Preface: I was going to write this piece on Monday, as I saw an excellent link to a paper on American stock ownership distribution on "the Zero Hedge", but Doug Kass wrote an article on RealMoney.com that almost stole my analysis word for word. Hence, I'll be incorporating some original thoughts with other data, but bravo for Kass for catching this as well - apparently he ZeroHedges as well.

-----------------------------

One thing we like to do here is dispute dogma. For example, one of my favorites (there are so many to choose from) is "American corporations are crippled and uncompetitive with a 35% tax rate." Anyone who looks at the actual data sees the real rate is roughly 19-20% which puts the U.S. squarely on equal terms with most industrialized first world countries. (further, corporate taxes as a percentage of GDP is at record lows).

Now of course I am including multinationals who keep profits offshore, running sophisticated tax evasion policies using Irish and Dutch tax havens to create 1-3% tax obligations, [Bloomberg - Google's 2.4% Rate Shows How $60 Billion Lost to Tax Loopholes] while waiting for the day the once a decade GOP drive to "repatriate profits" so that "we can bring that money home to reward shareholders & corporate insiders via stock repurchases or one time dividends create jobs."*

Anyone not in a comatose state will realize how many jobs the vast majority of our largest corporations are bringing back home the past few decades. These tax holidays are basically a scratch your back obligation of the political class for campaign funding, so that our largest corporations can even beat the "under" on the 19-20% quota on tax obligations. Who is paying the 35%? Small business - he with Joe the Accountant and a single state LLC without a 3 person office in Dublin to avoid American taxes. So yes, it is an onerous rate but not for the people complaining the loudest - they've got loopholes galore, entire treasury departments whose sole purpose is to avoid taxes, and PR machines like no other.

*here is an idea - let's let our multinationals repatriate dollars Tax Free 1:1 for every dollar they invest in plant, capital, or labor on U.S. shores. Outrageous? Out of the box? Far too sophisticated and "pro American"? I know... I know, that would defeat the purpose of the back scratching.

-------------------------------------

Anyhow that is but 1 dogma of countless in a country where sound bites dominate over rigorous analysis. Here is another ... "America is an ownership society, especially of a stock holding kind." I always find that one funny - some "55-60%" of Americans apparently own stock hence when the market goes up, it changes their behavior, drives spending for the majority, blah blah blah. Riddle me this... how is that possible when survey after survey after survey for decades says 70% of Americans live paycheck to paycheck, regardless of income strata. (apparently they are willing to send money to Etrade, before stashing a few bucks for their own savings account)

And about half a decade ago the national savings rate actually hit a negative figure, and has been closer to 0% than 5% since the late 90s. [Dec 29, 2008: What Happens if America Returns to a Historical Savings Rate?] Further half of working Americans don't even half $10K saved for retirement; a quarter less than $1K. [Mar 9, 2010: Bifurcation of American Society Continues at Pace; Nearly Half Have Less than $10K for Retirement, a Quarter Less than $1K] Something doesn't pass the smell test here, but finding data on the subject was difficult. But now we have an excellent analysis by Professor William Domhoff at UC-Santa Cruz, originally written in 2005, but updated as of September 2010.

We joke a lot around here (both in 2007 thru mid 2008... and now) how one has to throw their money into the stock market simply to make back what they are losing via inflation in food and energy (not to mention healthcare, tuition, daycare, whatnot). But all kidding aside, for this to truly work the vast majority of Americans would need a substantial booty in the stock market. For example, while of course some people not in the top tranche of income strata do have $30, $40, $50K of securities, my contention is many of the "ownership class" has a $1900 IRA or a $2400 401k (that of course when they leave the job, they cash out to fund a vacation), yet are co-mingled into the 'investor class' as if they are power investors.

Say you have $3400 and for the fine sum of $600 Billion Bernanke can make your accounts rise by 23% in a year. You sir (or madam) are $782 richer aka $65 a month aka a cell phone bill. A fine "wealth effect" that only costs the grandchildren untold future liabilities, potential currency wars, and untold ravages on third world country populations who don't have food stamps to offset Bernanke. Indeed, it sounds like a wonderful trade (not). For the average family of 4 that $65 might pay half a weekly grocery bill? Unfortunately the other 3-4 weeks are still up to them. Obviously this would assume the money is liquid and non retirement, and able to be withdrawn without penalty on a monthly basis and the stock market "only went up". If those assets were in said 401k or IRA, well then you just feel richer in spirit because you can't actually draw it down to pay for that wheat bread and sugar inflation.

But those comments are for middle America who actually has SOME money in stocks; per the piece I referenced yesterday by Jim Bianco, the bottom 20% is facing the most regressive of taxes by Bernanke's master plan. Like many in 3rd world countries they spend well in excess of 50% of income on the basics - food and energy.

