Based on a comparison of current premium/discounts of over 600 closed-end funds (CEF) to their relatively premium/discounts on both a 4 quarter and 4 month average, both Fiduciary/Claymore MLP Opportunity Fund (FMO) and Eaton Vance Risk-Managed Diversified Equity Income Fund (ETJ) appear to be at attractive entry points based on this metric alone. Here's why:

Simple Concept: Gravity is one of the four fundamental forces of nature, along with the strong force, electromagnetism and the weak force. When applied to investing it is usually in the context of gravitation to the mean or “mean reversion”, i.e. that there is a central tendency for a stock price to gravitate to its long-term average. Closed end funds (CEFs) are an excellent example of how there is a central tendency for the premiums/discounts to gravitate towards a central prem/disc given the visibility of both share price and NAV.

This phenomenon was demonstrated in an article I authored entitled, “CEF Provide Opportunities with Premium/Discount”(here) (2/2/09). For this article I screened for five of the CEFs with the largest current discounts at that time relative to their historical average.

Hypothesis: The hypothesis was that the five CEF’s should experience an increase of 12.6% if their respective prices again gravitated to their relative historical means.

Results: On average, from late January ’09 to the end of October ’10, those five stock prices are up 64.9% versus 46.3% for the Eqcome CEF Index. That is a 40.2% increase over the CEF market segment’s average. Also, the current average discount is now on par with its long-term average.

Evolution: While I had used the historical average for the purpose of the above analysis, it became evident that the historical average had a lot of “noise” in it on a comparative basis. Not all CEFs had the same operating histories and years of operations, therefore the comparisons were less than standardized.

Refinement: I decided to refine the concept further by looking at a rolling average of 4 quarters prem/disc so that the data would be comparable. In a subsequent article entitled, “Widening CEF Discounts May Indicate Future Performance” (7/20/10), I was able to demonstrate, based on historical performance, that there was a tendency for CEFs with extreme low rolling premium/discounts (“prem/disc”) spreads on average to outperform those with extremely high rolling prem/disc spreads on both a 3 to 6 month basis.[This algorithm is the basis of the selection of stocks included in the CEFDisc10™] (Rolling prem/disc spread = current prem/disc less average of the prem/disc on a 4 quarter rolling basis.)

Observations: As would be expected, those CEFs with extremely low prem/disc spreads were typically the subject of a previous adverse corporate event, i.e., cutting the distribution, dramatic drop in NAV, fraud, etc. The opposite was also true for those CEFs with extremely high rolling prem/disc spreads. Those CEFs many times were subject to favorable corporate events such as a merger, open-end fund conversion, buy-backs, etc.

Arbitrage: Given the skittish nature of the retail investors who own CEFs as a source of high, consistent income, these investors typically reacted in an indiscriminate fashion to adverse corporate events—particularly distribution reductions. Such investors have a tendency to oversell the stocks and thereby provide an opportunity to arbitrage the difference between short-term and long-term investors’ objectives.

Comparing the Rolling Spreads Quarterly and Monthly: A negative or positive corporate event can have a long lasting impact on the current prem/disc relative to its rolling quarterly average. It can reflect a permanent readjustment of price and NAV per share relationship and would take a year to work its impact out of the calculation.

Four Month Rolling Spreads: As a consequence, a rolling 4 month prem/disc spread was calculated for the current prem/disc to reflect its more recent relationship to its recent prem/disc.

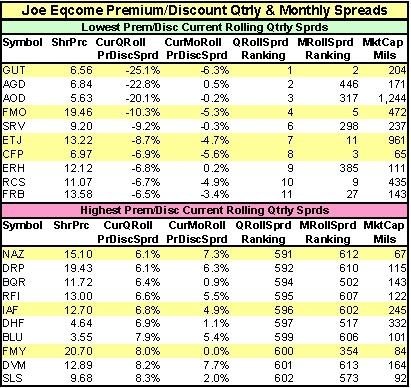

Both quarterly and monthly prem/disc spreads were ranked on ascending basis for purpose of comparison. (The top and bottom 10 are illustrated in the adjacent table along with quarterly and monthly rankings. A ranking of “1” is defined here as lowest and reflects a current prem/disc lower that it’s rolling average. A lower ranking would generally be considered favorable for investors.)

