKT:NG) and Allied Nevada Gold (NYSEMKT:ANV).

NovaGold owns 50% of the proposed Donlin mine in Alaska, with Barrick Gold (NYSE:ABX) owning the other half. This world class mine asset with 40-50 million ounces of economically recoverable gold is in the permitting process during 2014. Donlin will likely not produce any gold for another 4-5 years, giving an acquiring company plenty of time to fund its development properly. NovaGold also owns 50% of the Galore Creek development property in British Columbia, with Teck Resources (NYSE:TCK) retaining the other half. Galore Creek is projected to be one of the lowest cash cost copper/gold/silver mines on the planet when the proposed mine is fully operational. A truly aggressive Goldcorp strategy would include buying NovaGold and purchasing the 50% Donlin and/or 50% Galore Creek ownership stakes not held by NovaGold, at the same time.

Note: NovaGold is a favorite leveraged play on gold and silver for the likes of Marc Faber, John Paulson, Eric Sprott and Seth Klarman, just to name a few of the large stake owners. At the end of May 2014, NovaGold held $180 million in cash and short-term assets vs. $110 million in total liabilities, which should provide ample liquidity for the expected permit funding requirements through 2015.

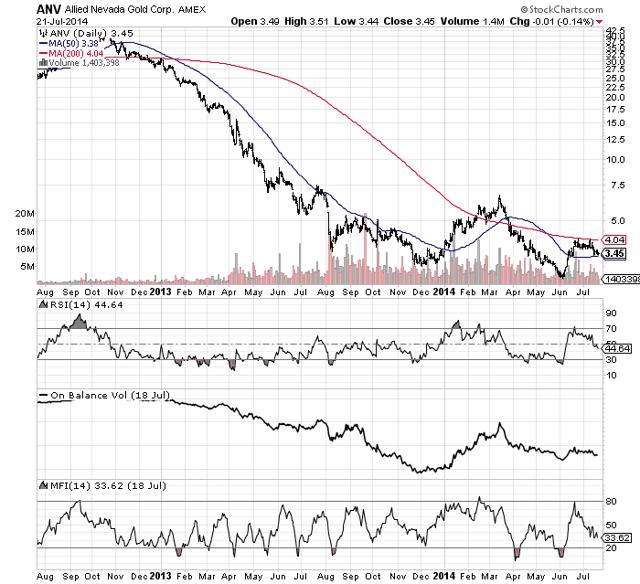

Allied Nevada Gold is a mining company that has been hammered by short sellers for two years straight, with the common share price falling from $40 during 2012 to under $3 in June 2014! Allied holds a monster open pit, heap leach mining reserve of 20 million equivalent ounces of gold (including silver credits) in Nevada, with a total estimated resource approaching 50 million equivalent gold ounces. Already operating a fully permitted and somewhat profitable mine on the same property, sellers have been dumping the stock because of rising debt service loads and overpromises my several management teams. The good news for Allied investors is the company is generating enough cash flow at today's depressed metals pricing to stay afloat and service debt, while it looks for a well-funded partner to extract yet more ounces from the ground in coming years.

All told, the unique undervaluation of Allied will not last long in my opinion if gold/silver prices begin to rise, and opens a great opportunity for a major producer to acquire the company and fully develop the valuable Hycroft mine asset. Goldcorp could purchase Allied for next to nothing, especially if issuing new common shares in an all-stock deal for the Hycroft asset upfront. Goldcorp can easily afford to pay off the $500 million in Allied debt and fund the $1.5 billion in estimated expansion costs the next 2-3 years to turn Hycroft into a hugely profitable operation decades into the future. Allied is one of the cheapest gold miners to own, based purely on reputable third-party discounted net present value calculations of resources in the ground.

Pan American Silver

Pan American is far and away the smartest independent play on silver mining. It is today ranked #9 in the overall Victory Formation sort. While most silver is produced as a byproduct of mining other metals, both precious and industrial, a few companies like Pan American have tried to focus on silver production/ownership as the main source of operating revenue and business worth. Truthfully, the handful of other silver-centered producers I follow have serious long-term issues including weak balance sheets with too much debt, high cash cost mines, or inferior management teams at the corporate level making decision on the behalf of shareholders.