Is it any wonder a proportion of Americans are running out of food at the end of the month,[Nov 10, 2009: Walmart Executive - "There are Families Not Eating at the End of the Month] even with a massive increase in food stamp usage? [Nov 29, 2009: 1 in 4 Children, and 1 in 8 Americans Now on Food Stamps] Let us be real and acknowledge no amount of "asset price manipulation" is going to help these people offset their rising costs. They only get the short end of the stick in Cramerica.

So who are the winners? The same groups almost all decisions are now made for - the upper crust. Now dear reader, I understand many of "us" here are in said upper crust (top 10%) although from email correspondence many of the FMMF audience are of the college age or 20 something crowd (thankfully, having their brains detached from the Matrix at an early adult age) so have not yet had the chance to reach the top 10%. (but hopefully in time) So do not take this as an attack... let's just get rid of dogma of who Bernanke will be helping, and speak the truth.

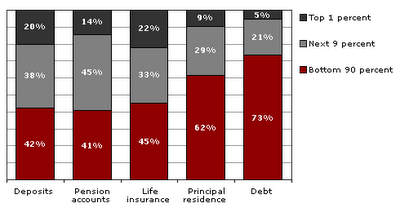

Per the analysis of Professor Domhoff, the percentage of financial securites (i.e. the type the firmly in moral hazard Fed is attempting to manipulate away from a fundamental value) held by the top 1% is 38%. That leaves 62% of the securities for the bottom 99%.

If we expand it out a little further the next 9% control 43% of stocks and mutual funds. That leaves 19% of said wealth 'effected' securities for the bottom 90% to fight over... to help them offset the commodity firestorm Bernanke has set off.

So let us look at each other in the face, and realize if you believe a wealth effect is real, who it is helping. It's not Joe the Plumber. And we can see myriad $1800 IRA accounts and $2300 401k accounts being inflated is going to do very little for the bottom 90%.... and especially 80%.

Being part of the speculator class, and marketing myself to the speculator class I suppose I should not be complaining. But I just hate disinformation, dogma, and outright obfuscation. (yes my probability of political office is 0%)

Of course if you are a believer in 'trickle on down economics' (which have been "awesome" for the middle class the past 2 decades) by inflating the assets of the upper 1%, they will buy another yacht, which will drive yacht builders to buy lumber, which will help the worker at Home Depot, yada yada yada. Let's be real - most in the top 1% are not going to be spending any more or less based on S&P 1100 or 1300. Indeed, in the Doug Kass piece the true multiplier on stock market wealth is a massive 3-4%... this is not the house ATM we are talking about here.

-------------------------------

Now let's look at it from one last angle before we leave the subject. There is one form of wealth that has a far more conventional distribution pattern in the US of A. That is saving deposits.

Top 1%: 20% of American deposits

Next 9%: 38%

Bottom 90%: 42%

So if one wanted to actually help the bottom 90%, and "lift all boats" and "generate economic activity" perhaps one would lift Fed fund rates to a level that banks would actually pay something larger than the size of a flea on savings. Or indeed something tangible on Certificates of Deposits (amazingly the average CD rate fell below 1% as of last week). That actually would be some form of wealth effect for the masses... instead our saver class is being used as a mass subsidization scheme for the debtors and speculator class. Of course the latter is concentrated in the upper shards of society as the previous paragraphs showcased. [Mar 31, 2010: Ben Bernanke Content to Sacrifice American Savors to Recapitalize Banks and Benefit Debtors]

So who again exactly is QE2 "benefiting" (if the 'wealth effect indeed is even real?) Due to the demolishment of savers, we will have people twice burned by NASDAQ 2000, and real estate 2007 trying to rebuild their savings facing a scorched earth scenario. As for those fixed income seniors (who receive no cost of living adjustment because America has "no inflation" per government statistics)? If they want to make any inflation adjusted returns they will be 'herded' out of CDs and savings into bonds and stocks so they can survive the Bernanke inflation regime. And that's in an environment where the dollar is stable ... don't even think about the losses the savers of the country are suffering as their wealth is sapped away, so that a small proportion of our corporations can create jobs in China and India! make some extra bucks via weak dollar exports.

Most likely just about these folks throw their hands up in disgust and go "all in" on risk assets, the next bubble implosion from fake asset values will commence, transferring the last vestiges of middle class wealth to the masters of our universe. (this will be round 3 of that cycle since 1999 - notice a pattern?) So as we clap for Mr. Bernanke, and sing kumbaya about how manipulation of asset prices is helping "us all" try not to think of any of the data in this piece. Stick to dogma recited on CNBC, or else your head might spin off.

(Source document here)