Both quarterly and monthly prem/disc spreads were ranked on ascending basis for purpose of comparison. (The top and bottom 10 are illustrated in the adjacent table along with quarterly and monthly rankings. A ranking of “1” is defined here as lowest and reflects a current prem/disc lower that it’s rolling average. A lower ranking would generally be considered favorable for investors.)

Comparison: Those CEFs that have experienced a relatively low ranking quarterly and a high rank monthly may have likely experienced a durable readjustment in their prem/disc ([[AGD]], AOD, SRV and [[ERH]]).

Those that have experienced both a low quarterly and a low monthly ranking may suggest that the prem/disc relationship has still not yet stabilized—it is continuing to erode on a relative basis.

Either the CEF stock price has the potential for further decline or it represents a mispricing of the stock on a relative basis and an opportunity for investors. An analysis at the micro level may be helpful to determine which—although the numbers themselves are self-reinforcing.

Sifting Through the Spreads: A couple of CEFs that have generated lowest prem/disc spreads (potential buys) both on a quarterly and monthly rolling basis include: Gabelli Utility Trust (GUT), Fiduciary/Claymore MLP Opportunity Fund (FMO), Eaton Vance Risk-Managed Diversified Equity Income Fund (ETJ) and Cornerstone Progressive Return Fund (CFP).

These 4 CEFs all have high return-of-capital components to their distributions. They can be further classified into “High Premium” and “Low-or-No Premium” categories.

High Premiums: Both the GUT and CFP are CEFs that sport extremely high premiums. Such premiums may be in the process of readjustment downward. Investors may get a “dead cat bounce” from these stocks. The Fed’s efforts to eliminate interest rates as an expense and investors hoodwinked into thinking both GUT’s and CFP’s distributions are earned, may be “marks” for the inexperienced in both stocks. If you had to choose one it would be GUT based on the strength of the Gabelli organization.

Of More Interest: Both FMO and ETJ are classified into the “Low or No Premium” category. While both FMO and ETJ also have high return-of-capital distributions, their return of capital distributions are more a function of timing issues related to GAAP accounting for financial purposes and E&P accounting for tax purposes. Therefore, in each case—and for different reasons, the cash flow is available to pay the distributions; these CEFs are not materially depleting their capital base.

High Rolling Premium/Discounts: Of the CEFs that generated higher prem/disc spreads that are currently not subject to a favorable corporate event include: First Trust/FIDAC Mortgage Income Fund (FMY) (mortgage), Aberdeen Australia Equity Fund (IAF) (Australia) and Nuveen Arizona Prem Income Muni Fund (NAZ) (Arizona).

FMY may be getting a lift from the Fed’s government debt repurchase program which will include mortgages; IAF’s strength may be due to Australia’s commodity-centric economy and the weak USD; NAZ for no discernable reason other than it trades by appointment.

Caveats: This article’s purpose is to highlight the extremely high and low rolling premium discounts on a quarterly and monthly basis for sake of comparison for the month of October and for the purpose of further discussion. It does not constitute a full analysis on any of the CEFs mentioned in this article which is beyond the scope and purpose of this article.

While there has been historical evidence to suggest that extreme relative rolling CEF prem/disc spreads have a tendency to perform in a certain manner, such historical performance may not be repeated in the future.

“Square one” for the departure in the field of investment research is: the “point of greatest astonishment”. This is the value of a “top/down” analysis. However, this doesn’t or should preclude a “bottoms/up” analysis of the targeted merchandise. The relentless question that needs to be resolved is “why” there’s a difference?

Disclosure: Disclosure: Long ITJ and FMO as well as a diversified portfolio of CEFs and ETFs

Disclaimer: As always, consult your trusted financial advisor prior to any significant investment decisions.