Under Armour Inc. (UA) is set to report FQ2 2014 earnings before the market opens on Thursday, July 24th. Under Armour has grown its sales in each quarter over the past two years by a minimum of 23% on a year-over-year basis. Under Armour still has a long way to go to catch its gigantic rival Nike (NKE), but then again Under Armour's sales are growing 2 to 3 times faster as well. Over the past year Under Armour's sales were about equivalent to 9% of Nike's total revenues. And Nike's quarterly sales are expanding by a smaller but still healthy 8% to 10% on average. On Thursday the expectations for Under Armour's sales growth are through the roof. Here's what investors are looking for.

Click here for chart details

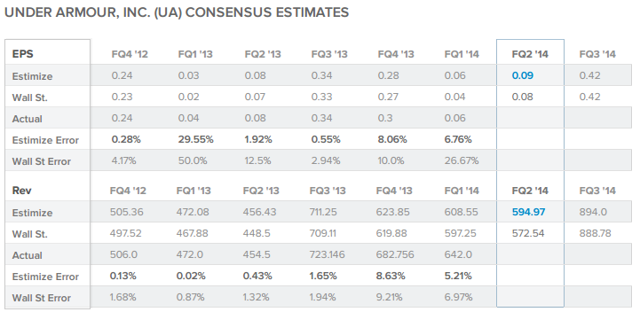

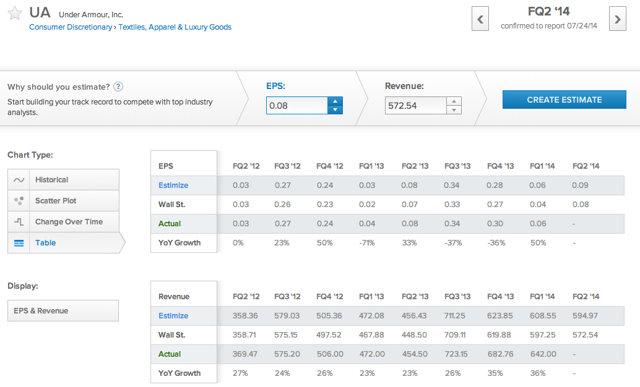

This quarter 27 contributing analysts on Estimize.com have come to a consensus earnings expectation of 9 cents EPS and $594.97M in revenue compared to a consensus of 8 cents EPS and $572.54M from Wall Street. Over the previous six quarters the consensus from Estimize.com has been more accurate than Wall Street in forecasting Under Armour's EPS and revenue every time.

Click here for chart details

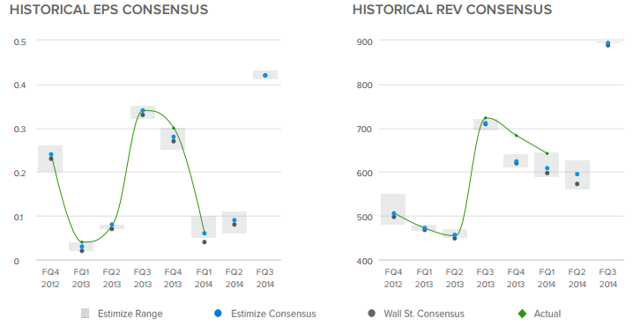

Under Armour historically posts its highest revenue in its 3rd fiscal quarter, then shows declining revenue over the next 9 months. Nothing about that pattern is predicted to break this quarter, but the Estimize community is forecasting that sales will grow by 31% compared to the same period of last quarter. This quarter contributing analysts on Estimize are only slightly ahead of Wall Street in their EPS forecast, but there is a significantly larger differential between revenue expectations.

Click here for chart details

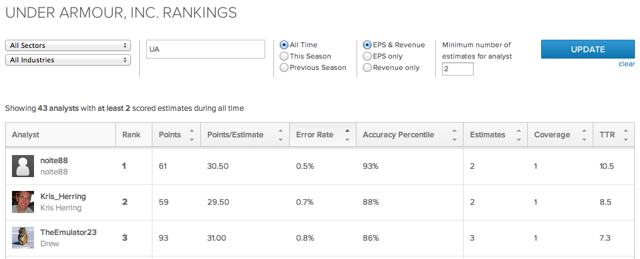

Estimize.com ranks and allows the sorting of analysts by accuracy. The analyst with the lowest error rate on Under Armour is anonymous user nolte88. Over 2 previously scored estimates on Under Armour nolte88 has averaged an impressively low error rate of 0.5% and nolte is ranked 96th overall among over 4,700 contributing analysts.

The Estimize consensus was more accurate than the Wall Street consensus 65% of the time last quarter on the coverage of nearly 1000 stocks. A combination of algorithms ensures that the data is not only clean and free from people attempting to game the system, but also weighs past performance and many other factors to gauge future accuracy.

Click here for chart details

Contributing analysts on the Estimize.com platform are forecasting that on Thursday Under Armour will report earnings a penny per share ahead of Wall Street's EPS forecast and beat the Street's revenue consensus by $22 million (4%). Under Armour is still trucking along at a great pace, and if the size and scope of Nike tell us anything, it's that there is a massive sports gear and athletic wear market out there for UA to grow into.

Disclosure: None.