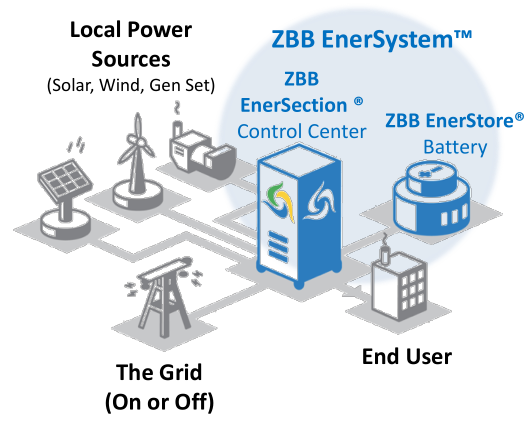

Company overview

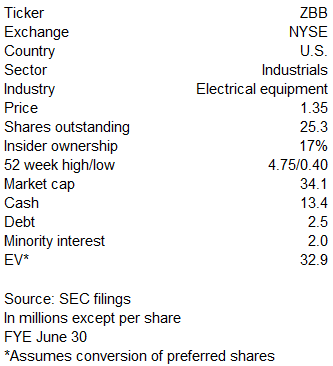

ZBB Energy (ZBB) manufactures distributed energy storage solutions based on its patented zinc-bromide storage technology and power electronics systems.

The ZBB EnerSystem combines energy controls and storage to provide a modular and scalable system with a low total cost of ownership.

Source: Company presentation

ZBB is at a key inflection point ahead of significant revenue growth

ZBB is positioned to benefit from the increasing demand for distributed power, renewable energy and energy storage by enabling customers to realize meaningful cost savings through peak shaving. For example, renewable power generated during peak production times can be stored and later discharged during peak hours when traditional utility power is more expensive. The ability to store variable power (compared to "constant" coal, nuclear or gas) eliminates one of the primary growth-limiting factors to greater use of renewables.

The primary target markets are listed below.

Microgrid. The ZBB EnerSystem provides emergency, reliable power and reduces the use of expensive (and polluting) diesel generators. This solution can be found in a wide range of applications, from a luxury eco-resort in French Polynesia to forward operating bases, where it could potentially save lives by eliminating the need to transport fuel through hostile environments. Military sales should begin to ramp up as the U.S. Navy completes testing and certification this year of the ZBB EnerSystem, which would clear it for more widespread deployment.

Off-Grid. The growth from this market alone could support the investment thesis given that there are 1.4 billion people without electricity while a large number of communications towers rely on expensive diesel generators and lead-acid batteries.

Commercial and industrial customers, which account for half of all domestic energy use, can save money (by minimizing peak load use, eliminating backup diesel generators and receiving tax credits/grants) without sacrificing reliability. Potential customers include hospitals, cable providers and data centers (the EnerSystem is already installed at Visa's flagship data center).

In addition, ZBB supplies Cummins Crosspoint with the controller technology for its hybrid motor vehicle systems. The controller is a critical component of the system (and accounts for about a third of the overall system price), which increases fuel mileage up to 30% and reduces emissions up to 35%. Moreover, the system can be quickly retrofitted into new and existing fleets. Going forward growth should be driven by the large market size (there are >260,000 class 3-6 trucks with 68,000 produced annually by 2016), low price for a rapid ROI, upgrades to the second generation system with even better fuel mileage and expansion into international markets.

Strategic partnerships provide funding and growth opportunities

As part of an expanded strategic partnership with Lotte Chemical, ZBB received a $3 million license fee relating to its zinc-bromide flow batteries. This one-time license fee, royalties on all Lotte sales outside of Korea until 2019 and high margin engineering and development revenue provide much needed cash flow to fund operations until ZBB reaches break even. By leveraging Lotte's production facilities, ZBB is able to rapidly respond to the expected increase in demand and save >$10 million in capex. ZBB and Lotte also signed an agreement to develop a next generation battery with 10x the storage capacity over the current version at a lower cost per kWh.

ZBB should benefit from the continued strong demand for renewable energy and storage in China through a joint venture with the market leader Meineng Energy. Management reported on the 3Q14 conference call that it is ahead of competitors in testing its flow battery in order to meet state grid requirements, which provides a valuable advantage when it competes for the requests for proposals expected to be issued following completion of these tests. Earlier this week, an ~$3.2 million investment from VC firm Shenzhen Oriental Fortune Capital tripled the valuation of the JV to ~$42 million.

