A country with a population of 35 million and growing at the rate of 1.2% annually, one of the least densely populated countries in the world, Canada is home to some very strong and resilient corporations in the world. The resource rich country is placed well to take advantage of macro trends such as warming climate providing access to the melting Arctic amongst other advantages. The climate change allows Canada to take advantage of controlling the shipping lanes (the Northwest Passage providing shorter and more efficient shipping routes between the east and the west), expanded farmland (longer growing seasons), underwater mineral and oil/natural gas resources (the melting ice caps provides easier access). While each of these can be targeted as an opportunity to invest in, an easier and safer way to expose to the bright future of the growing economy is to invest in the financial sector - a key to any strong and growing economy. Canadian banks are some of the safest banks in the world and have been rated very high in global rankings by countless organizations.

The Financial Sector

The Big Five, as they are known, make up the bulk of the Canadian financial sector include Royal Bank of Canada (RY), Toronto-Dominion Bank (TD), Bank of Nova Scotia (BNS), Bank of Montreal (BMO) and Canadian Imperial Bank of Commerce (CM).

The second tier of the Canadian financial sector consist of some strong names as well, which includes National Bank (OTCPK:NTIOF), Laurentian Bank (OTCPK:LRCDF) and Canadian Western Bank (OTCPK:CBWBF).

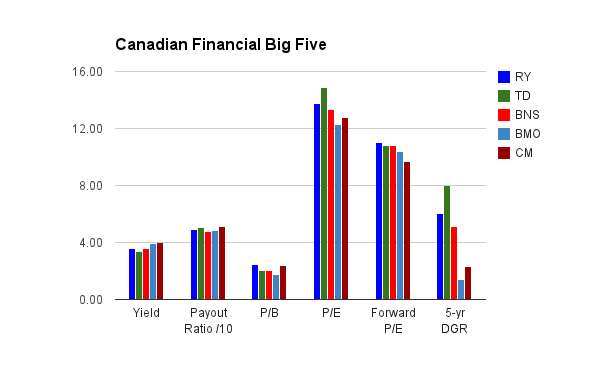

The Canadian financials are the bread and butter for plenty of the income investors. The banks are stable, pay a healthy dividend quarterly and have a track record of growing dividends year after year. While all Big Five saw a pause in dividend growth during the recent financial crisis, all banks have now started increasing them, some aggressively. The Big Five are also very attractively valued currently with P/Bs ranging 1.73-2.48, P/Es ranging 12.75-14.85 and Forward P/Es ranging 9.67-11.01.

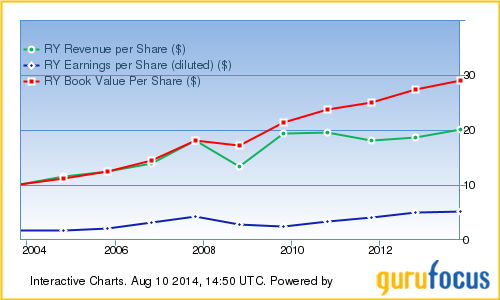

Royal Bank of Canada

Royal Bank of Canada is the largest financial institution in Canada, as measured by deposits, revenues and market cap. Royal Bank has operations in 52 countries including a strong presence in the Caribbean. RY saw a pause in its dividend growth during the financial crisis and has started raising its dividends since 2011 and has a 5-yr DGR (dividend growth rate) of 6.65%. RY has started raising dividends twice a year starting 2012 and the last dividend raise came in February 2014 with a raise of 6%. RY currently yields 3.6% with a payout ratio of 49.3%.

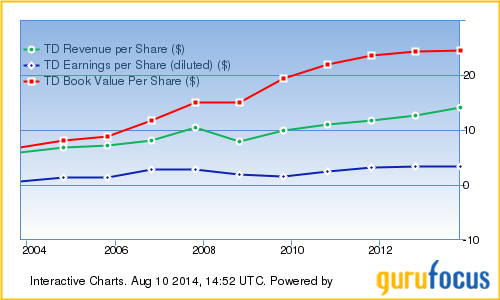

Toronto-Dominion Bank

The Toronto-Dominion Bank is the second largest of the Canadian banks by market cap and based on assets; and is the sixth largest bank branch network in North America. TD saw a pause in its dividend growth during the financial crisis. However, TD has started raising its dividends after the crisis with 5-yr DGR of 8.03% making it the best dividend grower of the Big Five. Since 2011, TD has started raising dividends in smaller increments, but more than once a year (the bank has raised dividends three times in the last 12 months). The latest dividend increase came in February 2014 with a raise of 9.3%. TD currently yields 3.38% with a payout ratio of 50.2%.

