In a recent article, I compared the merits of owning AT&T (T) to the expected consolidated entity of Kinder Morgan (KMI). Specifically, I focused the income component of each -- coming to the conclusion that KMI had more income-producing potential in the intermediate term, albeit with a bit more perceived execution risk.

Kinder Morgan management spent a great deal of time on this topic as well -- mentioning the dividend policy in no less than half of their slides in a recent presentation. The company went as far as providing dividend guidance all the way out to 2020: $2 in expected payouts per share next year and 10% annual growth thereafter. Considering the above-average "current" yield, certainly this is a great investment thesis for those primarily concerned with a strong and growing stream of income.

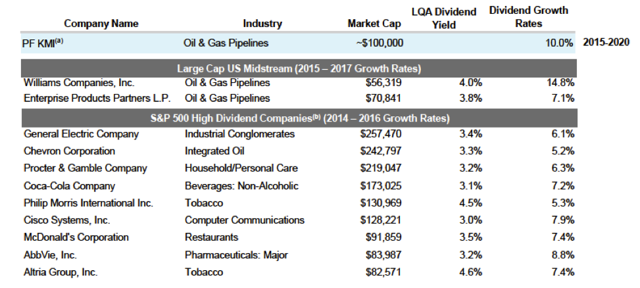

Interestingly, even if you don't fully believe in the KMI story, the company laid out a noteworthy comparison to a variety of companies. In the 7th slide of the acquisition presentation, management laid out 9 comparable income-producing companies in the S&P 500 (SPY). Here's what that slide looks like:

If you were just thinking in terms of a potential KMI investment, this might appear to be propaganda or something of the sort. The 9 companies listed from the S&P 500 all meet the following criteria: $75+ billion in market cap, a dividend yield over 3% and expected dividend growth above 5% -- the same criteria the new KMI would fall under. Considering that KMI would have both the highest "current" yield (with the $2 dividend) and expected growth rate, it would be easy to cast this table aside as Kinder Morgan touting its expected benefits.

However, I believe there's another viewpoint worth noting here. Sure, KMI wants you to see that they expect to be one the best dividend investment opportunities around. Yet even if you don't believe that, you have 9 other companies here that appear perfectly ripe for further due diligence. Kinder Morgan was nice enough to do a quick screen for you.

The "dividend growth sweet spot" is an elusive topic, but I would imagine a 3%+ yield and 5%+ expected growth is a good place to start. Add in the concept of being well established and (mostly) tremendous dividend payout histories and you might be on to something.

With that, I thought it might be interesting to take a quick look into each company's upcoming dividend opportunities. The expected growth rates are provided through 2016, but for simplicity, we'll imagine they represent 5-year expectations. Remember this is just a baseline to guide one's thinking, and you should always test assumptions through your own examination.

General Electric (GE)

A lot of people like to jump on General Electric for its dividend cut during the most recent recession. This is understandable, as those chiefly concerned with the reliability of payouts obviously saw a lack thereof. Although I would advocate that this is hardly a reason to avoid these types of companies -- a long-term holding period often makes up for even severe cuts. More importantly -- and pertinent to this article -- it appears GE is reasonably positioned to grow its dividend in the future.

General Electric "presently" yields about 3.4% based on its $0.22 quarterly payout. If it's able to grow its payout by 6.1% annually for the next 5 years, this would suggest that today's investor might receive about 20% of their initial capital back in the form of dividend payouts. A 3% "current" yield in 5 years' time would represent an 11% compound annualized expected total return, while a 4% yield would suggest 6% yearly returns.

Chevron (CVX)

Chevron has an effectively similar "current" yield as General Electric with expected dividend growth of 5.2%. Like GE, using the above assumptions, an investor of today might expect about 20% of their initial capital back in the form of a dividend. If the future yield is around 3%, this would indicate a 10% annualized expected total return, while a 4% yield would mean 5% yearly returns.