Pan American has one of the strongest balance sheets of any precious metals miner in the world right now, holding $840 million in cash and current assets vs. just $560 million in total liabilities at the end of March 2014. Translation: when you buy the company's stock you are basically acquiring net cash, silver inventories and numerous low cost, long resource life mines in the Americas almost clear and free of liabilities. The stock is trading near its book value per share of $14, is profitable at low-$20 silver prices per ounce with 2014 EPS of $0.25 estimated by Wall Street consensus, pays a robust dividend yield of 3.4% to share owners, and is priced at 13x projected annual cash flow at a $15 stock quote. Just like Goldcorp, the quality of Pan American's assets and management team, combined with its low level of liabilities have translated into a 10-year average price to cash flow reading of 20. However you move the parts in your investment equation, Pan American is well situated and has incredible leverage to rising silver prices.

Beside the need to hedge against excessive fiat money printing and spiraling geopolitical events in 2014, the biggest reason to own silver right now may be the relatively high gold to silver ratio. Given all the problems in the world and the potential loss of faith by foreigner investors in the true worth of each Dollar bill floating around the globe, excellent arguments can be made silver should see increasing rates of investor demand and valuation vs. gold. Poor Man's Gold (silver) historically spikes in value vs. the actual gold price when inflation is high and confidence in the financial markets is low.

From my work, it will not take much of a recession in the U.S. to create chaos in the incredibly intermingled world of banking and finance. I can easily argue we live under an "illusion of prosperity" that could evaporate over the course of a few weeks given the right trigger in the United States, or Europe or Asia or the Middle East. I believe the gold to silver ratio will decline from over 65 ounces of silver for each ounce of gold in June, closer to the 30 number of early 2011. Historically, the ratio has fluctuated between 10 and 100 since leaving the gold standard in the early 1970s, and the mean average has been about 50 during that span. My logic is a world in disarray during the next recession will dictate a 30 or even 20 to 1 number in several years. We could see a $2000+ gold price per ounce and $50, to as high as $100, silver quote per ounce in lightning fast fashion during 2015-17.

Pan American could easily witness after-tax annual earnings ABOVE the present revenue number of $5.50 per share. At $100 silver, using only a small rise in equivalent mining costs, Pan American would be generating $25 in revenues and $10+ in earnings per share each year. The stock price would likely rise 10-fold from $15 a share in coming years! Why not hold a little silver and some Pan American shares, just in case a loss of faith in the U.S. Dollar is right around the corner?

If you believe the U.S. won't have problems servicing the baby-boomers in retirement and through their medical intensive years, mounting federal government debts and pension obligations are not going to be noteworthy, and having most everything we consume/purchase in daily life made in communist China is a great long-term idea, then go ahead and skip precious metals ownership. On the other hand, if you are honestly searching for a hedge against reality, by all means consider silver coins/bullion and Pan American.

Conclusion

Goldcorp and Pan American Silver represent lower-risk gold and silver miner ideas to research on your own. NovaGold and Allied Nevada represent much higher risk and potential return candidates. I own shares in each personally, alongside gold and silver ETFs and bullion, and a handful of other precious metals mining equities.

Are we guaranteed to make money in gold and silver soon? Absolutely not. Gold and silver are taking their time turning higher. We may have to wait another year or two before big gains are made, depending on events in the world, both politically and financially speaking. Still, Goldcorp, Pan American, NovaGold and Allied Nevada are the best situated names, based on my decades of trading precious metals investments, to rise if the precious metals sector turns higher soon. I doubt we will get a clear signal to jump into precious metals, but more of a meandering advance. Looking back at today's pricing a couple of years down the road, fond memories of buying bargain basement gold/silver assets, or "I wish I would've bought some (more)" regrets may be commonplace. I will take my chances owning the greatest stores of wealth and value over the ages of human existence. Not owning precious metals right now seems like the foolish course of action to me.

People thought I was crazy when I held much of my wealth in gold at sub-$300 prices around the year 2000, including bullion and mining equities. 2014's long-term buying opportunity may prove another great entry point like the year 2000 situation of Wall Street's peak in greed and financial asset pricing using an overconfident Federal Reserve alongside a technology boom as its cornerstones. Sounds familiar? Not owning gold and silver today may prove a riskier strategy than owning them, if history is any guide. Remember gold has risen +8% compounded annually since 1969, before we left the gold standard in the early 1970s, against the +4% average cash-like returns from CDs and bank savings and Treasury bills over the same span. If cash is king, what is double the annual cash return called from your gold coins and bullion buried in the back yard?

Disclosure: The author is long ANV, GG, NG, PAAS. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.