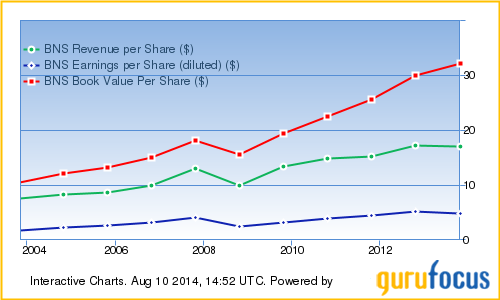

Bank of Nova Scotia

The Bank of Nova Scotia is the third largest of the Canadian banks by deposits and market cap. BNS has the most international presence of the Canadian banks with exposure in 55 countries outside Canada. BNS has the second longest streak in paying dividends in Canadian corporate history - an unbroken chain of dividends that have been paid since 1832. BNS saw a pause in its dividend growth during the financial crisis. However, BNS has started raising dividends after the crisis with a 5-yr DGR of 5.15%. Since 2012, BNS has started raising dividends in smaller increments, but twice a year. The latest dividend increase came in March 2014 where dividends were raised 3.2%. The next expected announcement is in August or September 2014. BNS currently yields 3.58% with a payout ratio of 47.6%.

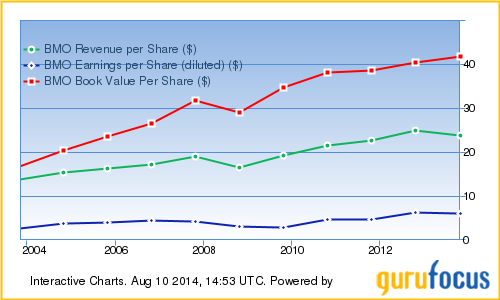

Bank of Montreal

Bank of Montreal is the fourth largest of the Big Five banks by market cap and assets; and is also the eleventh largest bank in North America. The bank is the oldest bank in Canada, in operations since 1817. BMO has the longest streak in paying dividends in Canadian corporate history - an unbroken chain of dividends that have been paid since 1829. BMO saw a pause in dividend raises during the financial crisis and has started raising dividends since 2012, with a 5-yr DGR of 1.66%. BMO currently yields 3.94% with a payout ratio of 48.4%.

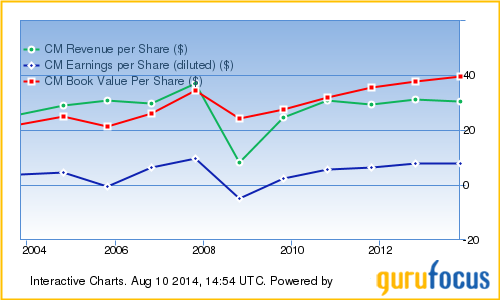

Canadian Imperial Bank of Commerce

CIBC is the smallest of the Big Five. CIBC's global presence includes operations in US, the Caribbean, Asia and UK. In 2012, CIBC was named the third strongest bank (globally) by Bloomberg Markets magazine. CM saw a pause in its dividend raise during the financial crisis but has started raising dividends since 2011 with a 5-yr DGR of 2.31%. CM is the highest yielder of the Big Five with a current yield of 4.03% and also has the highest payout ratio of 51.3%.

The Risks

The Canadian financial system, although resilient, faces some risks. The current biggest risk facing the financial system is the red hot housing market in Canada. The housing market, according to some economists, is in bubble territory and some have called for a housing crash. The consumers in Canada have an elevated debt level close to 160% of debt-to-income ratio. While the Bank of Canada governor Stephen Poloz expects a soft landing, financial institutions could see some headwinds in the next few years. However, a mass crisis similar to the 2008 financial crisis is not expected as the mortgages in Canada are backstopped by the taxpayer supported CMHC (Canada Mortgage and Housing Corporation).

Full Disclosure: Long BNS. My full list of holdings are available here.

Disclosure: The author is long BNS. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.