ZBB entered the Russian Market with a strategic relationship with BPC Engineering, which placed its first EnerSystem order in January 2013. Management reported no direct impact from the ongoing conflict with Ukraine.

Multiple overlooked catalysts

Any one of the below catalysts should be more than sufficient for the price target to be reached, especially as positive industry news flow resulted in the stock more than tripling in March 2014.

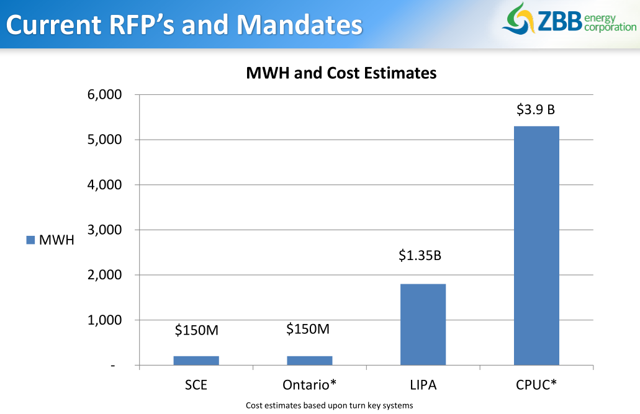

Source: Company presentation. SCE is Southern California Edison, LIPA is the Long Island Power Authority and CPUC is the California Public Utility Commission.

Hawaii is one of the largest near-term opportunities given the fossil fuel dependence (the most of any state) and small, remote electric grids. In May 2014, ZBB hired Theodore Peck as sales manager for Hawaii, whose vast sales and public policy experience (served as Energy Administrator and managed the first three years of the Hawaii Clean Energy Initiative) will be critical in capturing a greater portion of the $900 million market for elevator back-up system replacements.

California is an even larger opportunity after the CPUC set a target for utilities to procure 1.3 GW of energy storage by 2020 (a 6x increase over the existing storage capacity). Subsequent to the end of 3Q14, ZBB advanced to the request for quote stage (only 9 out of 150 applicants made the cut) to be a prime contractor for the Imperial Irrigation District's 40 MW energy storage project.

Last month the Department of Energy announced an additional $4 billion in loan guarantees for renewable energy projects including advanced grid integration/storage, which should not only offset the negative impact of sequestration and expiration of green energy tax credits but further reduce the risk of dilution by diversifying the funding sources.

Risks

ZBB may need to raise additional capital (in addition to the March 2014 secondary offering) in order to fund growth given the continuing losses although the near-term risk is low due to the strong balance sheet ($10.9 million of net cash) and lower cash burn rate. Even excluding the $3 million license payment, LTM operating cash flow improved by $2.6 million compared to FY13 due to lower OpEx. ZBB would reach the cash flow break-even run rate of $25 million if it only captured slightly more than half of the opportunities in the >$40 million sales funnel. ZBB should reach this target quicker due to a new sales/marketing strategy (expected to be in place by the end of calendar 1H14) that bypasses intermediary contractors and sells directly to end-use customers.

Four customers accounted for 63% of FY13 revenue.

ZBB faces a potential delisting in October 2014 although the NYSE said ZBB "made a reasonable demonstration of its ability to regain compliance".

Management expects continued lumpy revenue given the long sales cycle. For example, revenue decreased 26% in 3Q14 (excluding the $3 million license payment) as the 59% decrease in product revenue more than offset the 650% increase in engineering and development revenue.

Valuation and price target

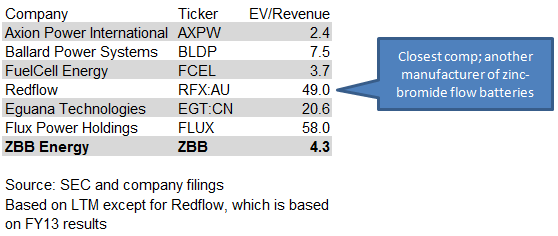

The investment thesis (built on the assumption of significant top line growth over the next several years) is reasonable in light of the historical growth and large market opportunity. Revenue more than quadrupled from FY11 to FY13 ($1.8 million to $7.7 million) while Lux Research expects zinc‐bromide flow batteries to capture 19% of the $114 billion energy storage market by 2017.

As shown in the chart below, ZBB is more attractive relative to its peers and growth prospects than on an absolute basis.

The price target of ~$2.00 (to be reached over the next two years) is derived by placing a 3.5x multiple on revenue of $15 million (slightly less than double the FY13 level). The pullback to the 200 DMA provides a perfect place for a stop loss.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.