Some might suggest that the dividend growth expectations are off -- as Chevron has a lower payout ratio than General Electric and thus perhaps more room to increase the dividend. Then again, Chevron's industry can be more cyclical as well. You can and should come up with your own expectations, but for the purposes of this article, the given estimates appear to be reasonable starting points.

Procter & Gamble (PG)

There's little uncertainty about this company's propensity to reward shareholders -- having not only paid but also increased its dividend for 58 consecutive years. The household and personal care mega company has a "current" yield of about 3.1% and expected dividend growth of 6.3%. This equates to an investor expecting to receive roughly 20% of their capital back in the next 5 years, along with returns in the 4% to 9% range if you expect the future dividend yield to be between 3% and 4%.

Coca-Cola (KO)

No dividend slouch itself, Coca-Cola has increased its dividend for 52 straight years and has a "current" yield of just under 3%. With 7.2% expected dividend growth, this would represent an investor receiving approximately 18% of their investment back and expected returns in the 4% to 9% range over the next 5 years.

Phillip Morris International (PM)

Phillip Morris has a "current" yield of 4.4% with expected dividend growth of 5.3%. This might suggest an investor would receive approximately 26% of their capital back in the form of a dividend in the next 5 years. If shares traded with a 4% yield in the future, and these dividend expectations came to fruition, this would indicate an 11% annualized total return. If the future yield happens to be 5%, this would represent 7% yearly returns.

Cisco Systems (CSCO)

Although Cisco doesn't share some of the grand dividend histories as the prior companies, this certainly doesn't take it off the list. Shares of CSCO presently trade hands with a yield around 3.1% and expected dividend growth of 7.9%. This equates to an expectation of receiving 19% of your capital back and annual total returns in the 6% to 11% range with corresponding yields in the 3% to 4% arena.

McDonald's (MCD)

Mickey D's has increased its dividend for 38 consecutive years and has a "current" yield of about 3.4%. With a 7.4% expected dividend growth rate, this could indicate that an investor would receive 21% of their initial investment back in the form of dividends. Return expectations for a future dividend yield in the 3% to 4% range would fluctuate between 7% and 13%.

AbbVie (ABBV)

Due to being spun off from Abbott Labs (NYSE:ABT), this company doesn't yet have a decades-long dividend track record, but it does carry along the prestige. With a 3% "current" dividend yield and an expectation of 8.8% annual future growth, this represents the opportunity to receive about 20% of your initial investment back over the next half-decade. Additionally, a 3% future dividend yield would indicate 11% expected yearly returns, while a 4% future yield would demonstrate 6% annualized gains.

Altria Group (MO)

Finally we have Altria, with its 4.9% "current" yield and 7.4% expected dividend growth. If these estimates come to fruition, this would indicate that an investor might receive about 30% of their initial capital back in the next 5 years. Additionally, a 5% future yield would provide annualized returns of about 11%.

Collectively, these 9 companies have average "current" yields of 3.5% with expected dividend growth in the coming years of just less than 7% annually. You could quibble over the growth prospects of this one or that, but really all of them appear to be reasonable places to begin one's research.

In short, it's overwhelmingly likely that Kinder Morgan showed the above table to demonstrate that the company will be among, or perhaps atop, the available large-cap dividend producing possibilities. Moreover, as seen in the calculations in my last article, this could very well be the case if KMI is able to meet its payout guidance.

However, the investment world isn't a "pick this, can't pick that" type of game. Instead, you could take the "why not all?" approach -- partnering with all 10 companies listed here. This holds true even if you believe KMI is the best option of the group; there's nothing wrong with having a little backup if you happen to be mistaken. Kinder Morgan's management thought they were using their latest presentation to woo potential investors: "look at us, our income prospects are the best." Yet what I gleaned from the information was slightly different: "here, take a look at this nice little dividend growth starter kit, we expect to match or best these compelling prospects, but all 10 partnership opportunities appear to be sensible places to start investigating."