Although Clorox's (NYSE:CLX) top-line growth remains pressurized due to competition in North America and a slowdown in international segment sales, I believe its investments behind brands will portend well for its top-line growth in the future. An increase in material and packaging cost due to inflation in Venezuela has been adversely affecting margins; however, CLX has ramped up its cost saving efforts to support its EPS growth. Also, the company has been consistently sharing its success with shareholders through share repurchases and dividends. Moreover, the company currently offers a healthy dividend yield of 3.2%, which makes it good investment option for dividend investors.

Sales Base = Near Term Challenges but Long Term Growth awaits

As off late, intense competition in the North American market has been adversely affecting the top-line growths of almost all consumer sector companies. CLX's top line is also facing competitive pressures; in Q4FY14, the company's net sales decreased by approximately 2%, year-over-year. Moreover, due to negative currency movements, forced by currency depreciation in Venezuela and Argentina, CLX's international segment sales were down by 8% year-over-year in Q4FY14.

As the company has been facing challenges in the U.S. and international markets, it has been making investments into its brands to increase consumer recognition and create brand loyalty, which I believe will portend well for its top-line growth in the future. Also, the company has also been increasing its advertisement spending, focusing on innovation and expanding its market presence in efforts to grow its top-line numbers.

In the U.S., after five quarters of market share declining for the bleach category, CLX registered a market share gain in Q4FY14. Also, the introduction of pricing adjustments and new product launches in the past few quarters positively affected the company's wipes' market share in the quarter. Also, the company's recent announcement to launch a lightweight Fresh Step product in its litter category will support its top-line growth.

The company anticipates top-line growth to be flat for FY15 as compared to FY14, and the positive impact of promotional spending and innovation will be offset by the persistent negative currency movements. I believe CLX's sales base will remain pressurized in the near term due to competition and adverse currency movements; however, in the long term, the company will benefit from an increase in advertisement spending, product innovation and expansion of its market presence.

Margins

Recently, the weak top-line growth and increase in logistic and packaging costs adversely affected the company's margins; in Q4FY14, CLX's gross margin dropped by 170 basis points to 42.3%. Given that the company has been facing challenges to grow its top line, it has increased its focus on reducing its costs to support EPS growth. Other than cost saving efforts, the company has the option to increases prices for its products in some international markets to offset the impact of adverse currency movements. Also, the company's SG&A expenses are expected to stay within its long term guidance range of 14% of net sales. The cost saving efforts and price increases will help the company address the ongoing challenges and positively affect margins in the future.

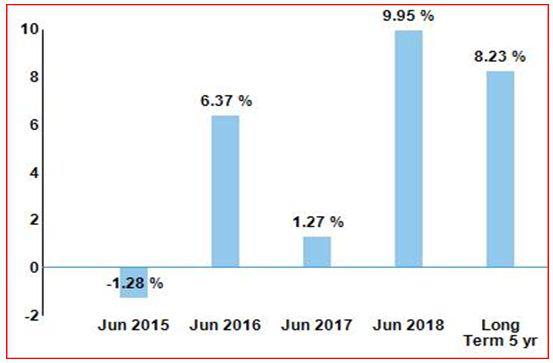

As the company has been taking measures to improve its top and bottom line results, analysts have anticipated a healthy long term rate of 8.23% per annum for the next five years, as shown in the chart below.

Source: Nasdaq.com

Value Creation = Key Focus area

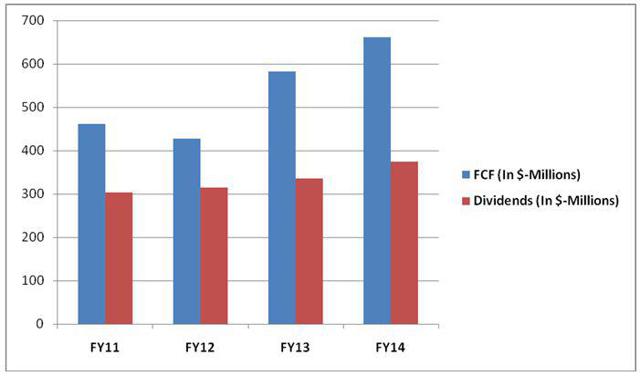

Over the past few years, value creation for investors has been one of CLX's key focus areas. With its rock-solid cash flow base, the company has been consistently returning cash to its shareholders through dividend payments and share buybacks. CLX recently announced a quarterly dividend payment of $0.74, up 4% quarter-over-quarter. Moreover, the company's free cash flow as a percentage of sales increased 11% in FY14, year-on-year. In FY14, the company repurchased 3 million common shares for $260 million. Also, the company offers a healthy dividend yield of 3.2%, backed by its solid cash flows. The company's CFO and SVP, Stephen Robb, reaffirmed in the Q4FY14 earnings conference call that the company remains committed to creating value for its shareholders by returning cash. He said:

You will continue to see us focus on keeping a healthy dividend we will probably periodically go back into the market and repurchase shares.

The following chart shows CLX's strong cash flow base supporting dividend payments over the past four years.

Source: Company's Yearly Earnings Report

Conclusion

Despite challenges that the company has been facing to grow its top-line numbers, I believe the company has been on track to improving its top-line numbers. CLX has been taking the right measures to address challenges through investments behind its brands. Also, product innovation, price increases and cost saving efforts will positively affect the company's top and bottom-line results. Moreover, the company's share repurchases and dividends have been consistently creating value for shareholders. The company's attractive dividend yield of 3.2% makes it a good investment option for dividend investors. Due to the aforementioned factors, I am bullish on CLX.

Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.