The Fed finally made up its mind and announced the widely expected QE2 program Wednesday at the FOMC meeting. The statement of this FOMC meeting said,

…the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month.

This QE size is slightly lower than predicted in my last article. And it definitely reflects the stronger than expected US economic data recently.

Now, what does this mean for the market? The first thing we need to understand is that everyone knew this day was coming and has positioned for the day since early September. So the trading in the hours after this news had more to do with re-positioning, hedging, and profit taking. And there is not going to be another QE in a while, so we should factor this expectation in the short term trading strategy as well.

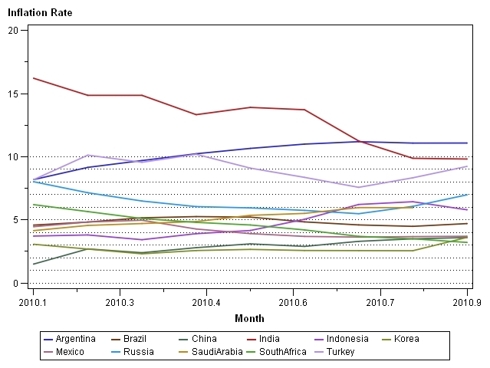

If we focus on the fundamentals, here are charts of inflation rates of emerging economies and developed economies in 2010 so far.

Chart 1. Inflation in EM Markets

Among the emerging economies, none has a lower than 3% inflation rate right now. Five out of these eleven major emerging economies have inflation rates higher than 5%. Among major developed economies, only UK and Australia have inflation rates higher than 2%. Japan has a negative inflation rate for a long time. Most other developed economies have inflation rates between 1% and 2%.

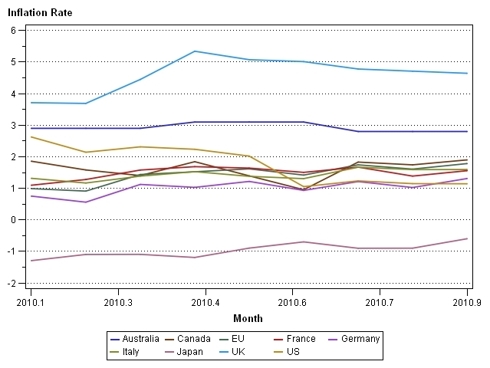

Chart 2. Developed Economies Inflation

There is no doubt that the QE2 will help push the expectation of inflation in the emerging markets even higher. Central bankers from these emerging economies understand that raising their domestic rates to fight inflation exported by the Fed is not the best solution because it will invite hot money inflow (warning of “currency war” came from the Brazilian). However, some emerging economies may have little choice, since capital controls and administrative measures are usually not sufficient. Especially for those emerging economies that are more vulnerable to the inflation pressure and that have raised policy rates in 2010, including Argentina, Brazil, China, and India - these countries will have to raise rates again, since the QE2 leakage will have the biggest impacts on inflation in these economies.

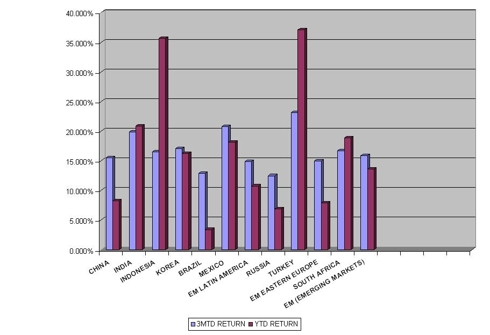

Because these emerging economies already have some bubbles to some extent, any rate hiking decision from them (these central banks will have to make such decisions very soon given QE2’s impact on commodities, also there is little room left in these economies to tolerate more inflation) will be an opportunity to short the risky assets related to those markets. Chart 3 shows the YTD returns and the 3MTD returns of major emerging market stock indexes. It is clear that the asset inflation in the emerging markets is largely due to anticipation of this QE2 program.

Chart 3. MSCI Index Returns for EM Markets

For developed economies, the UK and EU will make their rate decisions today. Given that most of the member states in the EU and the UK have taken measures to cut fiscal spending, it is difficult to see their central banks fighting inflation, especially for the UK, which has the highest inflation rate in the developed world. Expectations for the ECB and BOE to follow the Fed’s step will rise, since the fiscal austerity measures in their economies are going to dampen the aggregate demands in the EU and the UK. The ECB and BOE will have to draft their own QE programs before long.

Disclosure: No position